XM™|How to open the FX account.

XM deploys fluctuating spread system and realizes tight spread. XM provides excellent execution ratio without requote and high execution speed in the market with the highest liquidity worldwide and does not show any unfavorable prices to clients, as the result, clients can trade on the best spread.

For those who wish to experience extremely tight spread special to XM, open XM Ultra Low Accunt Standard. When you choose other accounts, spreads will become a little bit wider, still though, you can trade on effectively narrow spread in a practical way by using bonus specialized to XM or XM points in a skillful manner.

![]()

XM deploys fluctuating spread system which becomes wider or narrower depending on the market situation. XM also deploys price setting with fractional pip spread and makes it possible to provide extremely narrow spread below 1 pip in order to provide a favorable trading environment for clients. Below are the detailed explanation about features of XM's spread one by one.

XM deploys fluctuating spread system in order to provide more favorable trading environment for all clients. There are 2 types of spread system, which is, 'fixed spread system' and 'fluctuating spread system. 'Fixed spread system is the system where the spread is kept fixed regardless of market rate movement, on the other hand, fluctuating spread system is the system where spread fluctuates wider or narrower depending on the market change like interbank market.

Though spread tends to become wider when the market moves a lot in fluctuating spread system, spread normally stays in a narrower spread than in fixed spread system in a normal market, as the result, the cost relating to the spread in average becomes low. Instead of keep the fluctuatin of spread low, fixed spread system will cost you more.

Many FX brokerage houses which deploy fixed spread system tends to set a ristriction just before and after the important economic indicators and other events, however XM does not set such a restriction, therefore clients can make use of the chance to generate a big profit .

| Commodities (Descriptions) |

Standard/Micro | Ultra Low Standard |

| USDJPY | pips | pips |

| EURUSD | pips | pips |

| EURJPY | pips | pips |

| USDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURUSD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

XM provides 'fractional pip price setting' in order to reflect precisely fine prices from liquidity providers (LP). Fractional pip means a pip in decimal digit less than 1 pip in each currency pair. These fractional pip price setting make it possible to provide extreme narrow spread than 1 pip such as '0.1 pip.'

XM displays trading prices with 3 decimal places to 5 decimal places through fractional pip price setting. Therefore clients can trade on tight spread and generate profits from a small price change. Fractional pip price setting also goes well with scalping traders who seek to earn narrow pips (spread).

XM realizes 0.2 pip average spread in major currency pairs such as EUR/USD or USD/JPY and can provide as tight spread as other brokerage houses' narrow spread accounts.

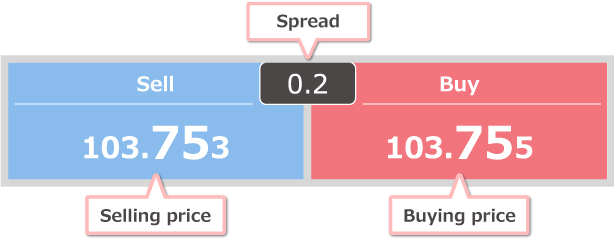

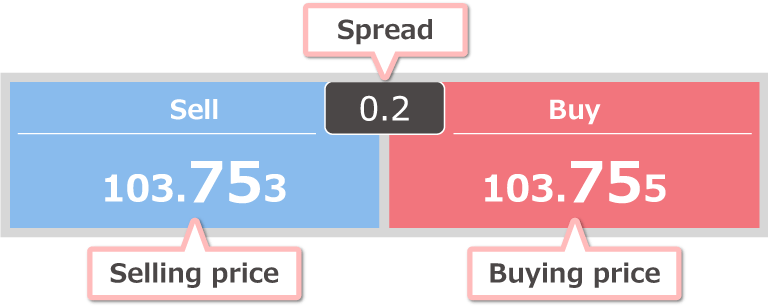

Spread is the difference between Bid and Ask of indicated price in trading currency pair. The narrower the spread is, clients can reduce the trading cost, therefore narrower spread gives traders favorable trading envirnment. Cost arising from spread will increase depending on the number of trades and trading amount, therefore spread becomes major barometer to choose FX brokerage house.

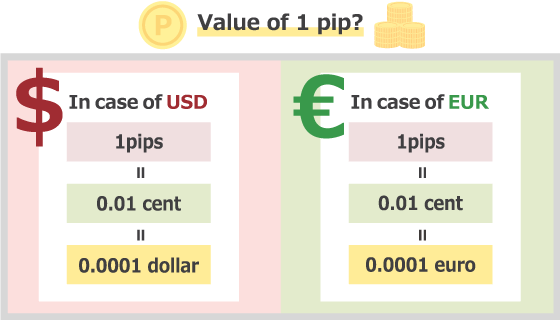

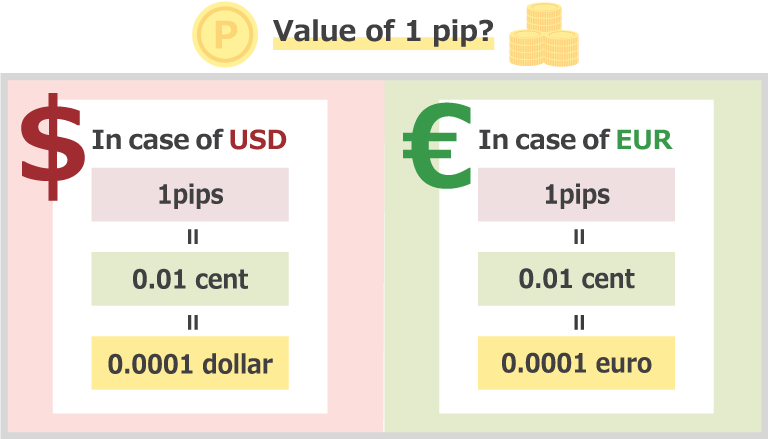

Spread is usually expressed in the unit called pips. Pips is the minimum unit of price movement and trading condition of each description can be expressed in the same unit even for various currency pairs by using unit of pips.

For example, unit of rate by currency pair such as 'Spread of USD/JPY is 1 sen' or 'Spread of EUR/USD is 0.02 cent' differs as yen, sen, dollar, cent or others. However by using unit of pips the units are standardized and expressed as 'Spread of USD/JPY is 1 pip,' or 'Spread of EUR/USD is 2 pips.'

The value of pips is different for each currency pair. For a currency pair with USD as the settlement currency, such as EUR/USD, 1 pips is equal to 0.01 cents.

The above is the value of 1 pips per currency. For example, if you trade 1 lot of EUR/USD with a spread of 1 pips, the spread of 1 pips is 1 pips (0.01 cent) x 100,000 currencies = 100,000 pips(10USD)

In order to calculate the cost of trading, you need to calculate the value of the pips in the spread, which can be cumbersome to do every time you trade. The XM pips calculator can be used to calculate the value of pips in the base currency, so it is easy to visualize the cost of trading.

Spread XM provides in Standard Account/Micro Account is rather average compared with other FX brokerage houses. However if you put XM's plentiful bonus scheme into consideration, practical spread in Standard Account/Micro Account will become competitive and not inferior to others.

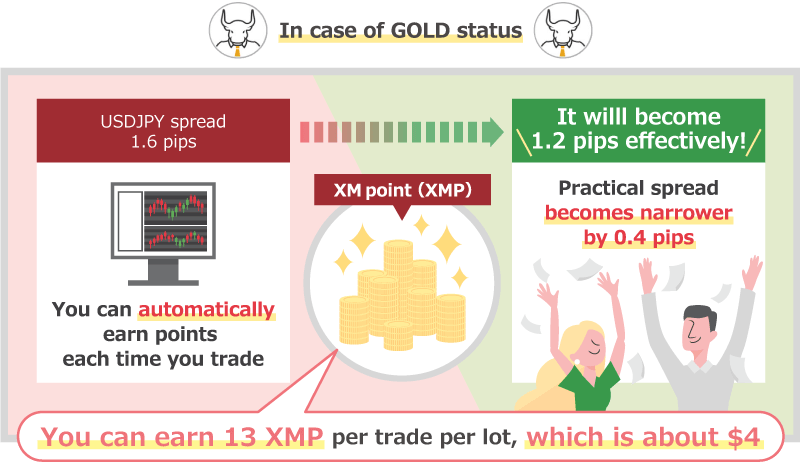

XM provides 'XM Loyalty Program' where clients can obtain XMP (XM poits) which can be exchanged with bonus depending on the trade volume every time of trade. XM ranks up clients' 'Loyalty Status' depending on the number of days clients trade and higher Loyalty Status gives clients more XMP obtainable. For your information, as a limited campaign to this site those who open XM's new real account can get GOLD status on Loyalty Program soon after the account opening, while others normally start from EXECUTIVE level.

Clients can obtain 10XMP per lot of trade on EXECUTIVE status and 13XMP per lot on GOLD status. When clients exchange XMP into trading bonus, approximately $4 per lot are added on clients' margin balance, as the result, the spread will economically become narrower than practical spread by about 0.4 pip. Loyal status is ranking up according to the number of days clients trade, therefore the longer clients use XM, the narrower the spread becomes.

| Commodities (Descriptions) | Normal spread | Spread considering XMP point |

| USDJPY | pips | pips |

| EURUSD | pips | pips |

| GBPUSD | pips | pips |

| USDCHF | pips | pips |

| USDCAD | pips | pips |

| Commodities (Descriptions) |

Normal spread |

XMP point |

| USDJPY | pips | pips |

| EURUSD | pips | pips |

| GBPUSD | pips | pips |

| USDCHF | pips | pips |

| USDCAD | pips | pips |

Why not trade on narrower spreads as much as you can by utilizing the bonus given by Lotalty program.

(*1) Bonuses and Loyalty Program are not eligible for clients registered under the Trading Point of Financial Instruments Ltd. Bonus availability depends on the client's country of residence.

XM provides 'New account opening bonus' which is $50 worth and can be used for margin, and 2 stage 'Deposit bonus' where clients can obtain upto maximum $5,000 worth of bonus ($500 plus $4,500). Clients can reduce practical spread by using these bonuses and can trade in a favorable conditions.

$50 worth New account opening bonus will be given free as solely used for trading for those who have never opened real accounts with XM, so clients can experience XM's trading without any risk.

(*1) Bonuses and Loyalty Program are not eligible for clients registered under the Trading Point of Financial Instruments Ltd. Bonus availability depends on the client's country of residence.

Spreads differ depending on the account types in XM. Below are the list of average spreads of major/minor/exotic currency pairs by each account types.

| Commodities (Descriptions) |

Standard/Micro | Ultra Low Standard |

| USDJPY | pips | pips |

| EURUSD | pips | pips |

| GBPUSD | pips | pips |

| USDCHF | pips | pips |

| USDCAD | pips | pips |

| CADCHF | pips | pips |

| CADJPY | pips | pips |

| CHFJPY | pips | pips |

| EURCAD | pips | pips |

| EURCHF | pips | pips |

| EURGBP | pips | pips |

| EURJPY | pips | pips |

| GBPCAD | pips | pips |

| GBPCHF | pips | pips |

| GBPJPY | pips | pips |

| USDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURUSD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPUSD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CADCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CADJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CHFJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURGBP | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| Commodities (Descriptions) |

Standard/Micro | Ultra Low Standard |

| AUDCAD | pips | pips |

| AUDCHF | pips | pips |

| AUDJPY | pips | pips |

| AUDNZD | pips | pips |

| AUDUSD | pips | pips |

| CHFSGD | pips | pips |

| EURAUD | pips | pips |

| EURDKK | pips | pips |

| EURHKD | pips | pips |

| EURHUF | pips | pips |

| EURNOK | pips | pips |

| EURNZD | pips | pips |

| EURPLN | pips | pips |

| EURSEK | pips | pips |

| EURSGD | pips | pips |

| EURTRY | pips | pips |

| EURZAR | pips | pips |

| GBPAUD | pips | pips |

| GBPDKK | pips | pips |

| GBPNOK | pips | pips |

| GBPNZD | pips | pips |

| GBPSEK | pips | pips |

| GBPSGD | pips | pips |

| NZDCAD | pips | pips |

| NZDCHF | pips | pips |

| NZDJPY | pips | pips |

| NZDSGD | pips | pips |

| NZDUSD | pips | pips |

| SGDJPY | pips | pips |

| USDCNH | pips | pips |

| USDDKK | pips | pips |

| USDHKD | pips | pips |

| USDHUF | pips | pips |

| USDMXN | pips | pips |

| USDNOK | pips | pips |

| USDPLN | pips | pips |

| USDSEK | pips | pips |

| USDSGD | pips | pips |

| USDTRY | pips | pips |

| USDZAR | pips | pips |

| AUDCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDNZD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDUSD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CHFSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURAUD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURDKK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURGBP | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURHKD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURHUF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURNOK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURNZD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURPLN | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURSEK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURTRY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURZAR | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPAUD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPDKK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPNOK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPNZD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPSEK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDUSD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| SGDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDCNH | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDDKK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDHKD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDHUF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDMXN | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDNOK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDPLN | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDSEK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDTRY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDZAR | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| AUDNZD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CADCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CADJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CHFJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| CHFSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURAUD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURDKK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURGBP | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURHKD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURHUF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURNOK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURNZD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURPLN | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURSEK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURTRY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| EURZAR | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPAUD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPDKK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPNOK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPNZD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPSEK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| GBPSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDCAD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDCHF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| NZDSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| SGDJPY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDCNH | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDDKK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDHKD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDHUF | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDMXN | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDNOK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDPLN | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDSEK | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDSGD | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDTRY | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

| USDZAR | |

| Standard/Micro | pips |

| Ultra Low Standard | pips |

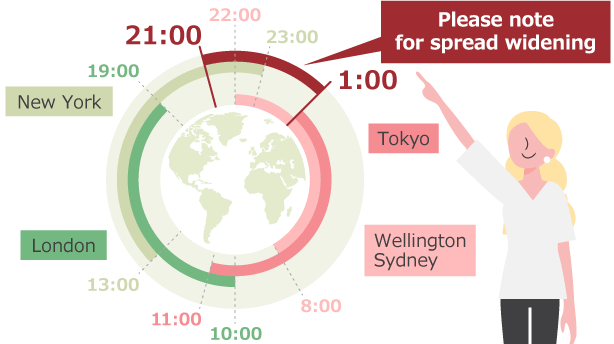

Spreads tend to become narrower when trading volume is high, on the other hand, spreads become wider when trading volume is low. XM deploys fluctuating spread system moving in tandem with interbank market, as the result, spreads may become wider in the hours with low liquidity such as in early morning. Especially 9:00 p.m. to 1:00 a.m. which is overlapped with late NY market time, most importantly between 11:00 p.m. and 0:00 a.m. when the trading volume become least during the day, spreads are getting even wider. Beyond that, spreads may become wider towards the year end when market participants are getting less for holiday, due to sudden market change due to release of economic indicators, politically unstable periods, unexpected external factors or others.

It is recommendable to avert risk in advance such as to try not to give new orders in early morning or at the time of economic indicator release as it is unpredictable how much the spread becomes widened depending on the situation of the market or liquidity. For your indormation, it is highly likely that spreads become wider temporalily at the timing of below economic indicator release.Please note that all times displayed are GMT+2.

You can trade 57 currency pairs in total including major, monir and exotic currencies with XM. Major currencies are the big 6 currency paires such as EUR/USD, USD/JPY, GBP/USD, USD/CHF, USD/CAD and AUD/USD, and is account for more than 80% of world's FX trades, as the result, the trading volumes are high, therefore the spreads become narrower. On the other hand exotic currencies are the currencies of emerging countries' or east european countries' currencies such as Turkish Lira, South African Rand, Mexican Peso, Hungarian Forint, Polish Zloty or HK Dollar and their trading volumes are low, therefore the spreads tend to become wider. However these currency pairs also have bigger movements and bigger swap points. Rest of the currency pairs are called minor currency pairs (cross currencies) and the spreads tend to become wider such as cross/Yen pairs.

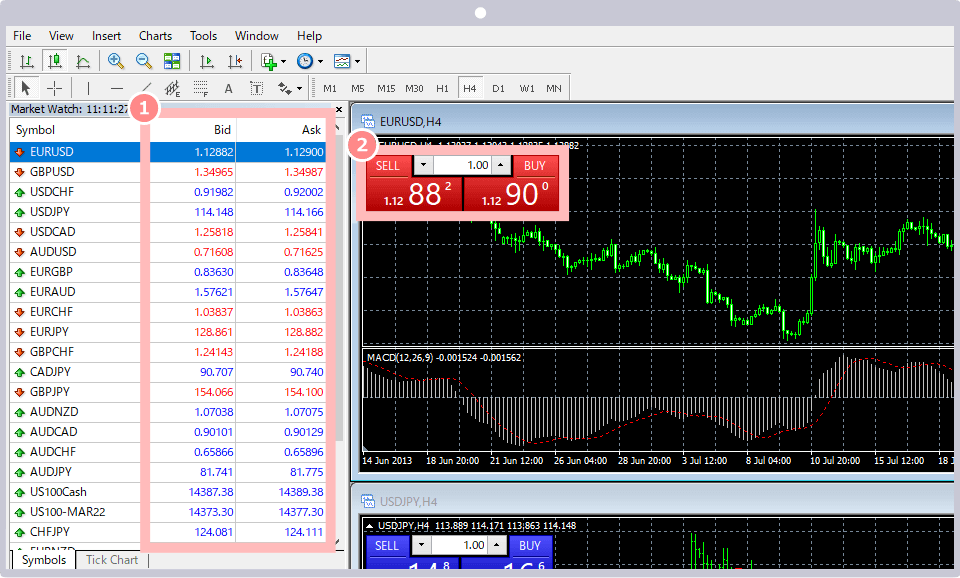

Practical spreads (Bid/Ask) offered by XM can be checked on ①Market watch window or ②one click trading panel after you log in to MT4 (MetaTrader 4)/MT5 (MetaTrader 5).

XM deploys fluctuating spread system in all account types. Fluctuating spread system is the system where spreads may become wider or narrower depending on the value of spread and change on trading hours or market situation all the time.

2022.02.18

Is there any difference of spreads depending on account types?

Yes, spreads differ depending on the account types with XM. XM realizes maximum 1:1,000 times leverage and narrow spreads in XM Ultra Low Account Standard among other types and clients can enjoy trade with no charge.

2022.02.18

Is there any hours when spreads tend to become wider?

Yes, spreads tend to become wider just before the close of market or into the hours of less trade volume not only in XM but also in other FX brokerage houses. Especially towards the close of NY market becomes unstable and spreads tend to become wider. Please be noted.

2022.02.18

Where can I check XM's spreads?

You can check real time spreads on MetaTrader 4 (MT4)/MetaTrader 5 (MT5) with XM. Right click Indicative price indication window, then click 'Spread' after you log in to MT4/MT5. Then the spreads of all currencies are shown on the right.

2022.02.18

Is there any difference of spreads between XM's CFD future and CFD cash?

Yes, you can trade on narrower spreads on XM's CFD cash than on CFD futures. Spreads on CFD cash and CFD futures of specific description can be checked on Indicative price tab or Trade tab on MetaTrader 4 (MT4)/MetaTrader 5 (MT5).

2022.02.18