XM™|How to open the FX account.

XM provides with maximum 1:1,000 leverage and it has an appeal to the investors. Wide range of 1:1 to 1:1,000 leverage is freely available from the beginning of real account opening (*1). The most attractive feature of FX trading is the leverage where you can trade in a big size amount with the minimal amount of margin. You can trade not only FX currency pairs but also popular gold with maximum 1:1,000 leverage with XM.

There would be no fluctuation of leverage or margin ratio with XM at the time of economic indicator release or during hours of low liquidity such as night time or weekends with XM. You can enjoy leverage trading to the full extent with taking the advantage of high leverage which is available on the stable trading environment of XM. Why not experience exciting feeling where you can expect a big amount of profit with the minimal market movement in the trading account of XM (*1).

![]()

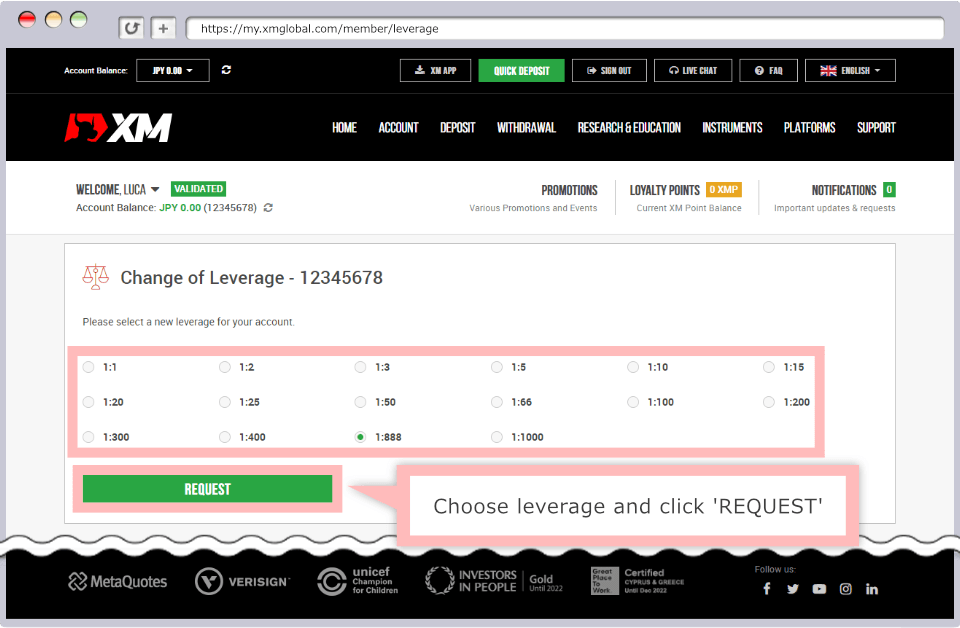

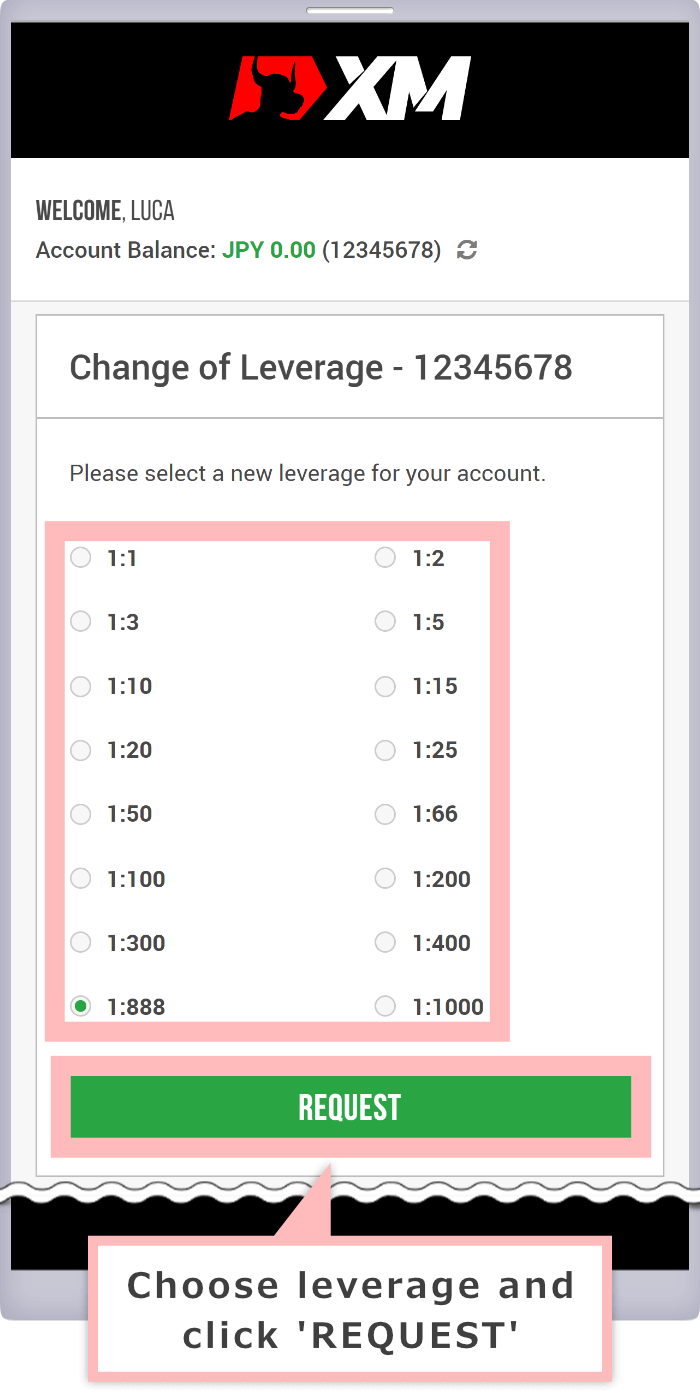

XM offers 17 kinds of leverage setting in Standard Account, Micro Account, XM Ultra Low Account Standard and XM Ultra Low Account Micro. Wide range of 1:1 to 1:1,1000 leverage is available depending on the risk management attitude of clients. Initial leverage setting can also be changeable through the Member Page(*1).

Explanation for how to change the leverage

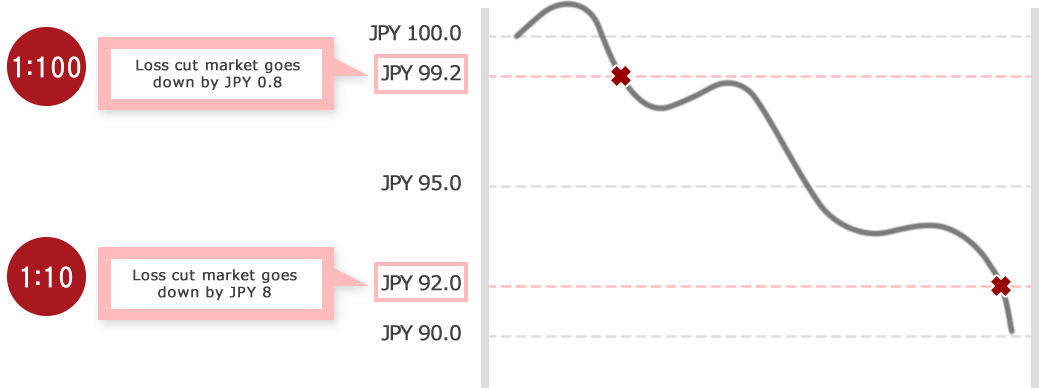

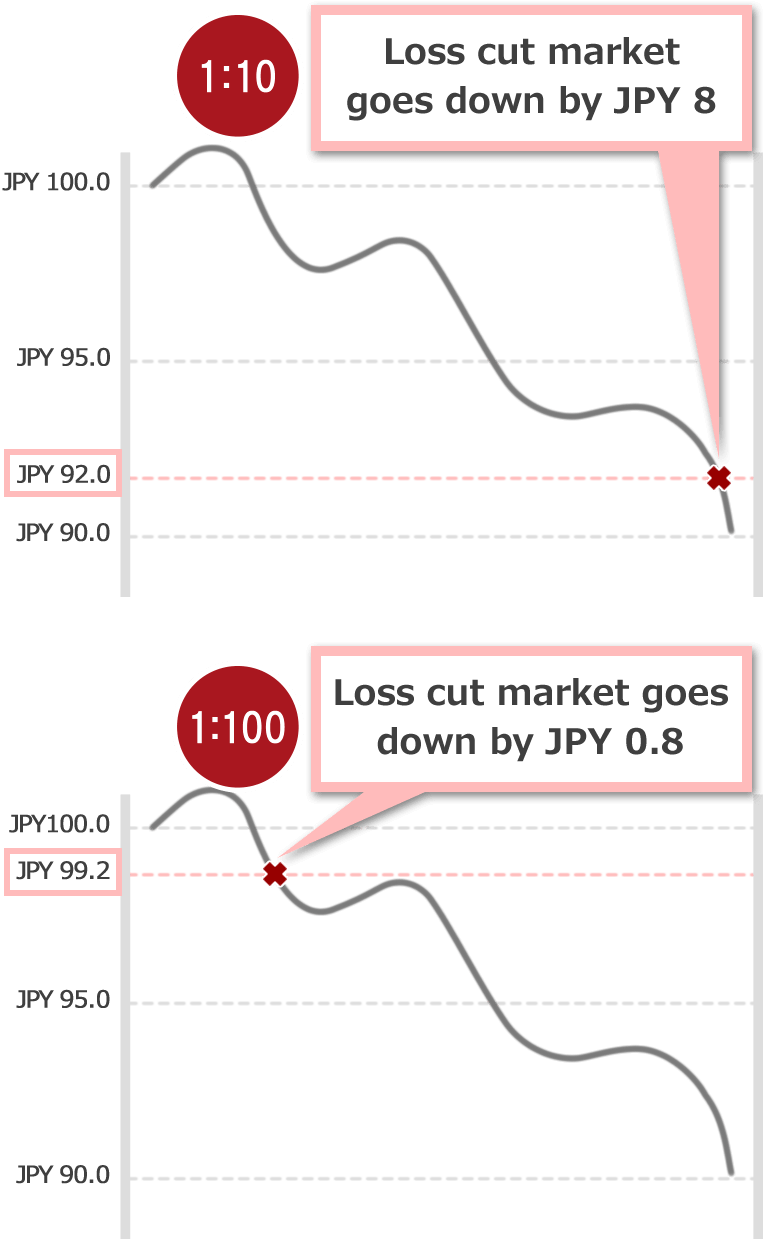

For your information, loss cut is exercised when margin level goes below 20% with XM. There are possibilities where you can generate a big amount of profit with leverage trade, on the other hand, there are also the other possibilities where the market goes against your position and it leads to a big loss. XM provides with Negative Balance Protection ready in case when loss cut does not work properly, so the risk is capped at the amount of money you deposited.

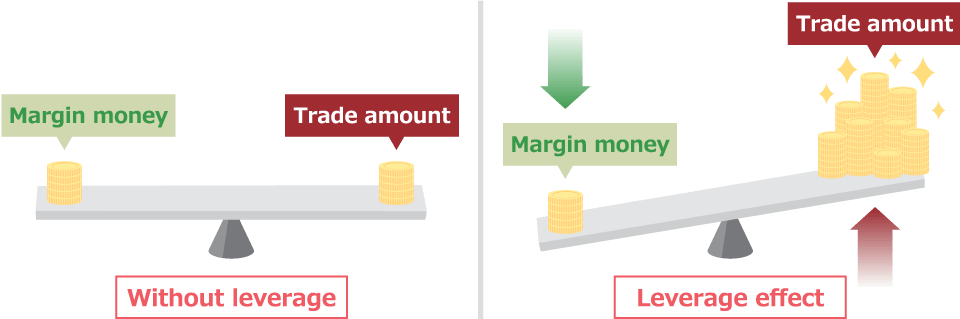

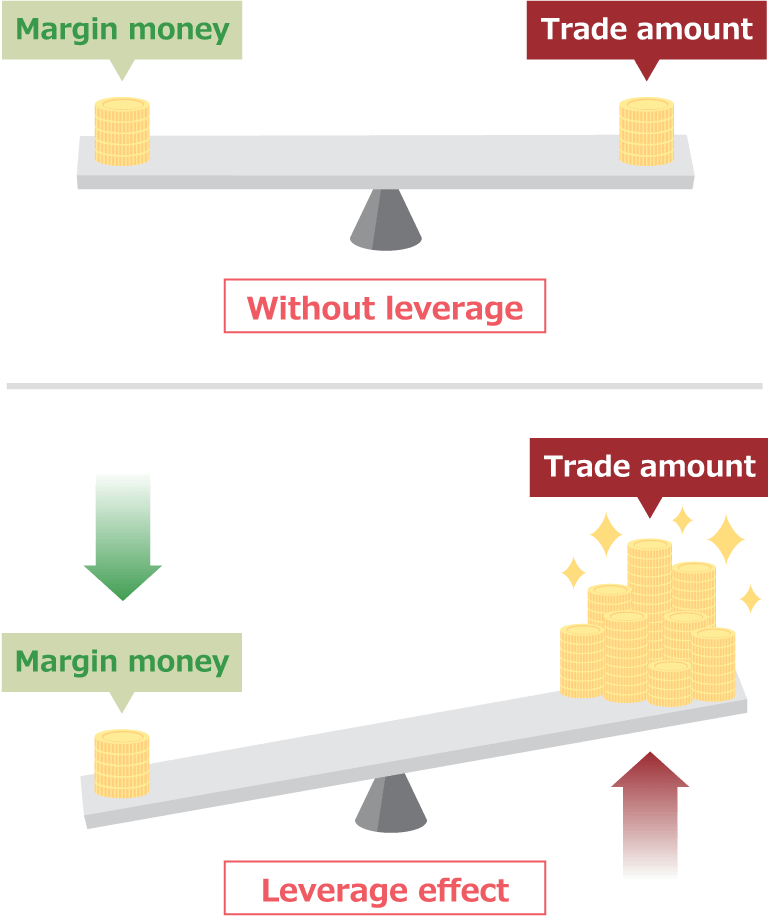

Leverage literally is a 'principle of lever,' and means to move relatively big things with a smaller power. 'Leverage effect' in FX means to trade in a big amount with a small amount of margin money through a 'principle of lever.'

1:1,000 leverage with XM' will make you trade worth JPY 10 million with JPY 10,000 margin.

Margin is the minimum amount of money required for the certain amount of trade, and plays a role of margin for the loss from trade.

Higher leverage requires smaller margin money, on the other hand, lower leverage requires bigger amount of margin money in the leverage trade. For example, when USD/JPY is 147.37,EUR/USD is 1.07 and Sterling Pound/JPY is 1.26, the relationship between leverage and required margin money for trading 10,000 each currency unit is as follows:

| leverage | USD/JPY | EUR/JPY | GPB/JPY |

| 1:1,000 | about 10.00USD | about 10.79USD | about 12.61USD |

| 1:888 | about 11.26USD | about 12.15USD | about 14.20USD |

| 1:500 | about 20.00USD | about 21.58USD | about 25.21USD |

| 1:400 | about 25.00USD | about 26.98USD | about 31.52USD |

| 1:300 | about 33.33USD | about 35.97USD | about 42.02USD |

| 1:200 | about 50.00USD | about 53.96USD | about 63.03USD |

| 1:100 | about 100.00USD | about 107.91USD | about 126.07USD |

| 1:66 | about 151.52USD | about 163.51USD | about 191.01USD |

| 1:50 | about 200.00USD | about 215.83USD | about 252.13USD |

| 1:25 | about 400.00USD | about 431.65USD | about 504.26USD |

| 1:20 | about 500.00USD | about 539.56USD | about 630.32USD |

| 1:15 | about 666.67USD | about 719.48USD | about 840.43USD |

| 1:10 | about 1,000.00USD | about 1,079.22USD | about 1,260.64USD |

| 1:5 | about 2,000.00USD | about 2,158.44USD | about 2,521.26USD |

| 1:3 | about 3,333.33USD | about 3,598.13USD | about 4,202.10USD |

| 1:2 | about 5,000.00USD | about 5,397.20USD | about 6,303.15USD |

| 1:1 | about 10,000.00USD | about 10,794.40USD | about 12,608.10USD |

| 1:1,000 | |

| USD/JPY | about 10.00USD |

| EUR/JPY | about 10.79USD |

| GPB/JPY | about 12.61USD |

| 1:888 | |

| USD/JPY | about 11.26USD |

| EUR/JPY | about 12.15USD |

| GPB/JPY | about 14.20USD |

| 1:500 | |

| USD/JPY | about 20.00USD |

| EUR/JPY | about 21.58USD |

| GPB/JPY | about 25.21USD |

| 1:400 | |

| USD/JPY | about 25.00USD |

| EUR/JPY | about 26.98USD |

| GPB/JPY | about 31.52USD |

| 1:300 | |

| USD/JPY | about 33.33USD |

| EUR/JPY | about 35.97USD |

| GPB/JPY | about 42.02USD |

| 1:200 | |

| USD/JPY | about 50.00USD |

| EUR/JPY | about 53.96USD |

| GPB/JPY | about 63.03USD |

| 1:100 | |

| USD/JPY | about 100.00USD |

| EUR/JPY | about 107.91USD |

| GPB/JPY | about 126.07USD |

| 1:66 | |

| USD/JPY | about 151.52USD |

| EUR/JPY | about 163.51USD |

| GPB/JPY | about 191.01USD |

| 1:50 | |

| USD/JPY | about 200.00USD |

| EUR/JPY | about 215.83USD |

| GPB/JPY | about 252.13USD |

| 1:25 | |

| USD/JPY | about 400.00USD |

| EUR/JPY | about 431.65USD |

| GPB/JPY | about 504.26USD |

| 20倍 | |

| USD/JPY | about 500.00USD |

| EUR/JPY | about 539.56USD |

| GPB/JPY | about 630.32USD |

| 15倍 | |

| USD/JPY | about 666.67USD |

| EUR/JPY | about 719.48USD |

| GPB/JPY | about 840.43USD |

| 1:10 | |

| USD/JPY | about 1,000.00USD |

| EUR/JPY | about 1,079.22USD |

| GPB/JPY | about 1,260.64USD |

| 1:5 | |

| USD/JPY | about 2,000.00USD |

| EUR/JPY | about 2,158.44USD |

| GPB/JPY | about 2,521.26USD |

| 1:3 | |

| USD/JPY | about 3,333.33USD |

| EUR/JPY | about 3,598.13USD |

| GPB/JPY | about 4,202.10USD |

| 1:2 | |

| USD/JPY | about 5,000.00USD |

| EUR/JPY | about 5,397.20USD |

| GPB/JPY | about 6,303.15USD |

| 1:1 | |

| USD/JPY | about 10,000.00USD |

| EUR/JPY | about 10,794.40USD |

| GPB/JPY | about 12,608.10USD |

You can trade with maximum 1:1,000 leverage in Standard Account, Micro Account, XM Ultra Low Account Standard and XM Ultra Low Account Micro with XM. The big advantage of leverage trading is to be able to generate a big profit with a minimal amount of margin.

You can expect high leverage effect through 1:1,000 leverage of XM among other FX brokerage houses.

One of the attractive features of leverage trade is that you can start trading with minimal amount of margin money. There is an apparent difference between XM and other FX brokerage houses when you trade in the same number of lots. Required margin to trade 10,000 unit of currency when USD/JPY is USD 1 = JPY 100.00 is as follows:

| XM Leverage 1:1,000 | Other brokerage houses 1:25 | |

| Required margin | about 10USD | about 400USD |

| Required margin | |

| XM Leverage 1:1,000 |

about 10USD |

| Other brokerage houses 1:25 |

about 400USD |

It is possible to trade USD/JPY 10,000 with just JPY 1,100 funds with XM. On the other hand, you will need more than JPY 40,000 to trade the same 10,000 currency unit through other brokerage houses with 1:25 leverage.

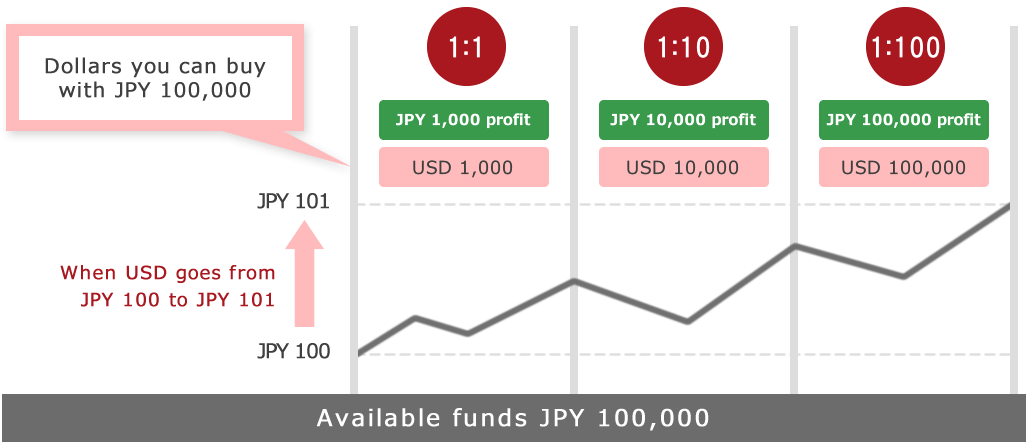

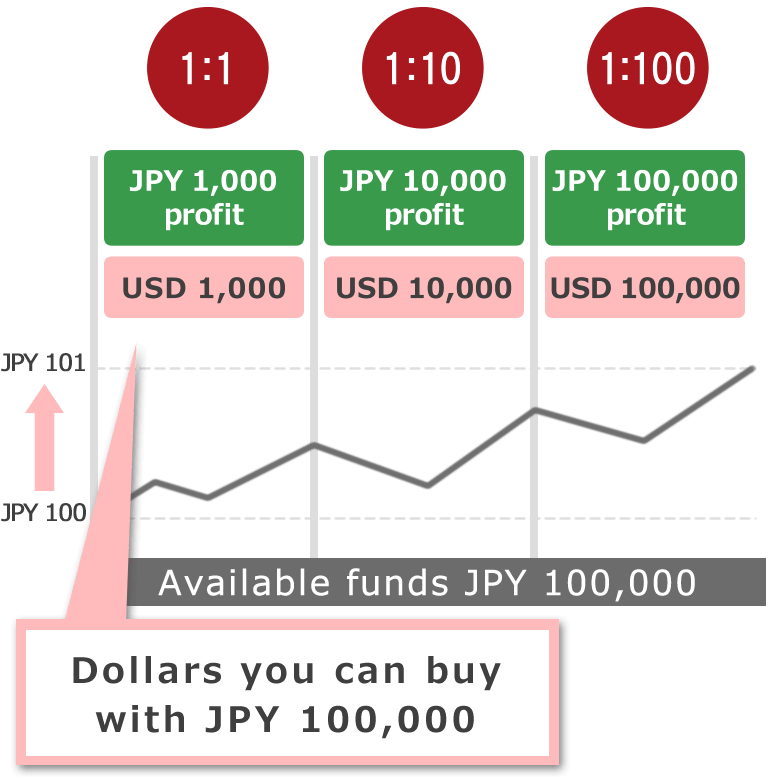

The advantage of leverage trade is that you can expect a big amount of profit in a short term. The trade amount and, profit and loss in leverage trade depend on the size of leverage and as the result the profit you can expect could become bigger.

For example, if you trade normally without leverage with your fund of JPY 100,000, you can trade in USD 1,000 worth. When you buy USD 1,000 at the time of USD 1 = JPY 100 and sell the same amount of USD at 101.00, you will make a profit of JPY 1,000. However if you use 1:100 leverage, you can trade in USD 100,000 and the expected profit would become JPY 100,000.

XM sets a leverage limitation depending on the equity for FX currency pairs and spot metals (gold and silver).

When the equity (margin balance including profit and loss of existing positions) of trading account goes above USD 20,000, maximum leverage will be reduced to 1:200, and when the equity goes above USD 100,000, maximum leverage will be reduced to 1:100.

| Equity balance | Maximum leverage |

| Standard Account / Micro Account / XM Ultra Low Account Standard / XM Ultra Low Account Micro | |

| $5~$20,000 | 1:1,000 |

| $20,001~$100,000 | 1:200 |

| $100,001~ | 1:100 |

| Standard Account / Micro Account / XM Ultra Low Account Standard / XM Ultra Low Account Micro |

|

| $5~$20,000 | 1:1,000 |

| $20,001~$100,000 | 1:200 |

| $100,001~ | 1:100 |

Leverage limitation through equity will not be levied on margin amount of each individual trading account, but on the total balance of all aggregated balance within the same account (equity). Caution is needed as equity includes bonus amount given to the accounts and unrealized profit and loss (unrealized profit/loss of existing positions).

Equity =

account balance+ bonus+ unrealized profit and loss

If there is increase of margin money or additional deposit during the course of holding positions, limit on the maximum leverage will be changed. As the result, caution is needed not to have forced position cut (loss cut) exercised due to lack of margin when placing orders.

Leverage limit change arises with XM when the total of all aggregated equity balance within the same trading account goes above the threshold.

Exercise of leverage limit change will be informed through e-mail or other ways in advance, however there would be some urgent cases where there is no previous information for the leverage limit change. Thank you for your understanding in advance.

Once the limitation becomes in place, the limit will not be released automatically even when the equity goes below the threshold through withdrawal of deposit or decrease of unrealized profit. If you wish to release the leverage limitation, you need to push down the equity amount below threshold and send the mail to XM Support Desk. Leverage limitation cannot be released unless there is a mail request from client.

XM sets a smaller maximum limit on some FX currency pairs and CFD products due to limited liquidity and volatility in the market.

Leverage ratio set on the trading account will be available for the most actively traded major FX currency pairs and you can enjoy maximum 1:1,000 leverage.

| Margin balance/maximum leverage | ||||

| Commodities (Descriptions) |

$5~ $40,000 |

$40,001~ $80,000 |

$80,001~ $200,000 |

$200,001~ |

| FX currency pairs | 1:1,000 | 1:500 | 1:200 | 1:100 |

| $5~$40,000 | |

| FX currency pairs | 1:1,000 |

| $40,001~$80,000 | |

| FX currency pairs | 1:500 |

| $40,001~$80,000 | |

| FX currency pairs | 1:500 |

| $80,001~$200,000 | |

| FX currency pairs | 1:200 |

| $200,001~ | |

| FX currency pairs | 1:100 |

Different leverage ratios from initial leverage setting in the account will be applied to each description of minor/exotic currencies. For your information, maximum leverage limit is the same for all the account types. So please be noted when you trade the descriptions below.

| Equity/maximum leverage | |||

| Commodities (Descriptions) |

$5~ $80,000 |

$80,001~ $200,000 |

$200,001~ |

| AUDCHF | 1:400 | 1:200 | 1:100 |

| CADCHF | 1:400 | 1:200 | 1:100 |

| CHFJPY | 1:400 | 1:200 | 1:100 |

| CHFSGD | 1:400 | 1:200 | 1:100 |

| EURCHF | 1:400 | 1:200 | 1:100 |

| GBPCHF | 1:400 | 1:200 | 1:100 |

| NZDCHF | 1:400 | 1:200 | 1:100 |

| USDCHF | 1:400 | 1:200 | 1:100 |

| EURTRY | 1:100 | ||

| USDTRY | 1:100 | ||

| EURDKK | 1:50 | ||

| GBPDKK | 1:50 | ||

| USDCNH | 1:50 | ||

| USDDKK | 1:50 | ||

| USDHKD | 1:50 | ||

| Equity/maximum leverage | ||

| $5~ $80,000 |

$80,001~ $200,000 |

$200,001~ |

| AUDCHF | ||

| 1:400 | 1:200 | 1:100 |

| CADCHF | ||

| 1:400 | 1:200 | 1:100 |

| CHFJPY | ||

| 1:400 | 1:200 | 1:100 |

| CHFSGD | ||

| 1:400 | 1:200 | 1:100 |

| EURCHF | ||

| 1:400 | 1:200 | 1:100 |

| GBPCHF | ||

| 1:400 | 1:200 | 1:100 |

| NZDCHF | ||

| 1:400 | 1:200 | 1:100 |

| USDCHF | ||

| 1:400 | 1:200 | 1:100 |

| EURTRY | ||

| 1:100 | ||

| USDTRY | ||

| 1:100 | ||

| EURDKK | ||

| 1:50 | ||

| GBPDKK | ||

| 1:50 | ||

| USDCNH | ||

| 1:50 | ||

| USDDKK | ||

| 1:50 | ||

| USDHKD | ||

| 1:50 | ||

Initial leverage setting in the account will not be applied to CFD trading. Fixed leverage ratio will be applied regardless of account types or equity.

GOLD can be traded with maximum 1:1,000 leverage and SILVER with 1:400 leverage in precious metal CFDs. Palladium and platinum can be traded 1:22.2 effective leverage regardless of account types or equity.

| Margin balance/maximum leverage | ||||

| Instruments | $5~ $40,000 |

$40,001~ $80,000 |

$80,001~ $200,000 |

$200,001~ |

| GOLD | 1:400 | 1:200 | 1:100 | - |

| SILVER | 1:400 | 1:200 | 1:100 | - |

| XAUEUR | 1:1000 | 1:500 | 1:200 | 1:100 |

| PALL | 1:22.2 | |||

| PLAT | 1:22.2 | |||

| GOLD | |

| $5~$40,000 | 1:400 |

| $40,001~$80,000 | 1:200 |

| $80,001~$200,000 | 1:100 |

| $200,001~ | - |

| SILVER | |

| $5~$40,000 | 1:400 |

| $40,001~$80,000 | 1:200 |

| $80,001~$200,000 | 1:100 |

| $200,001~ | - |

| XAUEUR | |

| $5~$40,000 | 1:1,000 |

| $40,001~$80,000 | 1:500 |

| $80,001~$200,000 | 1:200 |

| $200,001~ | 1:100 |

| PALL/PLAT | |

| $5~$40,000 | 1:22.2 |

| $40,001~$80,000 | |

| $80,001~$200,000 | |

| $200,001~ | |

You can trade cash and future products in stock indices. Same leverage ratio applies both to cash and futures for the same description.

| Commodities (Descriptions) |

Fixed leverage |

| AUS200Cash(ASX 200) | 1:100 |

| CA60Cash(CANADA60) | 1:250 |

| China50Cash(CHINA A50) | 1:250 |

| ChinaHCash(HONG KONG CHINA H-SHARES) | 1:250 |

| EU50Cash(EURO STOXX 50) | 1:100 |

| FRA40Cash(CAC 40) | 1:100 |

| GER30Cash(DAX) | 1:100 |

| HK50Cash(HSI) | 1:66.7 |

| IT40Cash(FTSE MIB) | 1:100 |

| JP225Cash(Nikkei) | 1:200 |

| NETH25Cash(AEX) | 1:100 |

| SA40Cash(SOUTH AFRICA 40) | 1:400 |

| Sing30Cash(SINGAPORE 30) | 1:250 |

| SPAIN35Cash(IBEX) | 1:100 |

| SWI20Cash(SMI 20) | 1:100 |

| UK100Cash(FTSE 100) | 1:100 |

| US100Cash(NASDAQ) | 1:100 |

| US2000Cash(US 2000) | 1:250 |

| US30Cash(Dow Jones) | 1:100 |

| US500Cash(S&P500) | 1:100 |

| Commodities (Descriptions) |

Fixed leverage |

| EU50(EURO STOXX 50) | 1:100 |

| FRA40(CAC 40) | 1:100 |

| GER30(DAX) | 1:500 |

| JP225(Nikkei) | 1:500 |

| SWI20(SMI 20) | 1:100 |

| UK100(FTSE 100) | 1:500 |

| US100(NASDAQ) | 1:500 |

| US30(Dow Jones) | 1:500 |

| US500(S&P 500) | 1:500 |

| USDX(US Dollar Index) | 1:100 |

| VIX(S&P 500) | 1:100 |

Crude oil and natural gas can be traded with maximum 1:66.7 and with 1:33.3 leverage respectively in energy CFD products. Especially crude oil market moves tremendously within a short time, therefore there is a possibility that you can make a big profit with high leverage.

| Commodities (Descriptions) |

Fixed leverage |

| BRENTCash | 1:200 |

| NGASCash | 1:200 |

| OILCash | 1:200 |

| Commodities (Descriptions) |

Fixed leverage |

| BRENT(Brent Crude Oil) | 1:66.7 |

| GSOIL(London Gas Oil) | 1:33.3 |

| NGAS(Natural Gas) | 1:33.3 |

| OIL(WTI Oil) | 1:66.7 |

| OILMn(WTI Oil Mini) | 1:66.7 |

Different leverage ratios will be applied depending on the description. Bitcoin, Ethereum, XRP and Litecoin can be traded with maximum 1:250 leverage and other altcoins can be traded with maximum 1:50 leverage. For your information, dynamic margin ratio will be applied to cryptocurrency CFDs.

| Commodities (Descriptions) |

Dynamic Margin Percentage |

Maximum Leverage(*) | Platform |

| 1INCHUSD (1INCH/USD) |

2% | 1:50 | MT5 |

| AAVEUSD (Aave/USD) |

2% | 1:50 | MT4/MT5 |

| ADAUSD (Cardano/USD) |

2% | 1:50 | MT4/MT5 |

| ALGOUSD (Algorand/USD) |

2% | 1:50 | MT4/MT5 |

| APEUSD (ApeCoin/USD) |

2% | 1:50 | MT5 |

| APTUSD (Aptos/USD) |

2% | 1:50 | MT5 |

| ARBUSD (Arbitrum/USD) |

2% | 1:50 | MT5 |

| ATOMUSD (Cosmos/USD) |

2% | 1:50 | MT5 |

| AVAXUSD (Avalanche/USD) |

2% | 1:50 | MT4/MT5 |

| AXSUSD (Axie Infinity/USD) |

2% | 1:50 | MT4/MT5 |

| BATUSD (Basic Attention Token /USD) |

2% | 1:50 | MT4/MT5 |

| BCHUSD (Bitcoin Cash/USD) |

0.4% | 1:250 | MT4/MT5 |

| BTCEUR (BItcoin/EUR) |

0.4% | 1:250 | MT4/MT5 |

| BTCGBP (Bitcoin/GBP) |

0.4% | 1:250 | MT4/MT5 |

| BTCUSD (Bitcoin/USD) |

0.2% | 1:500 | MT4/MT5 |

| BTGUSD (Bitcoin Gold/USD) |

0.2% | 1:500 | MT5 |

| CHZUSD (Chiliz/USD) |

2% | 1:50 | MT5 |

| COMPUSD (Compound/USD) |

2% | 1:50 | MT4/MT5 |

| CRVUSD (Curve DAO Token/USD) |

2% | 1:50 | MT5 |

| DASHUSD (Dash/USD) |

2% | 1:50 | MT5 |

| DOGEUSD (Dogecoin/USD) |

2% | 1:50 | MT5 |

| DOTUSD (Polkadot/USD) |

2% | 1:50 | MT5 |

| EGLDUSD (MultiversX/USD) |

2% | 1:50 | MT5 |

| ENJUSD (Enjin Coin/USD) |

2% | 1:50 | MT4/MT5 |

| EOSUSD (EOS/USD) |

2% | 1:50 | MT5 |

| ETCUSD (Ethereum Classic/USD) |

2% | 1:50 | MT5 |

| ETHBTC (Ethereum/Bitcoin) |

0.2% | 1:500 | MT5 |

| ETHEUR (Ethereum/EUR) |

0.4% | 1:250 | MT4/MT5 |

| ETHGBP (Ethereum/GBP) |

0.4% | 1:250 | MT4/MT5 |

| ETHUSD (Ethereum/USD) |

0.2% | 1:500 | MT4/MT5 |

| FILUSD (Filecoin/USD) |

2% | 1:50 | MT5 |

| FLOWUSD (Flow/USD) |

2% | 1:50 | MT5 |

| GRTUSD (The Graph/USD) |

2% | 1:50 | MT4/MT5 |

| ICPUSD (Internet Computer /USD) |

2% | 1:50 | MT5 |

| IMXUSD (Immutable/USD) |

2% | 1:50 | MT5 |

| LDOUSD (Lido DAO/USD) |

2% | 1:50 | MT5 |

| LINKUSD (Chainlink/USD) |

2% | 1:50 | MT4/MT5 |

| LRCUSD (Loopring/USD) |

2% | 1:50 | MT5 |

| LTCUSD (Litecoin/USD) |

0.4% | 1:250 | MT4/MT5 |

| MANAUSD (Decentraland/USD) |

2% | 1:50 | MT5 |

| MATICUSD (Polygon/USD) |

2% | 1:50 | MT4/MT5 |

| NEARUSD (NEAR Protocol/USD) |

2% | 1:50 | MT5 |

| OPUSD (Optimism/USD) |

2% | 1:50 | MT5 |

| SANDUSD (The Sandbox/USD) |

2% | 1:50 | MT5 |

| SHIBUSD (Shiba Inu/USD) |

2% | 1:50 | MT5 |

| SNXUSD (Synthetix Network Token/USD) |

2% | 1:50 | MT4/MT5 |

| SOLUSD (Solana/USD) |

2% | 1:50 | MT4/MT5 |

| STORJUSD (Storj/USD) |

2% | 1:50 | MT4/MT5 |

| STXUSD (Stacks/USD) |

2% | 1:50 | MT5 |

| SUSHIUSD (SushiSwap/USD) |

2% | 1:50 | MT4/MT5 |

| UMAUSD (UMA/USD) |

2% | 1:50 | MT4/MT5 |

| UNIUSD (Uniswap/USD) |

2% | 1:50 | MT4/MT5 |

| XLMUSD (Stellar Lumens/USD) |

2% | 1:50 | MT4/MT5 |

| XRPUSD (Ripple/USD) |

0.4% | 1:250 | MT4/MT5 |

| XTZUSD (Tezos/USD) |

2% | 1:50 | MT5 |

| ZECUSD (Zcash/USD) |

2% | 1:50 | MT5 |

| ZRXUSD (0x/USD) |

2% | 1:50 | MT4/MT5 |

| 1INCHUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| AAVEUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| ADAUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| ALGOUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| APEUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| APTUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| ARBUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| ATOMUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| AVAXUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| AXSUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| BATUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| BCHUSD | |

| Dynamic Margin Percentage |

0.4% |

| Maximum Leverage(*) | 1:250 |

| Platform | MT4/MT5 |

| BTCEUR | |

| Dynamic Margin Percentage |

0.4% |

| Maximum Leverage(*) | 1:250 |

| Platform | MT4/MT5 |

| BTCGBP | |

| Dynamic Margin Percentage |

0.4% |

| Maximum Leverage(*) | 1:250 |

| Platform | MT4/MT5 |

| BTCUSD | |

| Dynamic Margin Percentage |

0.2% |

| Maximum Leverage(*) | 1:500 |

| Platform | MT4/MT5 |

| BTGUSD | |

| Dynamic Margin Percentage |

0.2% |

| Maximum Leverage(*) | 1:500 |

| Platform | MT5 |

| CHZUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| COMPUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| CRVUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| DASHUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| DOGEUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| DOTUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| EGLDUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| ENJUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| EOSUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| ETCUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| ETHBTC | |

| Dynamic Margin Percentage |

0.2% |

| Maximum Leverage(*) | 1:500 |

| Platform | MT5 |

| ETHEUR | |

| Dynamic Margin Percentage |

0.4% |

| Maximum Leverage(*) | 1:250 |

| Platform | MT4/MT5 |

| ETHGBP | |

| Dynamic Margin Percentage |

0.4% |

| Maximum Leverage(*) | 1:250 |

| Platform | MT4/MT5 |

| ETHUSD | |

| Dynamic Margin Percentage |

0.2% |

| Maximum Leverage(*) | 1:500 |

| Platform | MT4/MT5 |

| FILUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| FLOWUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| GRTUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| ICPUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| IMXUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| LDOUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| LINKUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| LRCUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| LTCUSD | |

| Dynamic Margin Percentage |

0.4% |

| Maximum Leverage(*) | 1:250 |

| Platform | MT4/MT5 |

| MANAUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| MATICUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| NEARUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| OPUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| SANDUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| SHIBUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| SNXUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| SOLUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| STORJUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| STXUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| SUSHIUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| UMAUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| UNIUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| XLMUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

| XRPUSD | |

| Dynamic Margin Percentage |

0.4% |

| Maximum Leverage(*) | 1:250 |

| Platform | MT4/MT5 |

| XTZUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| ZECUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT5 |

| ZRXUSD | |

| Dynamic Margin Percentage |

2% |

| Maximum Leverage(*) | 1:50 |

| Platform | MT4/MT5 |

Dynamic margin ratio (leverage ratio changes depending on the trading size) will be applied to cryptocurrency CFDs.

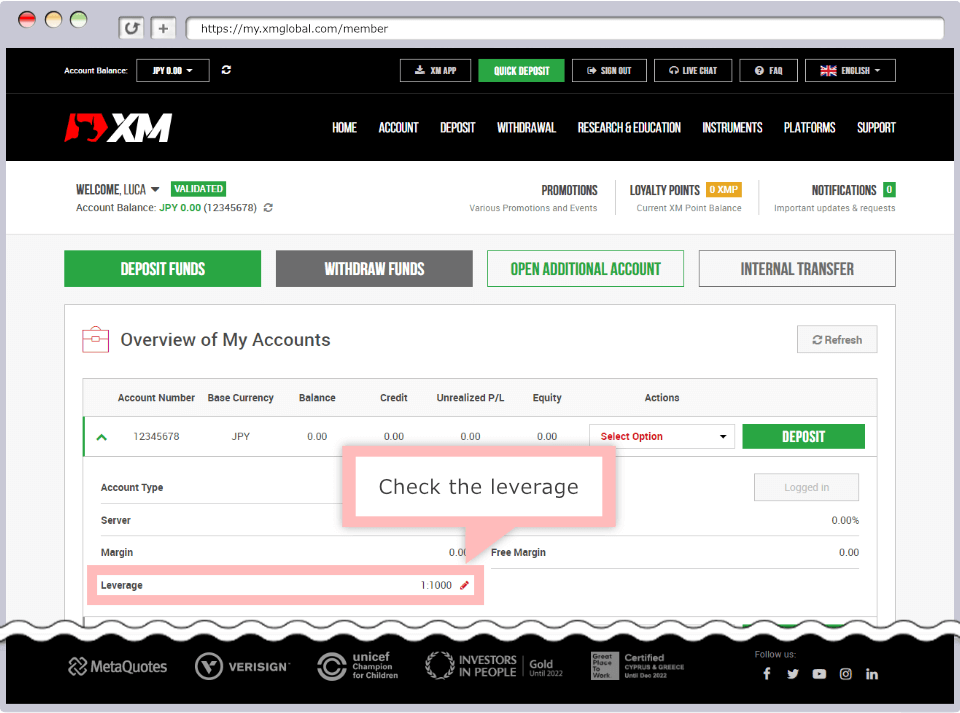

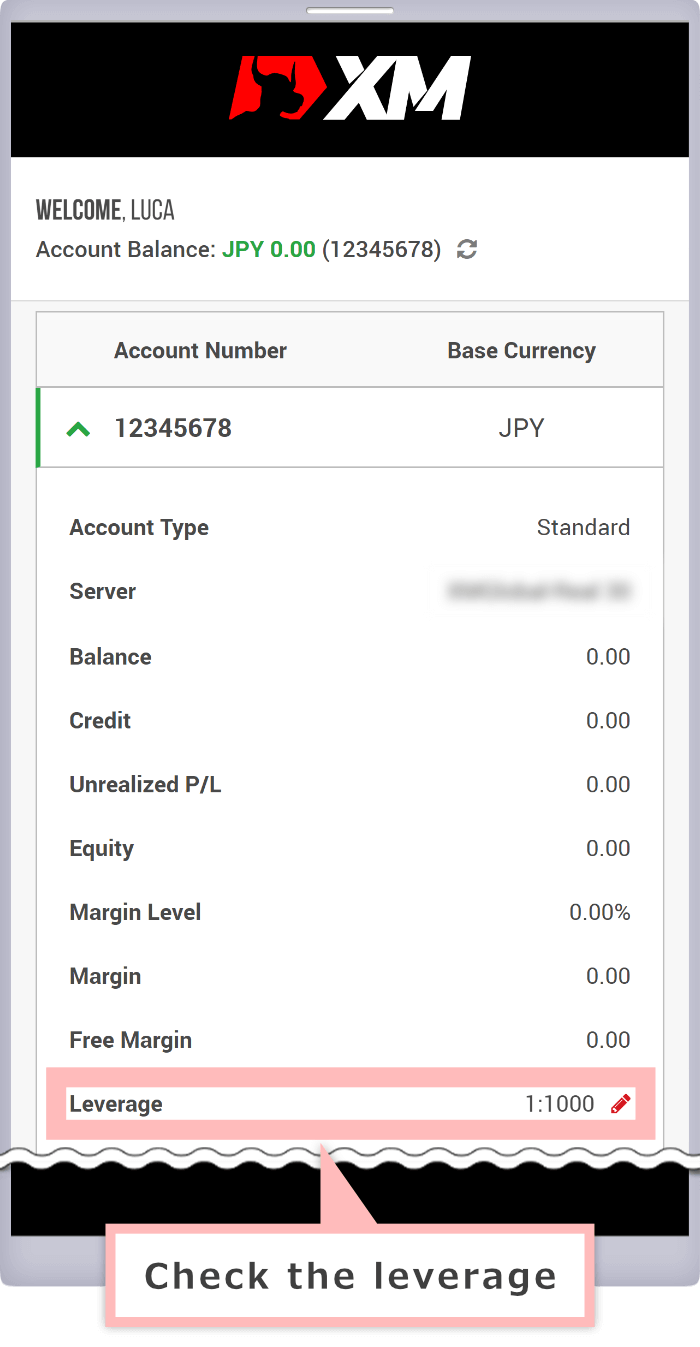

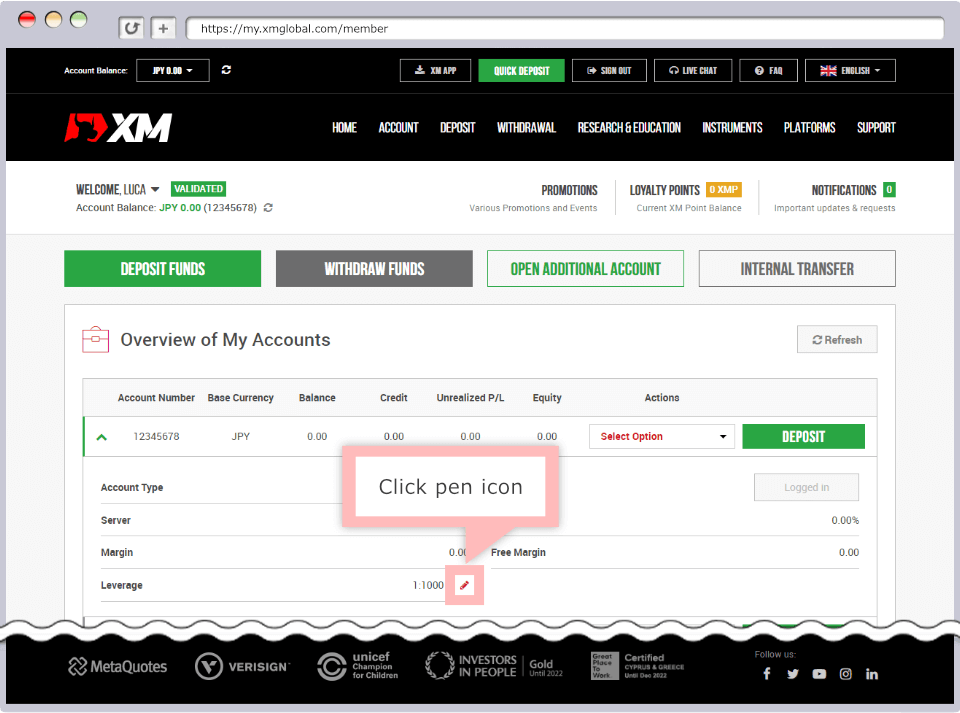

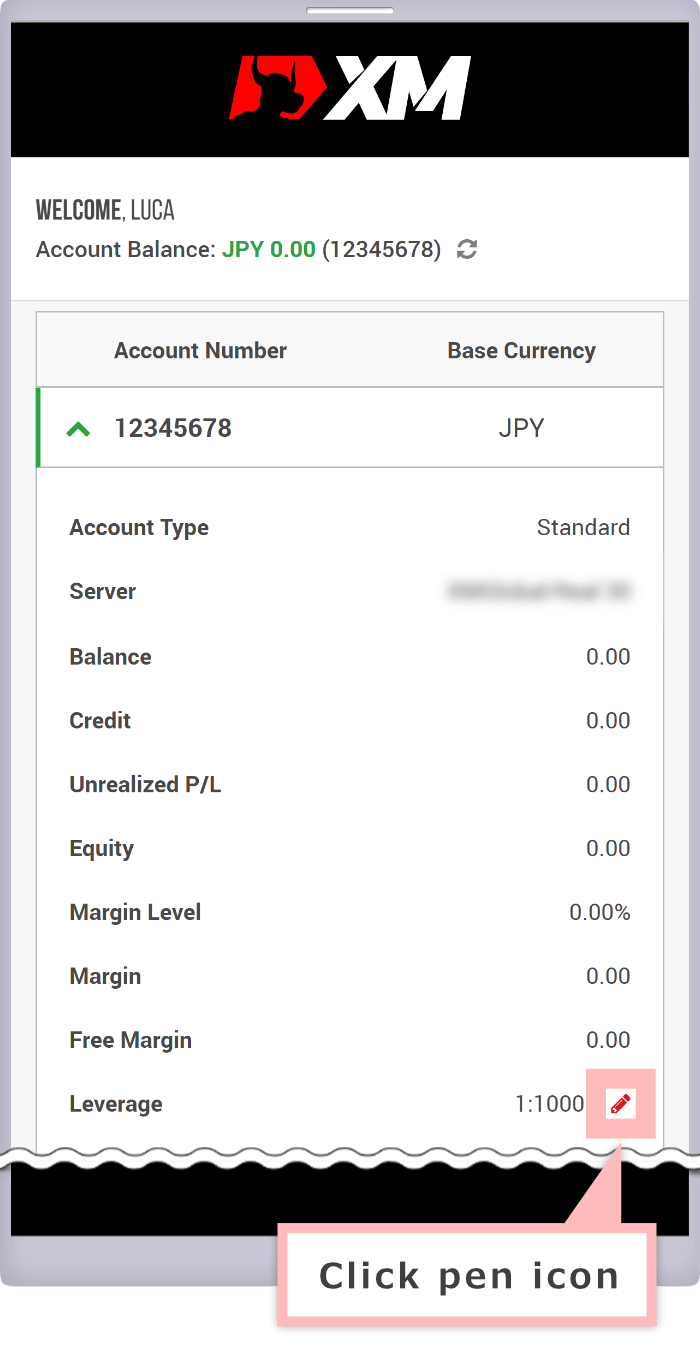

Leverage setting in your account with XM can be checked from your account summary in the Member Page. There is also no limit on times you can change the leverage setting. Even when you hold positions, you can change the setting, however it could lead to a margin level decrease. So please be noted.

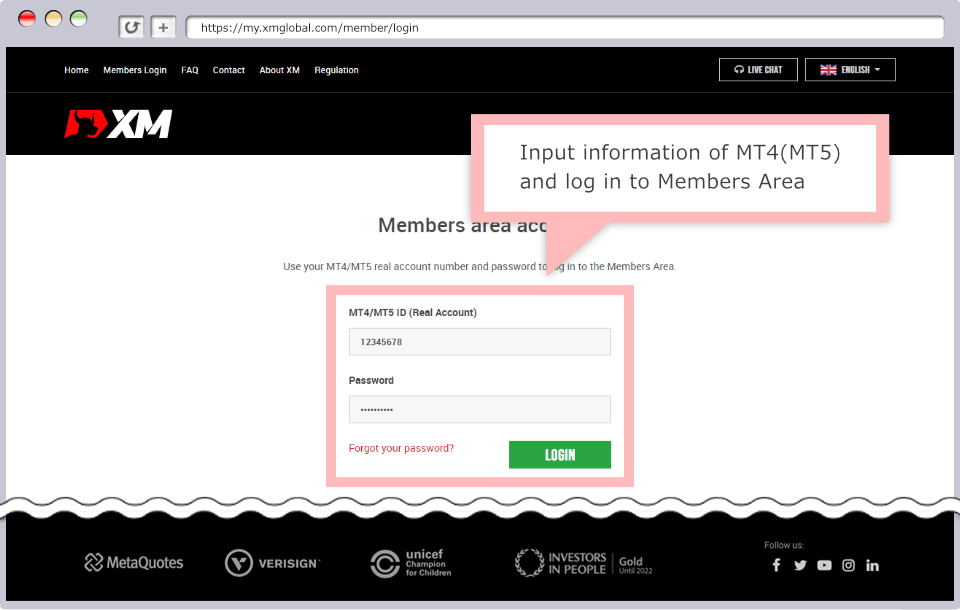

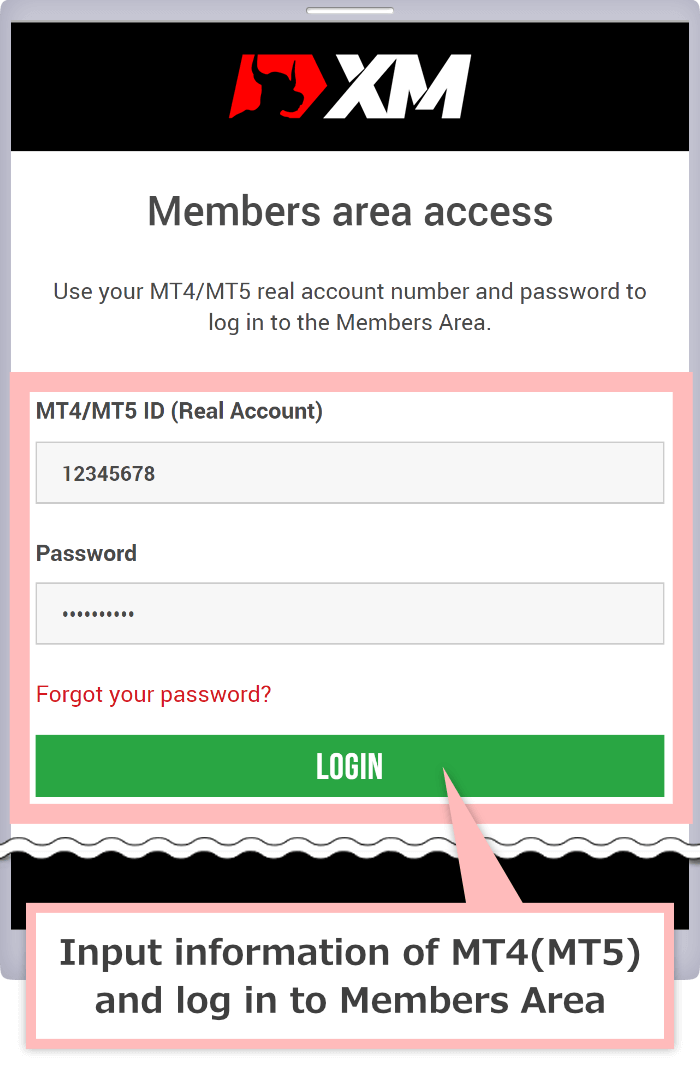

Log in to XM's 'Member Page' by using registered mail address and password.

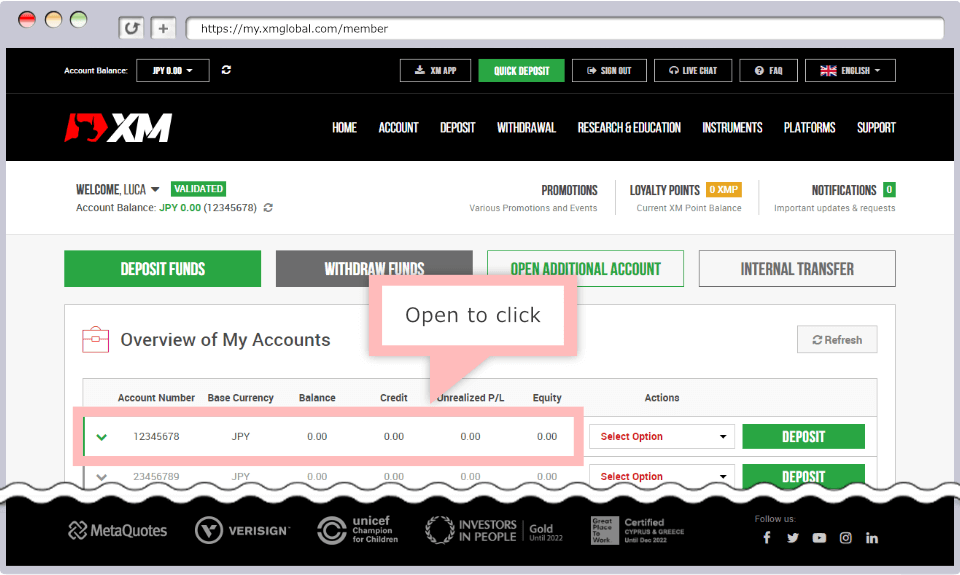

After login to XM Members Area, click "My Accounts".

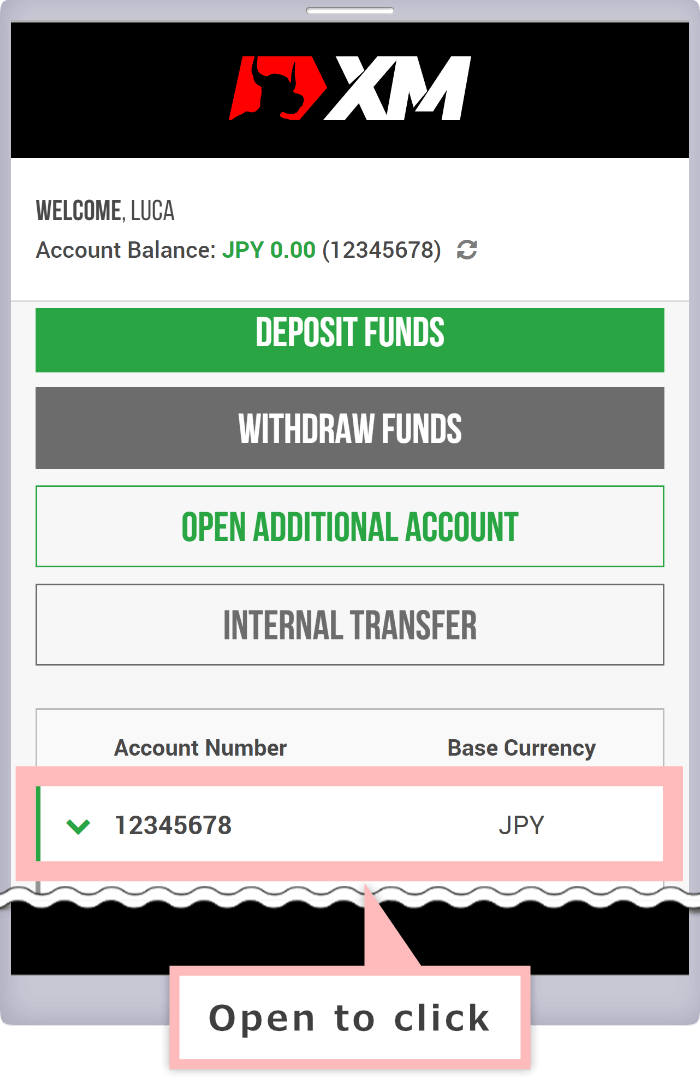

After login to XM Members Area, tap "My Accounts".

Click "...Manage", then choose "Change Leverage."

Tap "...", then choose "Change Leverage."

Choose the leverage you wish to apply on the leverage change screen, then click "Request."

Choose the leverage you wish to apply on the leverage change screen, then tap "Request."

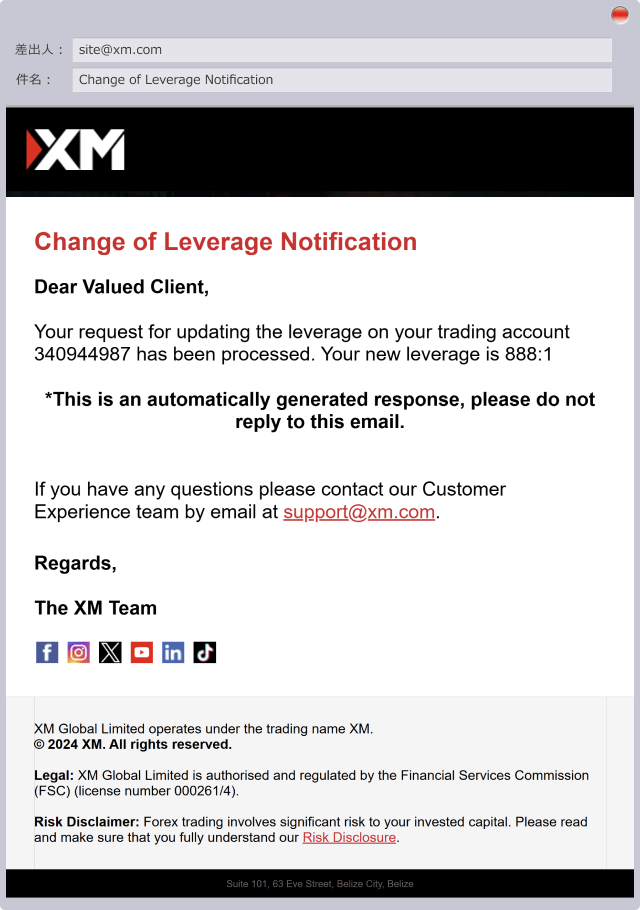

If you have successfully sent the request, you will see the message of "Leverage changed" and the mail titled "Change of Leverage Notification" will be sent to your registered mail address.

While leverage change is reflected on your trading account immediately, MetaTrader 4 (MT4) requires another login (or reboot) after the leverage change request. On the other hand, MetaTrader 5 (MT5) updates leverage change on a real-time basis even while the application is running.

Although leverage trade is the attractive way of trade, the higher the leverage goes, the bigger the risk you lose your margin money becomes. On the other hand, even when the market goes against your expectations a bit, there is an enough room to maintain the margin with low leverage. As the result, the possibility you lose your fund will become lower. However the possibility you lose your fund will become higher even with the minimal market movement in case of high leverage trade.

In this way, high leverage trades are said to be high risk trade while you can expect higher return. However in fact, if the market goes against you, unrealized loss arises. The higher the margin level is, the longer you expose the position under the risk. Therefore it cannot be said definitely, 'low leverage means low risk.'

Then what is the difference between low leverage and high leverage trade? It is the investment style of investors. The investment style of the user if he/she is aiming for a small amount of profit in the medium to long -term by capturing the long-term market trend or aiming for a short-term big profit, or aiming for swap points makes the difference of leverage ratio he/she uses. Therefore leverage should be used differently depending on the trading style of the investor himself/herself.

XM provides with 'Margin call' which inform clients of the decrease of margin when the market goes against the position and with forced settlement of the position (loss cut) in order to minimize the loss when the equity of the trading account goes below certain level of required margin.

| Margin call | Loss cut level |

| When equity goes below 50% | When equity goes below 20% |

| Margin call |

| When equity goes below 50% |

| Loss cut level |

| When equity goes below 20% |

In this way, XM finds clients' risk in the early stage and gives warning. And yet if the situation does not improve, XM monitors clients' trade in order to avoid the loss above deposited funds arising. Even in the case where the loss cut of the client does not take place properly due to rapid volatile movement, XM does not require clients of any additional margin for the minus balance. All the minus balance will be cut to nil at the timing of next deposit.

Are there any leverage limitation with XM?

XM does not have any leverage limitation as other FX brokerage houses have and provides with maximum 1:1,000 leverage. However there could be the cases that your leverage will become limited when your equity goes above certain amount, you are trading minor currency pairs or important political event occurrs.

2022.07.06

Is leverage 1:1,000 available for all the currency pairs?

No, you cannot avail 1:1,000 leverage in certain currency pairs with XM. Maximum leverage for CHF related currency pairs will be maximum 1:400, TRY related currency pairs 1:100 and HKD, CNH, DKK related currency pairs maximum 1:50.

2022.07.05

Why is my leverage ratio with XM suddenly changed?

XM deploys 'Floating Leverage System' where leverage ratio changes depending on the equity in your account. Therefore aggregated equity of all of your account goes above USD 20,000, your maximum leverage will become 1:200 and will become 1:100 when it goes above USD 100,000.

2022.07.05

What is the leverage variety I can choose from?

There are 17 kinds of leverages available ranging from 1, 2, 3, 5, 10, 15, 20, 25, 50, 66, 100, 200, 300, 400, 500, 888 to 1:1,000.

2022.07.05

Are there any leverage limitation depending on the position size held?

XM does not levy any leverage limitation depending on the position size held. However,when the equity goes above USD 40,000, maximum leverage will be capped at 1:500,it goes above USD 80,000, maximum leverage will be capped at 1:200.And if equity goes above USD 200,000, maximum leverage will be further capped at 1:100. There would also be the cases where the leverage limitation comes into place when there arise a political event or depending on the descriptions you trade.

2022.07.05

What is the highest leverage can I choose?

Maximum leverages XM offers differ depending on account types and it will be 1:1,000 times for Standard Account, Micro Account, XM Ultra Low Account Standard and XM Ultra Low Account Micro. Please choose the leverage you wish to apply at the account opening.

2022.07.05

You can change your leverage through your XM Member area. After you log in to your member area, please click the 'Select Option' on the right side of your account you wish to change the leverage, then choose the 'Change Leverage' in the pull down list.

2021.08.12