XM™|How to open the FX account.

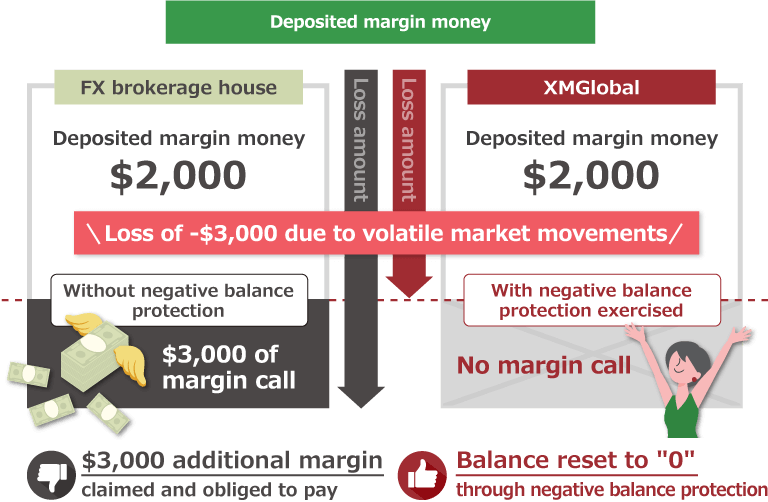

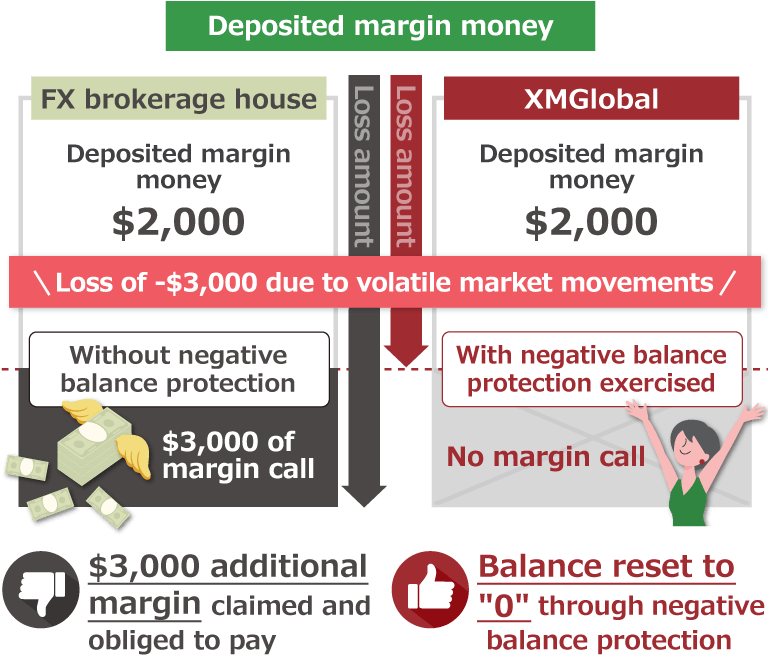

XM deploys "Negative balance protection" (reset of minus balance to zero) which does not require clients of any additional margin call even when the loss exceeds equity due to volatile market movements or any other reasons. Thanks to this system clients are able to trade without the loss above the money they deposited and you can trade at ease.

The negative balance protection is the biggest feature of XM for who wish to use overseas FX brokerage houses.

![]()

Negative Balance Protection XM deploys is the system where XM takes the loss of clients and reset the minus balance back to "0" (zero) when the loss cut does not meet the (forced-settlement) timing due to volatile movement in market and loss exceeds equity.

XM monitors clients' trading, finds their risk at an earlier stage and gives them warning. XM generally gives a "margin call" when clients' margin level goes below 50% of margin, and in addition, exercises the "loss cut" (forced-settlement) which tries to minimize the loss when the margin level goes below 20% in order not to occur the loss more than the amount deposited (deposit amount).

There may be the case that the loss cut is not in time for volatile movement of the market and the loss becomes more than the deposited amount. As XM deploys negative balance protection which resets client's account balance back to "0" (zero) even for the case the account balance goes below "zero". So the client can trade at ease.

| Margin call | Loss cut |

| It works when margin level below 50% | It works when margin level below 20% |

| Margin call |

| It works when margin level below 50% |

| Loss cut |

| It works when margin level below 20% |

What is margin call and loss cut?

Margin call and loss cut (forced-settlement) are excercised when margin level (the ratio of required amount as a margin for the position to the net asset) comes down to a certain level. Both "Margin call" which notifies that margin money goes below 50% of margin level and "Loss cut" which excercise forced-settlement in order to avoid loss more than deposited amount when margin money goes below 20% of margin level are notified through exercise mail to your mail address registered with XM.

After Margin call you will be able to avoid loss cut through raising the margin level by additional deposit. Still though the period of time between Margin call and Loss cut might become short in a rapid volatile market. XM recommends that clients maintain high margin level in order not to have Margin call and Loss cut worked.

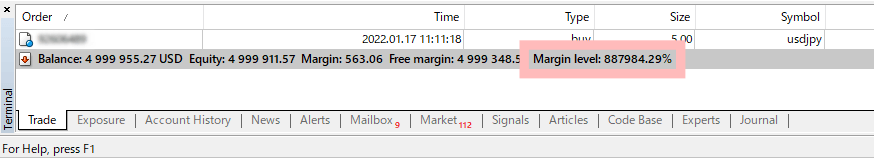

Your margin level can be checked in the "Trade" tab in terminal window (for MT5, in Toolbox window) of trading platform of MetaTrader 4 (MT4)/MetaTrader 5 (MT5).

XM market may cause negative balance due to lack of time of loss cut (forced-settlement) when market moves more than expected through the trend of world economy or various news.

There is a risk that clients owe bigger debt than expected due to additional margin call (additional margin call: the system where clients need to pay additional margin money in the case account balance goes below zero) with the FX brokerage house in the countries where negative balance compensation (Negative balance protection) is not allowed by law.

On the other hand, XM deploys negative balance protection and compensates all the minus balance in order to protect clients against unecpected loss such as these (loss bigger than deposited amount). Clients can put a limit on the risk of loss upto the deposited amount, as there will be no obligation to pay additional margin through this negative balance protection.

XM always provides the environment where clients can trade "at ease" through negative balance protection which protects traders against loss bigger than deposited amount. Why not experience active trade through maximum 1:1,000 times high leverage trade XM boasts.

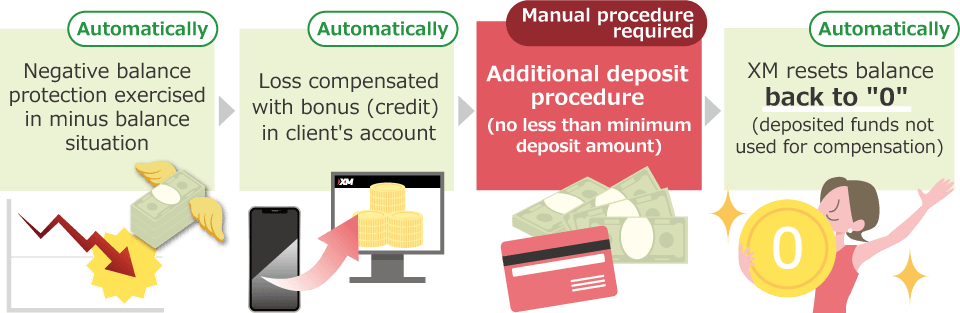

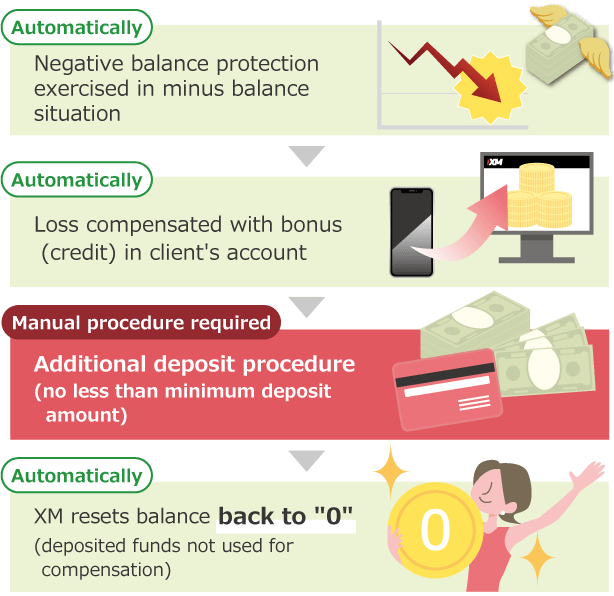

XM's negative balance protection resets account balance back to "0" (zero) when equity amount becomes minus due to forced-settlement in the situation of account balance minus and clients deposit additional funds. For your information, if there is bonus (credit) balance in the account, the bonus willl be used for the compensation first, then the rest of loss will be compensated by XM. This is how the negative balance protection works.

XM's negative balance protection works on all account types such as Standard,' 'Micro,' 'XM Ultra Low Account Standard,' 'XM Ultra Low Account Micro' and 'Shares Account.' XM will not claim additional margin money to clients in accounts such as 'Standard,' 'Micro,' 'XM Ultra Low Account Standard,' 'XM Ultra Low Account Micro' where clients can trade 1:1,000 times leverage maximum or Shares Account specialized in share trading. Clients can control risks and trade in all the accounts.

XM's negative balance protection works on all 7 products of XM (FX: , Precious metals: , Equity Indices: , Commodities: , Energies: , Cryptocurrencies: , Stock: ). As there is no margin call claim not only in FX currrency pairs but also in CFDs, you can trade safely.

XM automatically resets minus account balance back to "0" (zero) when the condition of negative balance protection is fulfilled by receiving additional funds into client's trading account. There is no need for clients to register beforehand or to apply for the Negative balance protection after the loss cut is exercised. We will automatically exercise negative balance protection when we check the recipt of additional funds, so please wait until minus balance is reset to nil.

There are certain rules in exercising XM's negative balance protection. Check the rule of XM's negative balance protection before trade.

XM's negative balance protection which resets minus balance back to "0" (zero) does not apply when equity ratio is plus even when the account balance is minus. Equity is the total amount of account balance, bonus (credit) and uneralized profit and loss. When your equity amount is plus, the condition of negative balance protection is not fulfilled as you are still in a position to be able to trade.

Equity= account balance + bonus (credit) ± unrealized profit and loss (unsettled position)

As XM's negative balance protection is exercised when equity is minus, if the equity money is plus due to bonus (credit), the system is not applicable.

For example, even when your account balance is -$500, and you have $1,000 worth of bonus (credit), your equity is $500. Then your equity is above "0" (zero) and as the result you are in a position to be able to trade, so negative balance protection is not applicable.

Even when account balance is minus, if you have unrealized profit in other positions within the same account, and as the result your equity is plus, you are in a position that the settlement of your unsettled position covers total loss of your account, then the negative balance protection is not applicable.

For example, even when your account balance is -$500, if you have $1,000 worth of total unsettled position of A and B (A: $1,200 and B: -$200), your equity is $500 and is above "0" (zero). As the result you are in a position to be able to trade, so negative balance protection is not applicable.

There is no upper limit on XM's negative balance protection exercise amount. Whenever the case falls on the exercise condition of negative balance protection, all the minus balance with XM will be compensated regardless of the size of loss amount. So you can trade at ease on maximum 1:1,000 times leverage.

There is no upper limit on the number of times for XM's negative balance protection. Even when loss cuts occur in a row, as far as the cases fall on the exercise condition of negative balance protection, the system will be applicable.

XM's negative balance protection is exercised for the account when account balance is minus, loss cut is exercised and equity is minus. Even you have the accounts with plus equity within the same account types, XM will not move your funds for the compensation of loss in XM. XM exercises negative balance protection not by account types but by account.

XM's negative balance protection is for clients to trade in a safe environment. If it becomes known that anyone abuses the system, and commit cross trade between two accounts in different name, in different account or between XM and other brokerage houses, negative balance protection will not be applied to the loss above the deposited amount. Also if clients conflict with prohibited matter or rules such as arbitrage or fraudulent procurement of XMP/bonus, negative balance protection will not be applied.

XM's negative balance protection works immediately after additional deposit more than minimum deposit amount, exchange XMP (XM Point) into cash (USD) or funds transfer from accounts with plus balance into the account where equity is minus.

XMP bonus exchange in the negative balance protection applicable account is not regarded as an additional deposit. If you exchange XMP in the negative balance protection applicable account without unsettled position, the XMP will be used for offsetting your minus balance. Negative balance protection will be immediately exercised for minus balance more than the offset amount by bonuses through any one of the following ways of additional deposit.

| Execution condition | Timing of execution |

| Additional deposit into account | Immediate |

| Exchange XM Point (XMP) into cash | |

| Funds transfer from other accounts of XM |

| Execution condition | Timing of execution |

| Additional deposit into account | Immediate |

| Exchange XM Point (XMP) into cash | |

| Funds transfer from other accounts of XM |

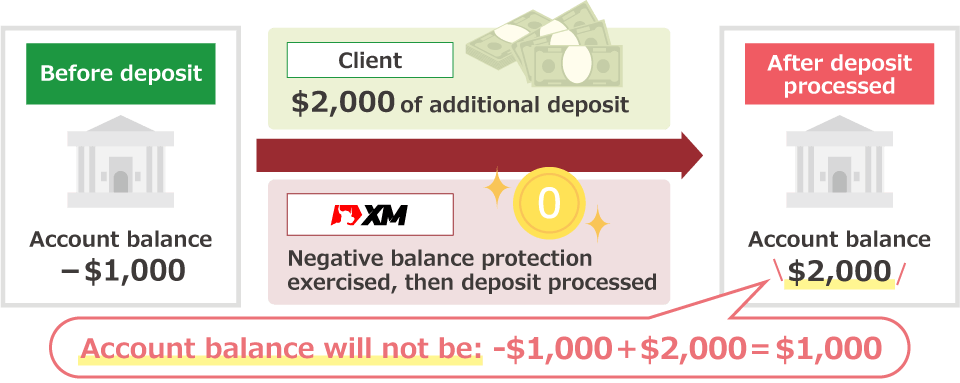

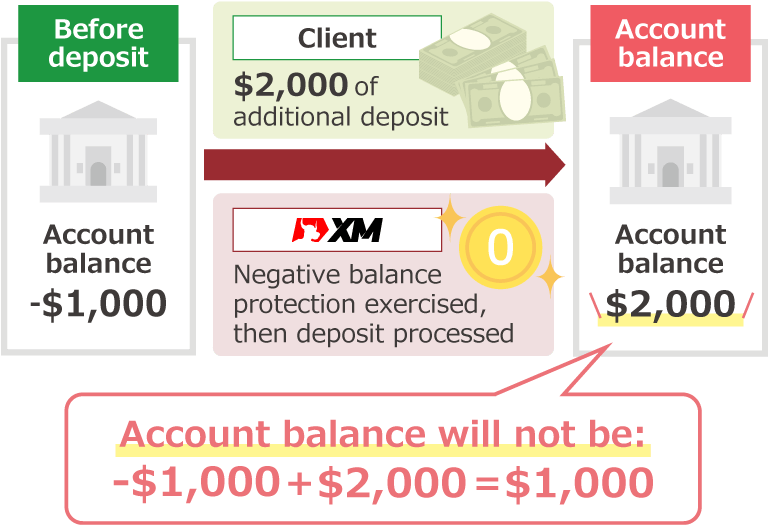

Additional funds deposited into negative balance protection applicable account is not used for compensation of loss. After client takes the procedure of additional funds deposit, XM will check if the account falls on the negative balance protection applicable account and exercise the system. After the reset of account to "0" (zero), process of additional funds deposit will be taken, as the result of that, the whole amount of deposit will be reflected in the account balance.

Bonus balance in the negative balance protection applicable account will be used first for the compensation of loss.

If the whole bonus amount cannot cover the loss, negative balance protection will be exercised. On the other hand, if the whole bonus amount is sufficient to cover the loss, negative balance protection will not be exercised. If there is no bonus balance in the account at the time of negative balance protection, whole loss of your equity will be compensated by XM.

When your account balance becomes -$1,000 through loss cut and if you have $500 worth of bonus (credit), your equity amount will be -$500. When negative balance protection is exercised, the bonus will be used to cover the loss and the rest of -$500 balance will be reset to "0" (zero).

Minus balance deducted from bonus (credit)

Minus balance realized

Minus balance deducted from bonus (credit)

Offset with bonus

If there is still minus balance left after offset with bonus, "Negative balance protection" applied

Negative balance protection applied

When the loss of -$1,000 is realized and there is no bonus (credit) balance, equity will be -$1,000 When negative balance protection is exercised, the whole loss of $1,000 will be reset to "0" (zero).

In case there is no bonus balance

Negative balance protection applied to whole minus balance

Minus balance realized

In case there is no bonus balance

Negative balance protection applied to whole minus balance

Negative balance protection applied

When negative balance protection reflected in account?

In general, minus balance will be reset back to zero, by taking any of the actions such as additional deposit, funds transfer between accounts or exchange XM Points into chash (USD) when the condition of negatice balance protection is fulfilled, the balance will be reset back to zero. However if you exchange XMP into bonus, it will be used for the compensation of minus balance. So please be noted.

2022.01.14

XM's negative balance protection works on all account types?

Yes, XM applies negative balance protection to all the account types. There is no need of previous setting for Negative balance protection. The system will automatically work on the account which fulfills the conditions on the timing of additional deposit. Also, there is no upper limit on the number of times for XM's Negative balance protection. So you can trade at ease.

2022.01.14

When negative balance protection in XM account exercised, what happens with bonus?

XM's negative balance protection resets your account balance back to zero for the rest of the loss after your bonus is used for offset of loss in the account. When bonus amount is more than the minus amount in the account, rest of the amount after cover the compensation of loss, bonus will remain in the account as a credit. For your information, if the valid margin money is plus, negative balance protection will not be exercised.

2022.01.14

Even though account balance of XM is minus, negative balance protection not reflected.

XM does not exercise negative balance protection if valid margin money is plus, even when account balance is minus. Only when loss more than valid margin money occurs and valid margin money becomes minus, the account will be reset to zero. For your information, Negative balance protection will automatically be exercised when additional funds are deposited.

2022.01.14

Am I able to deposit before the negative balance protection is put into motion?

Yes, you can deposit the funds before the negative balance protection is put into motion. When you deposit the funds in the situation of negative account balance occurs, it brings back the account balance to nil, then your funds will be topped up afterwards. So you can deposit at ease without having your funds compensated for the negative balance.

2021.08.12