XM™|How to open the FX account.

XM puts first priority on safety all over the services it provides in order to provide traders with safe and dependable trade environment.

XM Group is providing its service to over 190 countries in the world (with over 20 languages) and obtained many awards such as the Best FX Service Provider award. XM's service is welcomed by a lot of customers around the world as the most satisfiable FX service provider among others.

XM puts the priority on "Safety" of service and continue to provide clients with "Reliable" trade environment, by doing this XM tries to enhance the clients's satisfaction everyday.

Let us explain about the procedure of how XM deals with safty.

![]()

One of the barometer for safety and reliability of overseas FX brokerage houses is "Financial License." XM is under the scrutiny of Seyshelles Financial Services Agency and has obtained the permission of providing the financial services to the clients.

Financial license is the permission which allows brokerage houses to manage financial business such as FX and the license itself is issued by financial authorities of each country. In order to obtain financial license each brokerage house needs to meet the criteria (such as capital, funds custody situation, risk management system) regulated by financial authorities of each country. Therefore the criteria or difficulty level is depending on the issuer of financial license and it is the barometer of safety and reliability of FX brokerage house.

XM Group is an overseas FX brokerage house and obtained a permission from financial authorities around the world. XM is managed by "XM Global Limited" and has obtained a securities dealer's license with number 000261/397 issued by Financial Services Commission (FSC).

Each company within XM Group including "XM Global Limited" has multiple licenses besides the License from Finalcial Services Authority (FSA). Having obtained difficult licences such as Cyprus Securities and Exchange Commission (CySEC) indicates that XM Group is a highly safe overseas FX brokerage house.

| Companies within XM Group | License |

| Trading Point of Financial Instruments Ltd | Cyprus Securities and Exchange Commission (CySEC) Financial Conduct Authority (FCA) |

| Trading Point of Financial Instruments UK Limited | Financial Conduct Authority (FCA) |

| XM Global Limited | Financial Services Commission (FSC) |

| Trading Point of Financial Instruments Pty Ltd | Australian Securities Investments Commission (ASIC) |

| Trading Point MENA Limited | Dubai Financial Services Authority (DFSA) |

| Tradexfin Limited | Financial Services Authority Seychelles (FSA) |

| Trading Point of Financial Instruments Ltd | |

| License | Cyprus Securities and Exchange Commission (CySEC) Financial Conduct Authority (FCA) |

| Trading Point of Financial Instruments UK Limited | |

| License | Financial Conduct Authority (FCA) |

| XM Global Limited | |

| License | Financial Services Commission (FSC) |

| Trading Point of Financial Instruments Pty Ltd | |

| License | Australian Securities Investments Commission (ASIC) |

| Trading Point MENA Limited | |

| License | Dubai Financial Services Authority (DFSA) |

| Tradexfin Limited | |

| License | Financial Services Authority Seychelles (FSA) |

XM devides its cmpanies within the group, then each company holds the license of the country and operate according to the provision of each license. By doing this, each company within the group provides the residents of each country with unique service.

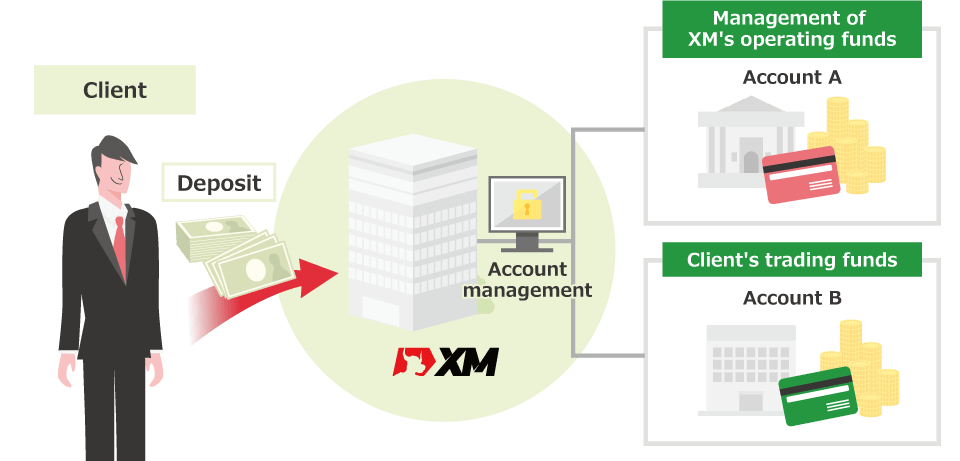

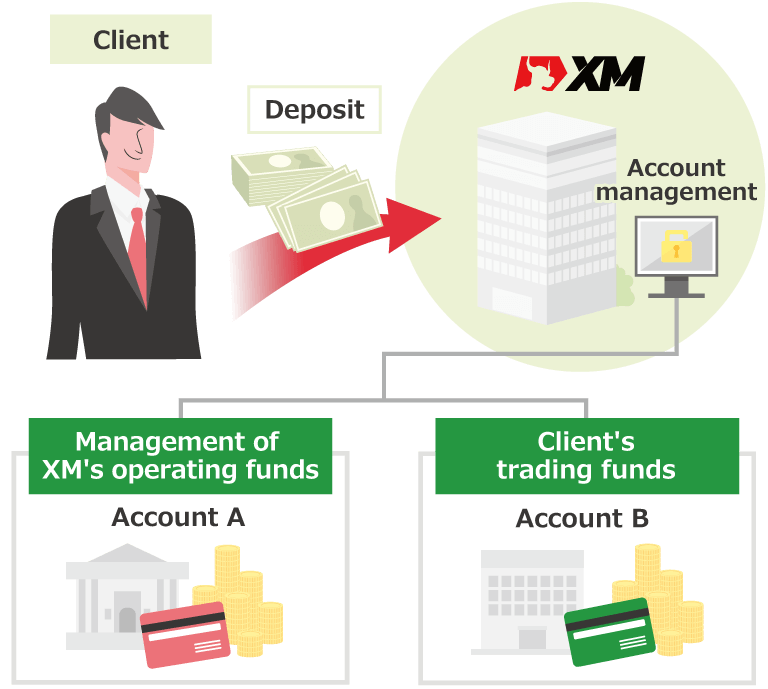

XM manages clients' funds under the "Segregated Funds Custody" which is separated from company's operating funds. Clients' funds including deposit and realized profit are all secured and you can trade at ease.

Segregated funds custody is the system where clients' funds are separately managed in the different bank account other than the funds of the company for its own operation. XM has obtained the financial license from Financial Services Commission (FSC) and clients' funds are safely managed according to the license procedure.

XM deploys " segregated funds" for its clients funds management. Clients' funds are dispersedly deposited in quality good banks located banks in Germany and Switzerland and are completely segregated and managed from our company's own funds. XM conducts proper evaluation of the banks for its deposit not only before the deposit but also after the funds deposited and tries to keep the safety of the funds. Clients' funds are not included in the balance sheet of the company and will be secured from the payment to the creditors even in the case of our bankruptcy.

XM has an obligation to follow strict financial rules as a holder of license of Financial Services Commission (FSC). Therefore if there is a lack of management or funds management along the regulations on yearly internal audit, the details are reported by our internal auditor to the financial authority, the license issuer.

XM has obtained the safety for clients' funds through segregated funds custody with reliable quality good banks and thorough safety management. Clients' funds with XM including deposited funds as well as the profit you have earned are all secured safely, so feel at ease.

Recently more traders are focusing on "Execution Power" as a priority in addition to the cost such as spread or trading fees for choosing FX brokerage house. XM tries to provide fair and transparent trading environment based on a firm belief that execution power is everything in FX.

All the orders are executed not through human intervention by dealers with XM, but through automatic next generation NDD system. As a result, there occurrs no conflict of interest between XM and clients and clients can enjoy trading in a fair and transparent trade environment at ease.

We also deploy highest level order infrastructure among competitors and 99.35% of all orders are executed within 1 second with no requote or no rejection even in the hours orders pouring in. As XM holds tremendous numbers of clients as the largest in the field, it can marry orders of clients and enables overwheling execcution ratio (execution power) and execution speed.

XM deploys negative balance protection which does not require clients of any additional margin call even when the loss exceeds the valid margin money. As the loss will be compensated by XM, clients can trade at ease without the risk of taking mre loss of deposit than the deposited amount.

Negative balance protection is the system where XM takes the loss of clients and reset the minus balance back to nil when the volatile market movement does not meet the loss-cut (forced-settlement) timing and loss exceeds the valid margin money.

Clients face "additional margin call" and will take the risk of higher debt than expected in the case loss exceeds valid margin money for domestic FX brokerage houses who are not allowed to compensate the loss of clients due to the regulation of Japan. On the other hand most of overseas FX brokerage houses including XM compensate all the losses from negative balance, therefore clients do not have to bear the loss. In addition to it, you can enjoy high leverage trading safely as there is no additional loss other than the deposited amount.

Negative balance protection promptly works when clients becomes deposit more money than minimum deposit amount, exchange XMP (XM Points) into USD or move funds between accounts.

| Execution condition for negative balance protection | Timing |

| Additional deposit into account | Immediate |

| Exchange XM points (XMP)into USD cash | |

| Transfer of funds from other accounts |

| Execution condition | Timing |

| Additional deposit into account | Immediate |

| Exchange XM points (XMP)into USD cash | |

| Transfer of funds from other accounts |

XM's Negative Balance Protection is executed at the timing of additional money deposited, however there may be the case that system will return client's balance back to "zero" without addditional deposit if the client does not have positions. In this case the timing of execution of negative balance protection might become irregular.

Loss Cut system is the system where the unrealized loss of the position held by client goes below certain level and is compulsory settled by the FX brokerage house in order to avoid further loss. This works as a safety device for lessening the loss of more than certain level and protect client's assets. XM's Loss cut system starts to work when the margin goes below 20% of the maitain ratio. This ratio is the lowest among the FX brokerage houses and clients can persistently continue to trade under the condition that market goes agaist client's expectation.

There may be the case that the loss cut is not in time for volatile movement of the market and the valid margin money goes below zero. Please do understand. Even when client's balance gose below zero, client will not meet additional margin call thorugh negtive balance protection, so client can trade at ease.

XM deals with all the clients' need for trade by operaators through mail/live chat in 27 languages. XM provides high quality support which does not have an unsafe feel apt to be common like "unable to be understood" or "late in response."

XM sets up the support desk of 24 hours, 5 days a week and are ready to accept the enquiries by e-mail in more than 27 languages and online support through live chat in 27 languages.

We stand by with full back-up framework of back office/IT staff and monitor the trade environment 24 hours 365 days.

If loss is caused, XM promptly adjust the trade record and there will not be any unfavorable loss for clients.

Working hours: 24/5 GMT

Email: [email protected]

Working hours: 24/7 GMT

Phone Support

Working hours: 24/7 GMT

Phone:+501 223-6696

Working hours: 24/5 GMT

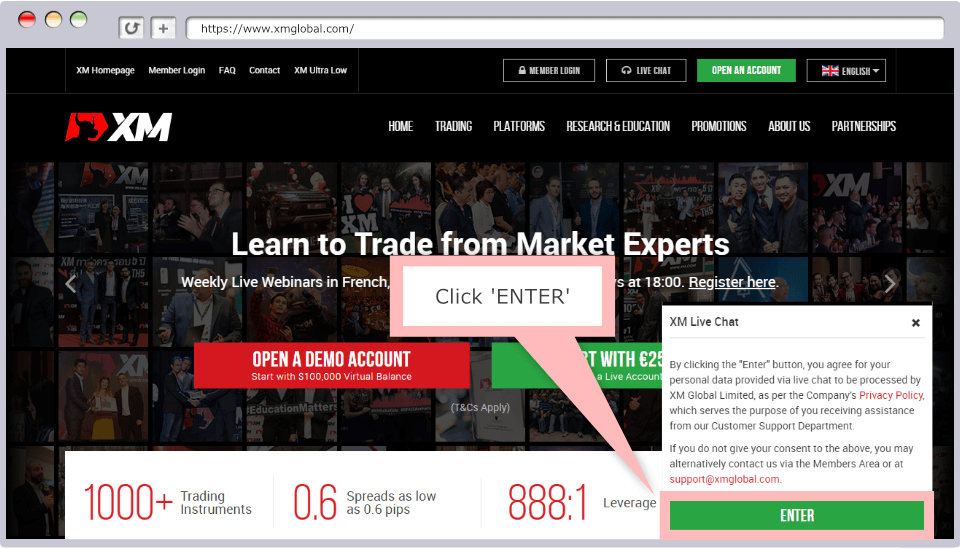

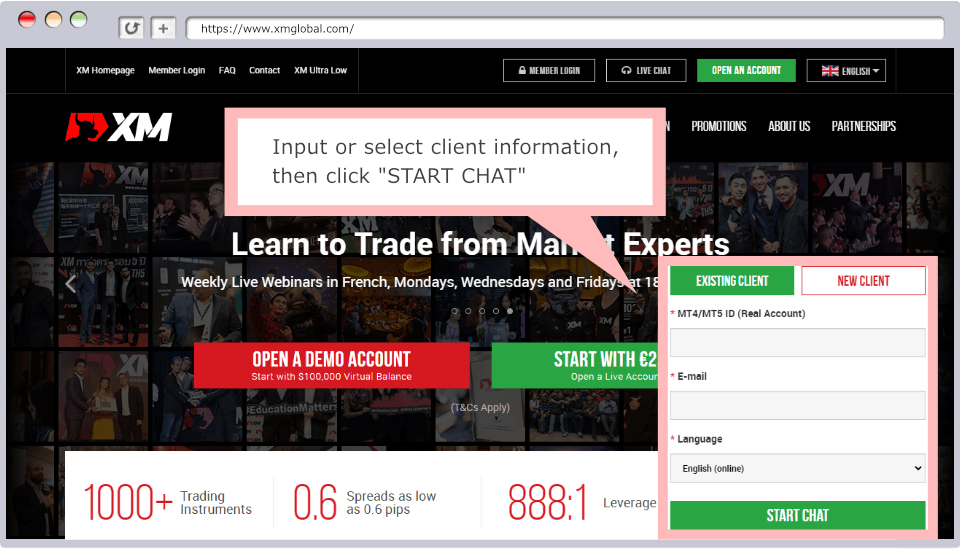

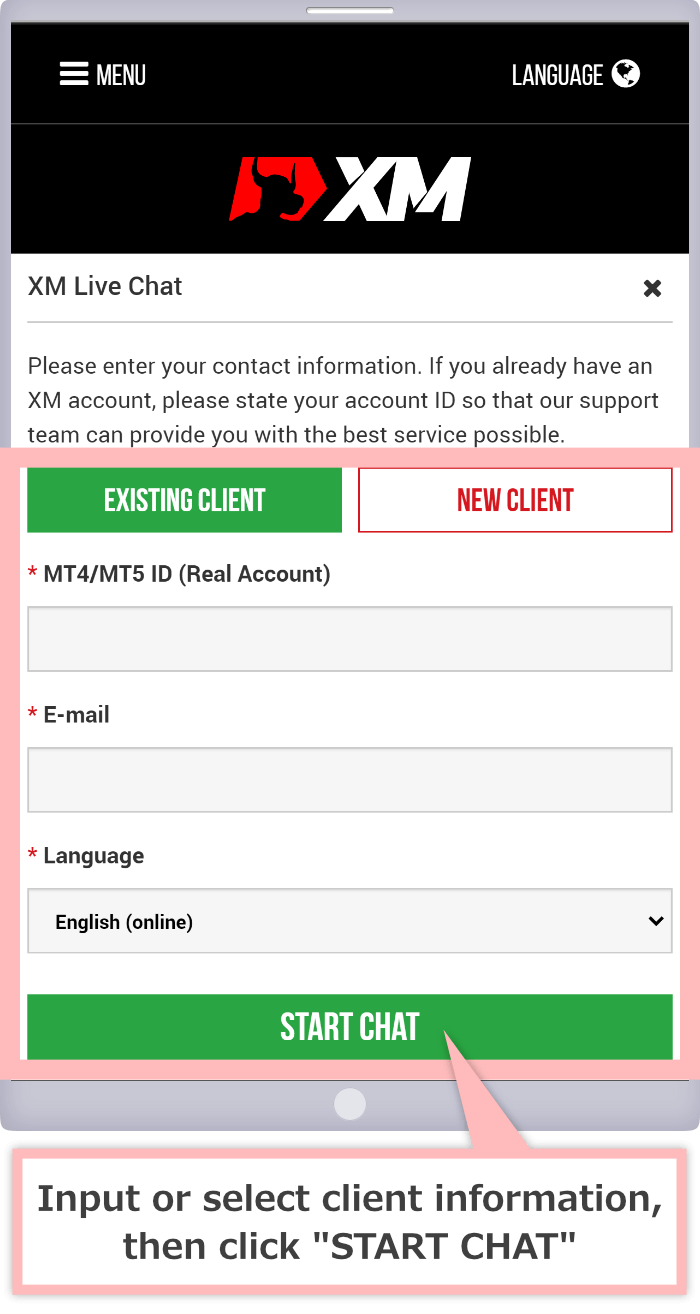

Access LIVE CHAT from XM's Members Area and click "Support" on the bottom right corner, then click "Live Chat."

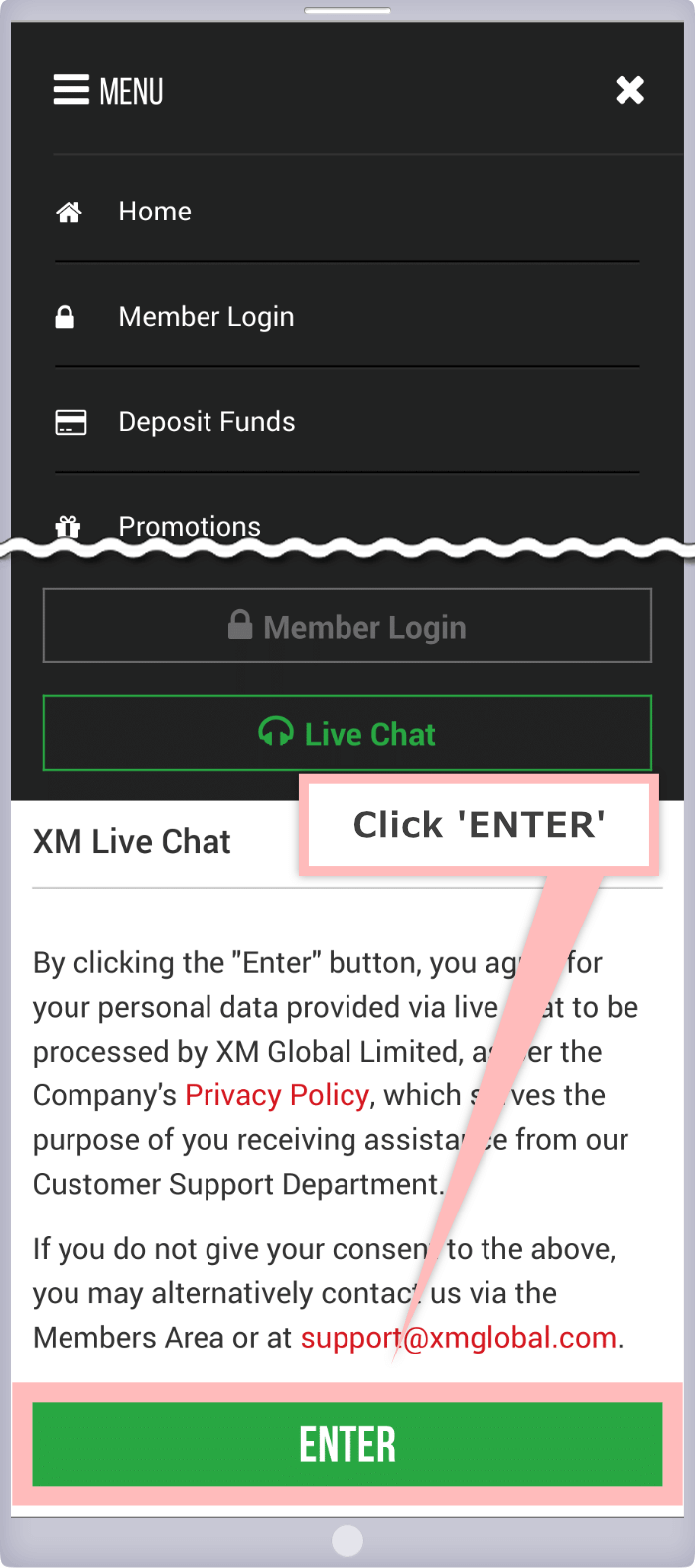

Access LIVE CHAT from XM's Members Area and tap "Support" on the bottom right corner, then tap "Live Chat."

After client's information input page comes up, input Name, Email address and choose language, then click "Start chat."

After client's information input page comes up, input Name, Email address and choose language, then tap "Start chat."

When client contacts us outside of our service time of Live chat, he/she will see the sign, "English (Offline)." so he/she should try again when the sign is shown as "English (online)."

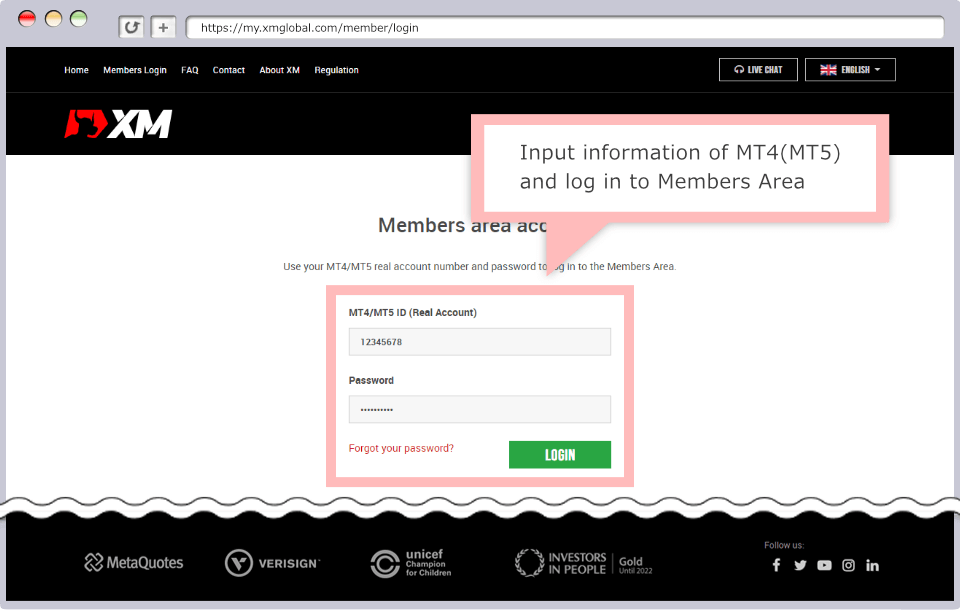

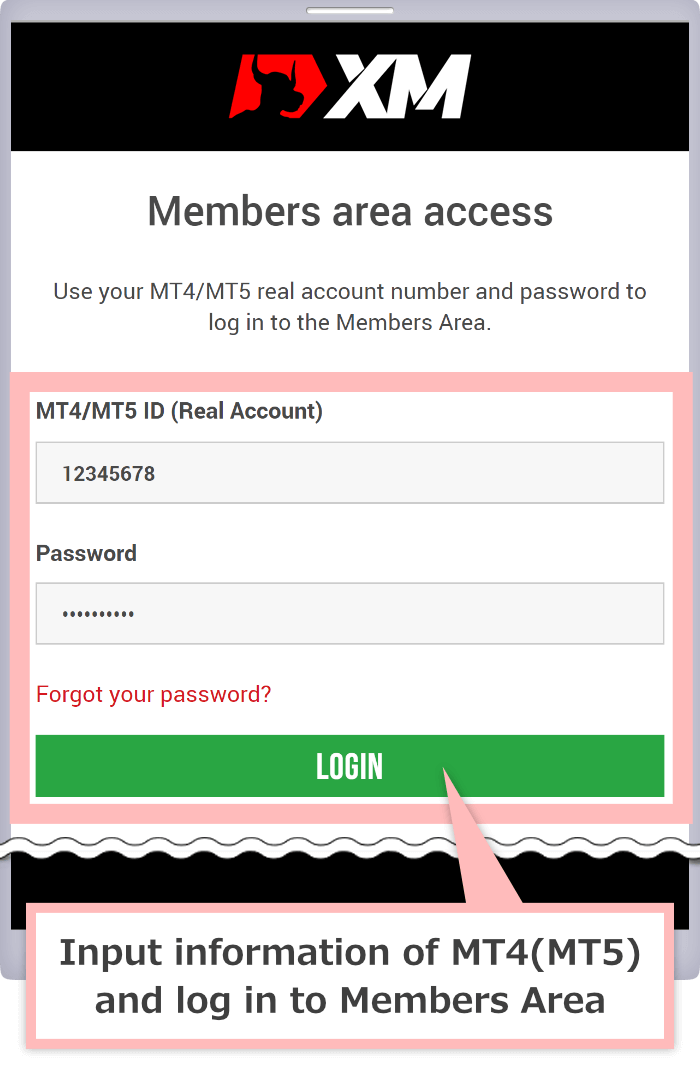

Log in to XM's 'Member Page' by using registered mail address and password.

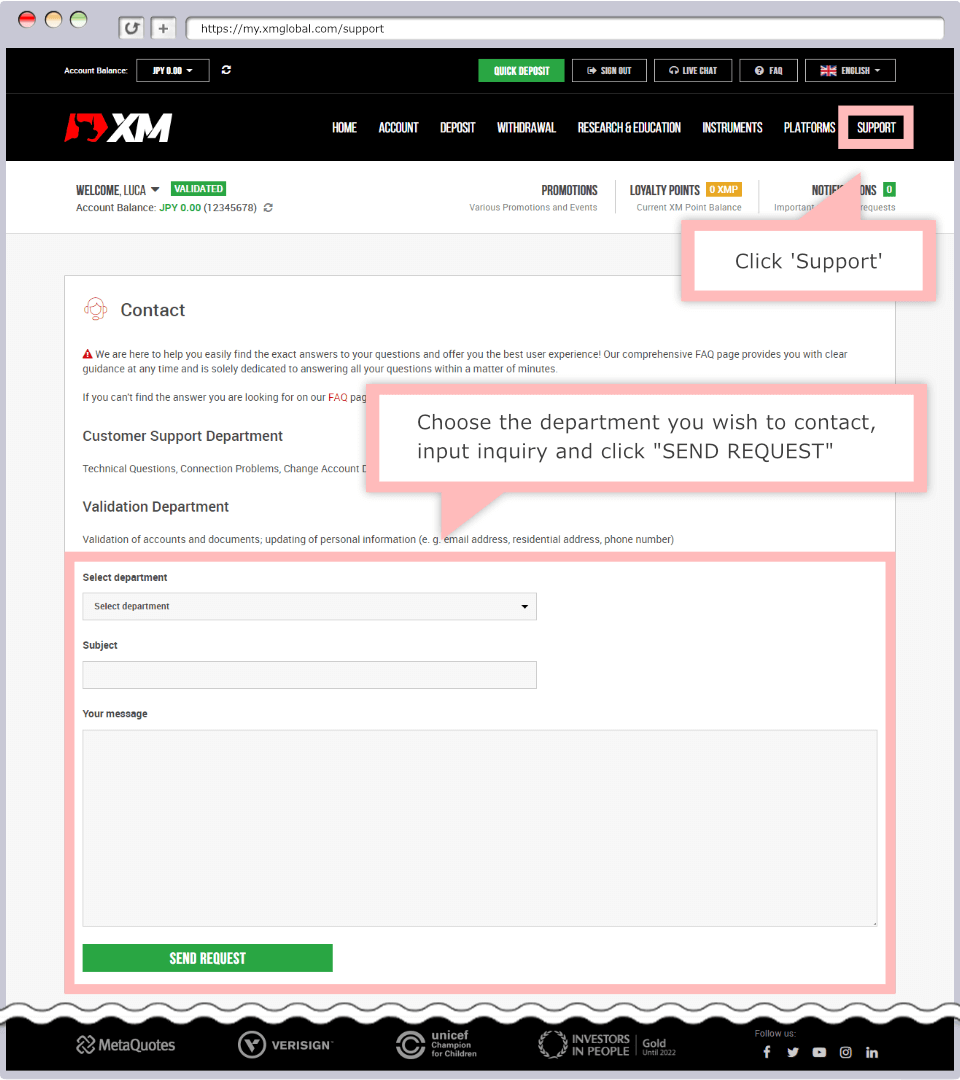

When you click "Support" from menu in Members Aera, then click "Submit a question" you will see the inquiry form. Choose the department you wish to contact (Customer Support Department or Validation Department), input the inquiry and click "Send Request."

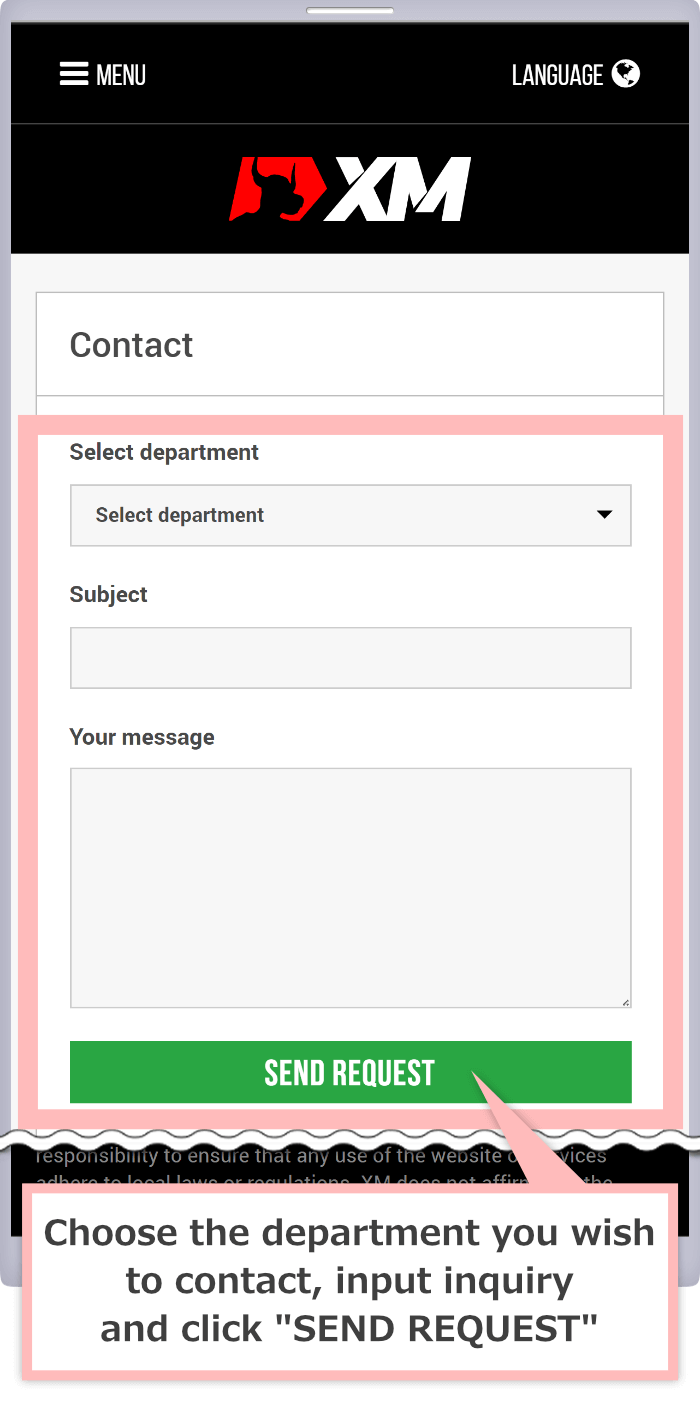

When you tap "Support" from menu in Members Aera, then tap "Submit a question" you will see the inquiry form. Choose the department you wish to contact (Customer Support Department or Validation Department), input the inquiry and tap "Send Request."

Are funds deposited with XM safe?

XM holds the clients' funds in 'Segregated Funds Custody.' Even in the case of our bankruptcy, clients' funds are completely segregated from company's operating funds and deposit as well as the profit you have earned are all secured, so feel at ease.

2021.12.15

Can I make an inquiry in other languages than english with XM?

XM deals with mail service in more than 26 languages and live chat service in 26 languages. Those who do not have a confidence in English can make an inquiry in other languages, so feel at ease.

2021.12.15

Is there any case where XM intervenes in execution?

No, there is no intervention in the trading as XM deploys fair order system called next generation NDD. XM does not intevene against client's interest for client's order and provides fair and transparent trade environment.

2021.12.15

Is there any cases that my account balance with XM goes negative?

No, there are no such cases as XM employs negative balance protection system, whenever your account balance goes negative due to the unexpected volatile movement of the market, your account will automatically be reset to nil. The negative balance will be compensated by XM and you will never be asked for the additional margin call. So you can trade at ease.

2021.08.12

Is there any cases that the execution is rejected by XM?

No, there is no requote of the price or rejection of the execution with XM. 99.35% of all the orders are executed within 1 second and our system enables us to realize the highest level of execution and its high speed. High execution capability means that there is no slippage and you can trade at ease.

2021.08.12