XM™|How to open the FX account.

You can enjoy exciting trading through Cryptocurrency CFDs with XM. A total of cryptocurrency pairs including major cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH) and Ripple (XRP) and other cryptocurrencies which have fewer market capitalizations or lower reputations are tradable.

Cryptocurrency CFDs have higher volatilities and traders might be able to aim for a big profit, on the other hand, there is also a possibility that traders might make a big loss within in a short period of time. XM deploys a 'Negative Balance Protection' system where you can avoid additional margin call and provides you with nice trading environment with 1:500 leverage so that you can minimize the investment amount.

![]()

XM deals with A total of Cryptocurrency CFDs. You can trade various cryptocurrencies ranging from major cryptocurrencies such as Bitcoin (BTC) or Ethereum (ETH) to the minor cryptocurrencies with minimal market capitalization against USD, EUR and GBP.

In Cryptocurrency CFDs of XM you do not need to be bothered by opening a wallet somewhere else in a cryptocurrency exchange and can trade on the margin in the trading account exactly in the same way as Forex or other CFD instruments.

Cryptocurrency is traded only on internet and is also referred to as 'virtual asset' or 'virtual currency.' Cryptocurrencies are the currencies which are digital and do not exist in the form of paper or coin, and have varieties, that is, some can be used in a specific Web site or in the game, others can be used for a daily life such as shopping or domestic and overseas remittance.

Cryptocurrencies are unlike the legal tender such as JPY or USD which states or central banks issue and in most of the cases cryptocurrencies do not have administrators. Having said that, cryptocurrencies are safely administrated even without the administrator through trade history by using 'Blockchain,' the technique which makes it quite difficult to destroy or falsify the data. Not only the safety is recognized through this fact but also big enterprises use cryptocurrencies for the means of settlement of the their purchase and sale or the number of enterprises or states who enter into the business of cryptocurrencies has increased, therefore the cryptocurrency markets have rapidly been developing.

As of September 2022 there are more than 10,000 kinds of cryptocurrencies around the world and further development of the market is expected.

Here are the details of Cryptocurrencies of XM

What is CFD?

CFD (Contract For Difference) is referred to as 'trade settled through offset,' the settlement of the profit and loss between the prices of trade entered and trade closed. When profit arises from the trade, the profit will be added on the margin, on the other hand when loss occurs, it will be deducted from the margin.

XM provides trading environment with high volatile cryptocurrency CFD trades which make traders perform best without causing the loss above the amount deposited.

Maximum 1:500 leverage is available for Cryptocurrency CFDs of XM to trade. In other words you have only to use about minimum 1/500 funds to invest into Cryptocurrency CFDs. There may be the cases where you can buy some newly developed cryptocurrencies with less than 1 cent to a few cents, on the other hand, there are also the cases where you need to invest several hundred dollars to a few ten thousand dollars to buy certain highly reliable and high-in-demand cryptocurrencies as they have a large market capitalization. With XM you can trade cryptocurrencies in CFD when you use maximum 1:500 leverage with low investment amount.

For your information, leverage available with Cryptocurrency CFDs with XM is 1:500 for BTCUSD,BTGUSD,ETHBTC,ETHUSD,1:250 for Bitcoin Cash (BCH), Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC) and Ripple (XRP) and 1:50 for others.

| Maximum leverage | Instruments |

|---|---|

| 1:500 |

BTCUSDBTGUSDETHBTCETHUSD

|

| 1:250 |

BCHUSDBTCEURBTCGBPETHEURETHGBPLTCUSDXRPUSD

|

| 1:50 |

1INCHUSDAAVEUSDADAUSDALGOUSDAPEUSDAPTUSDARBUSDATOMUSDAVAXUSDAXSUSDBATUSDCHZUSDCOMPUSDCRVUSDDASHUSDDOGEUSDDOTUSDEGLDUSDENJUSDEOSUSDETCUSDFETUSDFILUSDFLOWUSDGRTUSDICPUSDIMXUSDLDOUSDLINKUSDLRCUSDMANAUSDMATICUSDNEARUSDOPUSDSANDUSDSHIBUSDSNXUSDSOLUSDSTORJUSDSTXUSDSUSHIUSDUMAUSDUNIUSDXLMUSDXTZUSDZECUSDZRXUSD もっと見る閉じる |

| Maximum leverage |

Instruments |

| 1:500 |

BTCUSDBTGUSDETHBTCETHUSD

|

| 1:250 |

BCHUSDBTCEURBTCGBPETHEURETHGBPLTCUSDXRPUSD

|

| 1:50 |

1INCHUSDAAVEUSDADAUSDALGOUSDAPEUSDAPTUSDARBUSDATOMUSDAVAXUSDAXSUSDBATUSDCHZUSDCOMPUSDCRVUSDDASHUSDDOGEUSDDOTUSDEGLDUSDENJUSDEOSUSDETCUSDFETUSDFILUSDFLOWUSDGRTUSDICPUSDIMXUSDLDOUSDLINKUSDLRCUSDMANAUSDMATICUSDNEARUSDOPUSDSANDUSDSHIBUSDSNXUSDSOLUSDSTORJUSDSTXUSDSUSHIUSDUMAUSDUNIUSDXLMUSDXTZUSDZECUSDZRXUSD もっと見る閉じる |

XM deploys "Negative balance protection" (reset of minus balance to zero) which does not require clients of any additional margin call even when the loss exceeds equity due to volatile market movements or any other reasons. Thanks to this system clients are able to trade without the loss above the money they deposited and you can trade at ease.

Cryptocurrency CFDs have higher volatilities than other financial products and it is quite common that cryptocurrencies move more than 10% in a day. They have the feature that there are many chances to earn a profit as the price movements are big, on the other hand, if it moves in the other direction than you have expected, the risk that the big loss may occur in a short period of time. It is possible with XM through Negative Balance Protection that you seek for a limitless profit while minimize the loss to the margin balance even for volatile Cryptocurrency CFDs.

Dynamic margin ratio (leverage ratio changes depending on the trading size) apply to XM's cryptocurrency CFDs. As the trade volume per instrument increases, the margin percentage also increases, relevant to the dynamic leverage value of each instrument. This "Dynamic margin" is only applicable to CFDs on virtual currencies. Please note that the number of lots, margin ratio, and leverage differ for each issue, so please check before trading.

For example, if you trade BTCUSD (Bitcoin/USD), the leverage and margin ratio depending on the number of lots held vary stepwise as follows:

| Number of lots | Dynamic margin percentage | Leverage |

| 0-40 | 0.20% | 1:500 |

| 40-120 | 0.40% | 1:250 |

| 120-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| Number of lots |

Dynamic margin percentage |

Leverage |

| 0-40 | 0.20% | 1:500 |

| 40-120 | 0.40% | 1:250 |

| 120-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

If you have 5 lots of unsettled position of above mentioned instrument and will try to place a new order of 5 lots, 1:250 leverage will apply to the first 2 lots and 1:50 leverage will apply to the rest of 3 lots.

Required margin (=necessary margin) for the condition of above Dynamic margin is calculated by the formula below.

Number of lots ×contract size

× open price × required margin ratio

= required margin

For your information, when the account currency and settlement currency (right side of the trade currency pair) are different, you can work out the required margin based on the account currency through the calculation of required margin times the rate of 'settlement currency/account currency.'

If the account currency is in EURO and you trade BTCUSD (Bitcoin/USD), the required margin according to the number of lots are as follows:

※ Note: 'BTCUSD (Bitcoin/USD) = 30,000.00' is used for calculation.

| Number of lots | Dynamic margin percentage | required margin ratio |

|---|---|---|

| 40 | 0.20% | 40 × 1 × 30,000.00 × 0.2% = 2,400USD |

| Number of lots |

| 40 |

| Dynamic margin percentage |

| 0.20% |

| required margin ratio |

| 40 × 1 × 30,000.00 × 0.2% = 2,400USD |

| Number of lots | Dynamic margin percentage | required margin ratio |

|---|---|---|

| 40 | 0.20% | 40 × 1 × 30,000.00 × 0.2% = 2,400USD |

| 5 | 0.40% | 5 × 1 × 30,000.00 × 0.4% = 600USD |

| Total | 2,400USD +600USD = 3,000USD | |

| Number of lots |

| 40 |

| Dynamic margin percentage |

| 0.20% |

| required margin ratio |

| 40 × 1 × 30,000.00 × 0.2% = 2,400USD |

| Number of lots |

| 5 |

| Dynamic margin percentage |

| 0.40% |

| required margin ratio |

| 5 × 1 × 30,000.00 × 0.4% = 600USD |

| Total |

| 2,400USD +600USD = 3,000USD |

| Number of lots | Dynamic margin percentage | required margin ratio |

|---|---|---|

| 40 | 0.20% | 40 × 1 × 30,000.00 × 0.2% = 2,400USD |

| 80 | 0.40% | 80 × 1 × 30,000.00 × 0.4% = 9,600USD |

| 5 | 2% | 5 × 1 × 30,000.00 × 2% = 3,000USD |

| Total | 2,400USD +9,600USD + 3,000USD = 15,000USD | |

| Number of lots |

| 40 |

| Dynamic margin percentage |

| 0.20% |

| required margin ratio |

| 40 × 1 × 30,000.00 × 0.2% = 2,400USD |

| Number of lots |

| 80 |

| Dynamic margin percentage |

| 0.40% |

| required margin ratio |

| 80 × 1 × 30,000.00 × 0.4% = 9,600USD |

| Number of lots |

| 5 |

| Dynamic margin percentage |

| 2% |

| required margin ratio |

| 5 × 1 × 30,000.00 × 2% = 3,000USD |

| Total |

| 2,400USD +9,600USD + 3,000USD = 15,000USD |

Here is the list of Dynamic margin for Cryptocurrency CFDs

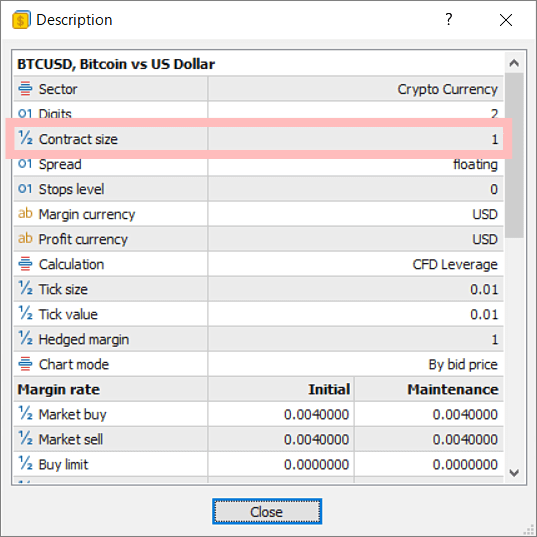

What is Contract size ?

The size of contract is also referred to as 'Contract size' or 'Trade unit.' Contract size for each instrument can be checked by right-clicking the instrument on 'Indicative Price Indication' of MT4/MT5, choose 'Specification,' then you can check the contract size on 'Trading Conditions.'

XM provides with Swapfree (Zero swap) in Cryptocurrency CFDs. There are cases where there arise high swap points in other brokerage houses which provide cryptocurrency CFDs with high leverage. Or there are also many other cases where brokerage houses provide swap free setting instead of setting lower leverage ratio. However it is possible to set up flexible trade strategies without worrying about piling up the loss arising from minus swap in a medium to longer term trade as XM provides swap free where there arise no swap points regardless it is plus or minus while enjoying 1:500 leverage so that you can build up your trading strategies flexibly.

What is Swap point ?

Swap point is the profit and loss arising from adjusting the difference of interest rates between countries. In FX trading where two currencies which have different policy interest rates are exchanged, receipt and pay-out of swap point arising out as the adjustment of difference of policy interest rates between 2 countries continue everyday until the position is settled. When you buy higher interest rate currencies and sell lower interest rate currencies, you can earn swap points, on the other hand, when you buy lower interest rate currencies and sell higher rate currencies, you need to pay swap point. For your information, XM provides with Swapfree (Zero swap) in Cryptocurrency CFDs.

Cryptocurrency CFDs of XM are available 24 hours 365 days. Cryptocurrency CFDs are tradable on weekends even when Forex or other CFD instruments are out of trading hours or on worldwide holidays such as Christmas and New year holiday season, and you can trade at any time you want. However service for Cryptocurrency CFDs is suspended for 30 minutes due to server maintenance on Saturday as below.

| GMT+2 time zone | Saturday 10:05~10:35 |

Bonuses and XM Points can be used for the trade of Cryptocurrency CFDs of XM. XM provides 3 kinds of bonuses including $50 worth of 'New account opening bonus' for those who open a new real account with XM, maximum $5,000 worth of 'XM deposit bonus' in 2 steps depending on the deposit amount and 'Loyalty Program' depending on the trade volume. All these bonuses are available for the margin of Cryptocurrency CFD trades.

※ Bonuses and Loyalty Program are not eligible for clients registered under the Trading Point of Financial Instruments Ltd. Bonus availability depends on the client's country of residence.

Trading conditions for Cryptocurrency CFDs of XM vary depending on the instruments. Be sure to check the trading conditions before you trade.

You can start trading all Cryptocurrency CFDs of XM with minimum 0.01 lot. However the maximum trading size, maximum aggregated trade lots or maximum leverage may vary depending on the instruments.

Also the value of 1 lot will differ depending on the instruments such as '1 lot = 1 BTC' or '1 lot = 1,000 Cardano.' So please be noted.

| Instruments | Value of 1 lot | Mini/Max trade size |

Platform |

| 1INCHUSD (1INCH Network/USD) |

10,000 tokens |

0.01/100 | MT5 |

| AAVEUSD (Aave/USD) |

10 Aave |

0.01/1,000 | MT4/MT5 |

| ADAUSD (Cardano/USD) |

1,000 Cardano |

0.01/3,000 | MT4/MT5 |

| ALGOUSD (Algorand/USD) |

1,000 Algorand |

0.01/3,000 | MT4/MT5 |

| APEUSD (ApeCoin/USD) |

1,000 tokens |

0.01/100 | MT5 |

| APTUSD (Aptos/USD) |

100 tokens |

0.01/500 | MT5 |

| ARBUSD (Arbitrum/USD) |

1,000 tokens |

0.01/500 | MT5 |

| ATOMUSD (Cosmos/USD) |

100 tokens |

0.01/500 | MT5 |

| AVAXUSD (Avalanche/USD) |

10 Avalanche |

0.01/7,000 | MT4/MT5 |

| AXSUSD (Axie Infinity/USD) |

100 Axie Infinity |

0.01/1,000 | MT4/MT5 |

| BATUSD (Basic Attention Token/USD) |

1,000 Basic Attention Tokens |

0.01/3,000 | MT4/MT5 |

| BCHUSD (Bitcoin Cash/USD) |

10 Bitcoin Cash |

0.01/460 | MT4/MT5 |

| BTCEUR (Bitcoin/EUR) |

1 Bitcoin |

0.01/30 | MT4/MT5 |

| BTCGBP (Bitcoin/GBP) |

1 Bitcoin |

0.01/30 | MT4/MT5 |

| BTCUSD (Bitcoin/USD) |

1 Bitcoin |

0.01/80 | MT4/MT5 |

| BTGUSD (Bitcoin Gold/USD) |

1,000 tokens |

0.01/22 | MT5 |

| CHZUSD (Chiliz/USD) |

10,000 tokens |

0.01/500 | MT5 |

| COMPUSD (Compound/USD) |

10 Compound |

0.01/1,600 | MT4/MT5 |

| CRVUSD (Curve DAO Token/USD) |

1,000 tokens |

0.01/500 | MT5 |

| DASHUSD (Dash/USD) |

100 tokens |

0.01/100 | MT5 |

| DOGEUSD (Dogecoin/USD) |

10,000 tokens |

0.01/500 | MT5 |

| DOTUSD (Polkadot/USD) |

100 tokens |

0.01/800 | MT5 |

| EGLDUSD (MultiversX/USD) |

100 tokens |

0.01/100 | MT5 |

| ENJUSD (Enjin Coin/USD) |

1,000 Enjin Coins |

0.01/1,600 | MT4/MT5 |

| EOSUSD (EOS/USD) |

1,000 tokens |

0.01/500 | MT5 |

| ETCUSD (Ethereum Classic/USD) |

100 tokens |

0.01/200 | MT5 |

| ETHBTC (Ethereum/Bitcoin) |

100,000 tokens |

0.01/43 | MT5 |

| ETHEUR (Ethereum/EUR) |

1 Ethereum |

0.01/400 | MT4/MT5 |

| ETHGBP (Ethereum/GBP) |

1 Ethereum |

0.01/400 | MT4/MT5 |

| ETHUSD (Ethereum/USD) |

1 Ethereum |

0.01/1,180 | MT4/MT5 |

| FETUSD (Fetch AI/USD) |

1,000 Fetch AI |

0.01/1,600 | MT4/MT5 |

| FILUSD (Filecoin/USD) |

1,000 tokens |

0.01/100 | MT5 |

| FLOWUSD (Flow/USD) |

1,000 tokens |

0.01/500 | MT5 |

| GRTUSD (The Graph/USD) |

1,000 The Graph |

0.01/7,000 | MT4/MT5 |

| ICPUSD (Internet Computer /USD) |

1,000 tokens |

0.01/100 | MT5 |

| IMXUSD (Immutable/USD) |

1,000 tokens |

0.01/500 | MT5 |

| LDOUSD (Lido DAO/USD) |

1,000 tokens |

0.01/200 | MT5 |

| LINKUSD (Chainlink/USD) |

100 Chainlink |

0.01/1,000 | MT4/MT5 |

| LRCUSD (Loopring/USD) |

10,000 tokens |

0.01/200 | MT5 |

| LTCUSD (Lite coin/USD) |

10 Litecoin |

0.01/720 | MT4/MT5 |

| MANAUSD (Decentraland/USD) |

10,000 tokens |

0.01/100 | MT5 |

| MATICUSD (Polygon/USD) |

1,000 Polygon |

0.01/1,000 | MT4/MT5 |

| NEARUSD (NEAR Protocol/USD) |

1,000 tokens |

0.01/200 | MT5 |

| OPUSD (Optimism/USD) |

1,000 tokens |

0.01/200 | MT5 |

| SANDUSD (The Sandbox/USD) |

1,000 tokens |

0.01/800 | MT5 |

| SHIBUSD (Shiba Inu/USD) |

100,000 tokens |

0.01/500 | MT5 |

| SNXUSD (Synthetix Network Token/USD) |

1,000 Synthetix Network Tokens |

0.01/400 | MT4/MT5 |

| SOLUSD (Solana/USD) |

10 Solanas |

0.01/3,000 | MT4/MT5 |

| STORJUSD (Storji/USD) |

1,000 Storj |

0.01/3,000 | MT4/MT5 |

| STXUSD (Stacks/USD) |

1,000 tokens |

0.01/500 | MT5 |

| SUSHIUSD (SushiSwap/USD) |

1,000 SushiSwap |

0.01/1,000 | MT4/MT5 |

| UMAUSD (UMA/USD) |

1,000 UMA |

0.01/400 | MT4/MT5 |

| UNIUSD (Uniswap/USD) |

100 Uniswap |

0.01/1,000 | MT4/MT5 |

| XLMUSD (Stellar Lumens/USD) |

1,000 Stellar Lumens |

0.01/7,000 | MT4/MT5 |

| XRPUSD (Ripple/USD) |

1,000 Ripple |

0.01/1,600 | MT4/MT5 |

| XTZUSD (Tezos/USD) |

1,000 tokens |

0.01/500 | MT5 |

| ZECUSD (Zcash/USD) |

100 tokens |

0.01/100 | -MT5 |

| ZRXUSD (0x/USD) |

1,000 0x |

0.01/3,000 | MT4/MT5 |

| Value of 1 lot |

Mini/Max trade size |

Platform |

| 1INCHUSD | ||

| 10,000 tokens |

0.01/100 | MT5 |

| AAVEUSD | ||

| 10Aave | 0.01/1,000 | MT4/MT5 |

| ADAUSD | ||

| 1,000 Cardano |

0.01/3,000 | MT4/MT5 |

| ALGOUSD | ||

| 1,000 Algorand |

0.01/3,000 | MT4/MT5 |

| APEUSD | ||

| 1,000 tokens |

0.01/100 | MT5 |

| APTUSD | ||

| 100tokens | 0.01/500 | MT5 |

| ARBUSD | ||

| 1,000 tokens |

0.01/500 | MT5 |

| ATOMUSD | ||

| 100tokens | 0.01/500 | MT5 |

| AVAXUSD | ||

| 10 Avalanche |

0.01/7,000 | MT4/MT5 |

| AXSUSD | ||

| 100 Axie Infinity |

0.01/1,000 | MT4/MT5 |

| BATUSD | ||

| 1,000 Basic Attention Tokens |

0.01/3,000 | MT4/MT5 |

| BCHUSD | ||

| 10 Bitcoin Cash | 0.01/460 | MT4/MT5 |

| BTCEUR | ||

| 1 Bitcoin | 0.01/30 | MT4/MT5 |

| BTCGBP | ||

| 1 Bitcoin | 0.01/30 | MT4/MT5 |

| BTCUSD | ||

| 1 Bitcoin | 0.01/80 | MT4/MT5 |

| BTGUSD | ||

| 1,000 tokens |

0.01/22 | MT5 |

| CHZUSD | ||

| 10,000 tokens |

0.01/500 | MT5 |

| COMPUSD | ||

| 10 Compound |

0.01/1,600 | MT4/MT5 |

| CRVUSD | ||

| 1,000 tokens |

0.01/500 | MT5 |

| DASHUSD | ||

| 100tokens | 0.01/100 | MT5 |

| DOGEUSD | ||

| 10,000 tokens |

0.01/500 | MT5 |

| DOTUSD | ||

| 100tokens | 0.01/800 | MT5 |

| EGLDUSD | ||

| 100tokens | 0.01/100 | MT5 |

| ENJUSD | ||

| 1,000 Enjin Coins |

0.01/1,600 | MT4/MT5 |

| EOSUSD | ||

| 1,000 tokens |

0.01/500 | MT5 |

| ETCUSD | ||

| 100tokens | 0.01/200 | MT5 |

| ETHBTC | ||

| 100,000 tokens |

0.01/43 | MT5 |

| ETHEUR | ||

| 1 Ethereum |

0.01/400 | MT4/MT5 |

| ETHGBP | ||

| 1 Ethereum |

0.01/400 | MT4/MT5 |

| ETHUSD | ||

| 1 Ethereum |

0.01/1,180 | MT4/MT5 |

| FETUSD | ||

| 1,000 Fetch AI |

0.01/1,600 | MT4/MT5 |

| FILUSD | ||

| 1,000 tokens |

0.01/100 | MT5 |

| FLOWUSD | ||

| 1,000 tokens |

0.01/500 | MT5 |

| GRTUSD | ||

| 1,000 The Graph | 0.01/7,000 | MT4/MT5 |

| ICPUSD | ||

| 1,000 tokens |

0.01/100 | MT5 |

| IMXUSD | ||

| 1,000 tokens |

0.01/500 | MT5 |

| LDOUSD | ||

| 1,000 tokens |

0.01/200 | MT5 |

| LINKUSD | ||

| 100 Chainlink |

0.01/1,000 | MT4/MT5 |

| LRCUSD | ||

| 10,000 tokens |

0.01/200 | MT5 |

| LTCUSD | ||

| 10 Litecoin | 0.01/720 | MT4/MT5 |

| MANAUSD | ||

| 10,000 tokens |

0.01/100 | MT5 |

| MATICUSD | ||

| 1,000 Polygon |

0.01/1,000 | MT4/MT5 |

| NEARUSD | ||

| 1,000 tokens |

0.01/200 | MT5 |

| OPUSD | ||

| 1,000 tokens |

0.01/200 | MT5 |

| SANDUSD | ||

| 1,000 tokens |

0.01/800 | MT5 |

| SHIBUSD | ||

| 100,000 tokens |

0.01/500 | MT5 |

| SNXUSD | ||

| 1,000 Synthetix Network Tokens |

0.01/400 | MT4/MT5 |

| SOLUSD | ||

| 10 Solanas | 0.01/3,000 | MT4/MT5 |

| STORJUSD | ||

| 1,000 Storj | 0.01/3,000 | MT4/MT5 |

| STXUSD | ||

| 1,000 tokens |

0.01/500 | MT5 |

| SUSHIUSD | ||

| 1,000 SushiSwap |

0.01/1,000 | MT4/MT5 |

| UMAUSD | ||

| 1,000 UMA | 0.01/400 | MT4/MT5 |

| UNIUSD | ||

| 100 Uniswap |

0.01/1,000 | MT4/MT5 |

| XLMUSD | ||

| 1,000 Stellar Lumens |

0.01/7,000 | MT4/MT5 |

| XRPUSD | ||

| 1,000 Ripple |

0.01/1,600 | MT4/MT5 |

| XTZUSD | ||

| 1,000 tokens |

0.01/500 | MT5 |

| ZECUSD | ||

| 100tokens | 0.01/100 | MT5 |

| ZRX/USD | ||

| 1,000 0x | 0.01/3,000 | MT4/MT5 |

XM deploys 'Dynamic margin' for the position held only in Cryptocurrency CFDs. When the aggregated number of lots per instruments increases, the applicable leverage will become lower and required margin ratio will become higher. So please be noted when you trade.

| Instruments | Volume in Lots | Dynamic margin percentage | Leverage |

| 1INCHUSD (1INCH Network/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| AAVEUSD (Aave/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| ADAUSD (Cardano/USD) |

0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

| ALGOUSD (Algorand/USD) |

0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 | |

| APEUSD (ApeCoin/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| APTUSD (Aptos/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| ARBUSD (Arbitrum/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| ATOMUSD (Cosmos/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| AVAXUSD (Avalanche/USD) |

0-3,500 | 2% | 1:50 |

| 3,500+ | 100% | 1:1 | |

| AXSUSD (Axie Infinity/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| BATUSD (Basic Attention Token/USD) |

0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 | |

| BCHUSD (Bitcoin Cash/USD) |

0-230 | 0.40% | 1:250 |

| 230-460 | 2% | 1:50 | |

| 460+ | 100% | 1:1 | |

| BTCEUR (Bitcoin/EUR) |

0-15 | 0.40% | 1:250 |

| 15-30 | 2% | 1:50 | |

| 30+ | 100% | 1:1 | |

| BTCGBP (Bitcoin/GBP) |

0-15 | 0.40% | 1:250 |

| 15-30 | 2% | 1:50 | |

| 30+ | 100% | 1:1 | |

| BTCUSD (Bitcoin/USD) |

0-40 | 0.20% | 1:500 |

| 40-120 | 0.40% | 1:250 | |

| 120-200 | 2% | 1:50 | |

| 200+ | 100% | 1:1 | |

| BTGUSD (Bitcoin Gold/USD) |

0-22 | 0.20% | 1:500 |

| 22-45 | 0.40% | 1:250 | |

| 45-75 | 2% | 1:50 | |

| 75+ | 100% | 1:1 | |

| CHZUSD (Chiliz/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| COMPUSD (Compound/USD) |

0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 | |

| CRVUSD (Curve DAO Token/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| DASHUSD (Dash/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| DOGEUSD (Dogecoin/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| DOTUSD (Polkadot/USD) |

0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 | |

| EGLDUSD (MultiversX/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| ENJUSD (Enjin Coin/USD) |

0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 | |

| EOSUSD (EOS/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| ETCUSD (Ethereum Classic/USD)) |

0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 | |

| ETHBTC (Ethereum/Bitcoin) |

0-43 | 0.20% | 1:500 |

| 43-86 | 0.40% | 1:250 | |

| 86-145 | 2% | 1:50 | |

| 145+ | 100% | 1:1 | |

| ETHEUR (Ethereum/EUR) |

0-200 | 0.40% | 1:250 |

| 200-400 | 2% | 1:50 | |

| 400+ | 100% | 1:1 | |

| ETHGBP (Ethereum/GBP) |

0-200 | 0.40% | 1:250 |

| 200-400 | 2% | 1:50 | |

| 400+ | 100% | 1:1 | |

| ETHUSD (Ethereum/USD) |

0-590 | 0.20% | 1:500 |

| 590-1,770 | 0.40% | 1:250 | |

| 1,770-2,950 | 2% | 1:50 | |

| 2,950+ | 100% | 1:1 | |

| FETUSD (Fetch AI/USD) |

0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 | |

| FILUSD (Filecoin/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| FLOWUSD (Flow/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| GRTUSD (The Graph/USD) |

0-3,500 | 2% | 1:50 |

| 3,500+ | 100% | 1:1 | |

| ICPUSD (Internet Computer/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| IMXUSD (Immutable/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| LDOUSD (Lido DAO/USD) |

0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 | |

| LINKUSD (Chainlink/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| LRCUSD (Loopring/USD) |

0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 | |

| LTCUSD (Lite coin/USD) |

0-360 | 0.40% | 1:250 |

| 360-720 | 2% | 1:50 | |

| 720+ | 100% | 1:1 | |

| MANAUSD (Decentraland/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| MATICUSD (Polygon/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| NEARUSD (NEAR Protocol/USD) |

0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 | |

| OPUSD (Optimism/USD) |

0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 | |

| SANDUSD (The Sandbox/USD) |

0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 | |

| SHIBUSD (Shiba Inu/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| SNXUSD (Synthetix Network Token/USD) |

0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 | |

| SOLUSD (Solana/USD) |

0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 | |

| STORJUSD (Storji/USD) |

0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 | |

| STXUSD (Stacks/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| SUSHIUSD (SushiSwap/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| UMAUSD (UMA/USD) |

0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 | |

| UNIUSD (Uniswap/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| XLMUSD (Stellar Lumens/USD) |

0-3,500 | 2% | 1:50 |

| 3,500+ | 100% | 1:1 | |

| XRPUSD (Ripple/USD) |

0-800 | 0.40% | 1:250 |

| 800-1,600 | 2% | 1:50 | |

| 1,600+ | 100% | 1:1 | |

| XTZUSD (Tezos/USD) |

0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 | |

| ZECUSD (Zcash/USD) |

0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 | |

| ZRXUSD (0x/USD) |

0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

| Volume in Lots |

Dynamic margin percentage |

Leverage |

| 1INCHUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| AAVEUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| ADAUSD | ||

| 0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

| ALGOUSD | ||

| 0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

| APEUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| APTUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| ARBUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| ATOMUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| AVAXUSD | ||

| 0-3,500 | 2% | 1:50 |

| 3,500+ | 100% | 1:1 |

| AXSUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| BATUSD | ||

| 0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

| BCHUSD | ||

| 0-230 | 0.40% | 1:250 |

| 230-460 | 2% | 1:50 |

| 460+ | 100% | 1:1 |

| BTCEUR | ||

| 0-15 | 0.40% | 1:250 |

| 15-30 | 2% | 1:50 |

| 30+ | 100% | 1:1 |

| BTCGBP | ||

| 0-15 | 0.40% | 1:250 |

| 15-30 | 2% | 1:50 |

| 30+ | 100% | 1:1 |

| BTCUSD | ||

| 0-40 | 0.20% | 1:500 |

| 40-120 | 0.40% | 1:250 |

| 120-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| BTGUSD | ||

| 0-22 | 0.20% | 1:500 |

| 22-45 | 0.40% | 1:250 |

| 45-75 | 2% | 1:50 |

| 75+ | 100% | 1:1 |

| CHZUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| COMPUSD | ||

| 0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 |

| CRVUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| DASHUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| DOGEUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| DOTUSD | ||

| 0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 |

| EGLDUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| ENJUSD | ||

| 0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 |

| EOSUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| ETCUSD | ||

| 0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| ETHBTC | ||

| 0-43 | 0.20% | 1:500 |

| 43-86 | 0.40% | 1:250 |

| 86-145 | 2% | 1:50 |

| 145+ | 100% | 1:1 |

| ETHEUR | ||

| 0-200 | 0.40% | 1:250 |

| 200-400 | 2% | 1:50 |

| 400+ | 100% | 1:1 |

| ETHGBP | ||

| 0-200 | 0.40% | 1:250 |

| 200-400 | 2% | 1:50 |

| 400+ | 100% | 1:1 |

| ETHUSD | ||

| 0-590 | 0.20% | 1:500 |

| 590-1,770 | 0.40% | 1:250 |

| 1,770 -2,950 |

2% | 1:50 |

| 2,950+ | 100% | 1:1 |

| FETUSD | ||

| 0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 |

| FILUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| FLOWUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| GRTUSD | ||

| 0-3,500 | 2% | 1:50 |

| 3,500+ | 100% | 1:1 |

| ICPUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| IMXUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| LDOUSD | ||

| 0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| LINKUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| LRCUSD | ||

| 0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| LTCUSD | ||

| 0-360 | 0.40% | 1:250 |

| 360-720 | 2% | 1:50 |

| 720+ | 100% | 1:1 |

| MANAUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| MATICUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| NEARUSD | ||

| 0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| OPUSD | ||

| 0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| SANDUSD | ||

| 0-800 | 2% | 1:50 |

| 800+ | 100% | 1:1 |

| SHIBUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| SNXUSD | ||

| 0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| SOLUSD | ||

| 0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

| STORJUSD | ||

| 0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

| STXUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| SUSHIUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 5100% | 51:1 |

| UMAUSD | ||

| 0-200 | 2% | 1:50 |

| 200+ | 100% | 1:1 |

| UNIUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| XLMUSD | ||

| 0-3,500 | 2% | 1:50 |

| 3,500+ | 100% | 1:1 |

| XRPUSD | ||

| 0-800 | 0.40% | 1:250 |

| 800-1,600 | 2% | 1:50 |

| 1,600+ | 100% | 1:1 |

| XTZUSD | ||

| 0-500 | 2% | 1:50 |

| 500+ | 100% | 1:1 |

| ZECUSD | ||

| 0-100 | 2% | 1:50 |

| 100+ | 100% | 1:1 |

| ZRXUSD | ||

| 0-1,500 | 2% | 1:50 |

| 1,500+ | 100% | 1:1 |

Please be noted when you trade Cryptocurrency CFDs of XM as below:

Cryptocurrencies tradable on XM are only in the form of 'CFDs (trade settled through offset)' where the settlement of the profit and loss takes place between the prices of trade entered and trade closed. As there is no actual delivery of cryptocurrencies, trade can be done not only through entering from 'buy' aiming for the increase of the value, but also from 'sell' aiming for the decrease of the value.

Meanwhile, Cryptocurrency CFDs of XM are not held on the network of blockchain, therefore you will not be able to obtain rewards arising from staking. Available Cryptocurrencies of XM are all in CFD trade, and you will not be able to deposit and withdrawal nor delivery of Cryptocurrency. So please be noted.

What is staking?

Staking is the structure you can obtain rewards only when you hold the relevant cryptocurrency on the network of blockchain. Relevant cryptocurrency will differ by the exchanges offering the staking service.

Cryptocurrency CFDs of XM cannot be traded on XM Shares Account. If you want to trade Cryptocurrency CFDs of XM, please use Standard Account, Micro Account, XM Ultra Low Account Standard and XM Ultra Low Account Micro.

For your information, XM allows you to hold maximum 10 accounts per person. You can make the most use of them by instrument, by strategy or as a way of diversification of risk. Additional accounts can easily be created by using 'OPEN ADDITIONAL ACCOUNT' button after member page login.

It is possible to conduct cross trade only within the same account. While it's possible, the required margin for cross trade on Cryptocurrency CFDs will be 50% and is different from Forex and other instruments. So please be noted. Required margin for Forex, GOLD and Silver cross trade in the same instrument and for the same number of lots will be zero by offset, however offset is not applicable for required margin with CFDs including Cryptocurrency CFDs and margin for one way (buy or sell) will be required. Only when you have enough equity in your trading account, you can enter into a market with position for cross trade.

What is Cross trade ?

Cross trade is the trading way where you hold 'selling' and 'buying' position of the same instrument at the same time. With cross trade you can fix the unrealized loss and unrealized profit, so that you can reduce the risk of loss increase due to a rapid market movement.

Is Cryptocurrency CFDs of XM available in all types of account?

Yes, you can trade Cryptocurrency CFDs of XM in all types of accounts except Shares Account. If you wish to trade Cryptocurrency CFDs, please use Standard Account, Micro Account, XM Ultra Low Account Standard and XM Ultra Low Account Micro. Cryptocurrency CFDs of XM are available 24/7.

2022.09.26

How many kinds of Cryptocurrency CFDs are available with XM?

58 Cryptocurrency CFDs are available including popular cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), Ripple (XRP), Litecoin (LTC) and even minor cryptocurrencies.

2022.09.26

Is cross trade possible with Cryptocurrency CFDs of XM?

Yes, cross trade within the same account is allowed for Cryptocurrency CFDs of XM. However the required margin will be 50% for cross trade of Cryptocurrency CFDs of XM. Unlike Forex, required margin for cross trade will not be offset and you will be required to have the margin for one way (sell or buy). So please be noted.

2022.09.26

Is there any restrictions of leverage on trading of Cryptocurrency CFDs of XM?

Yes, Cryptocurrency CFDs of XM deploys Dynamic margin where leverage changes depending on the number of lots you hold. You can trade Cryptocurrency CFDs at the maximum leverage of 1:500, however the upper limit will be reduced depending on the number of lots by instrument held. So please be noted.

2022.09.26

Tell me about the trading hours for Cryptocurrency CFDs of XM.

Cryptocurrency CFDs of XM are available 24 hours 365 days. However service for Cryptocurrency CFDs is suspended from 10:05 to 10:35 (GMT+2) due to server maintenance on Saturday and is unavailable for these periods. So please be noted.

2022.09.26