XM™|How to open the FX account.

'Cross trade' is allowed only within the same account with XM. By utilizing cross trade proactively you can obtain various advantages such as risk hedge for the rapid market movement as well as avoiding forced stop-out due to lack of margin or maximizing the profit. If any of cross trades against XM rule are conducted, measures such as profit nullification or account freeze may be taken. So please note the basic rules of cross trade and prohibited matters.

![]()

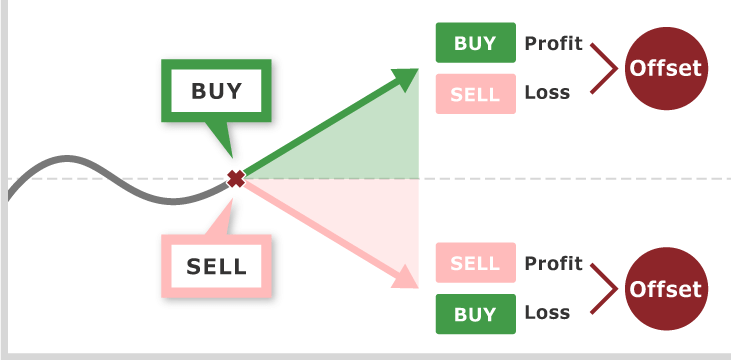

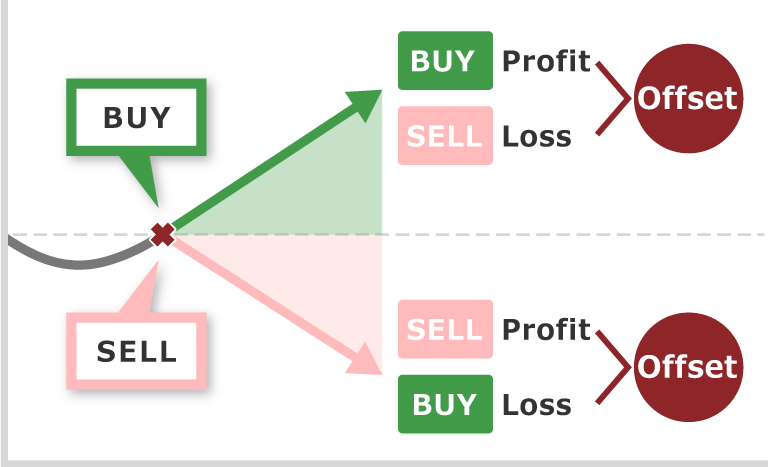

Cross trade is a trading technique where you have selling/buying positions in a same currency pair at the same time. When you have selling/buying position in the same lots, unrealized profit and loss are setoff, therefore cross trades will become a risk hedge for a rapid market movement.

It is also possible to avoid forced loss cut in an unfavorable situation as well as maximize the profit while minimize the loss by using the cross trade proactively.

Cross trade is only allowed within the same account with XM. XM basically prohibits cross trade except within the same account, and even if you unintentionally conduct cross trade in multiple accounts with XM or between XM and other FX brokerage houses, there may be the possibility of penalty such as account freeze or nullification of profit. Please note the prohibit matters for cross trade with XM in order to avoid unexpected violation of rules.

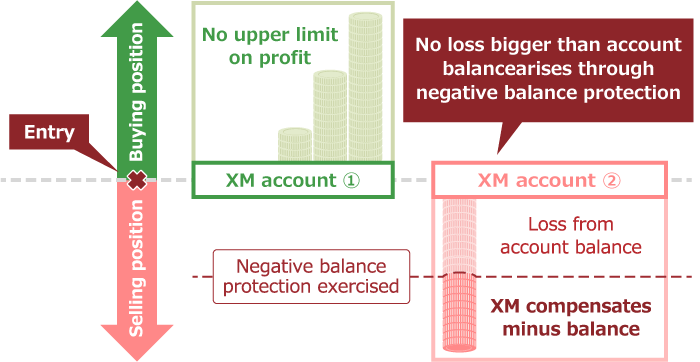

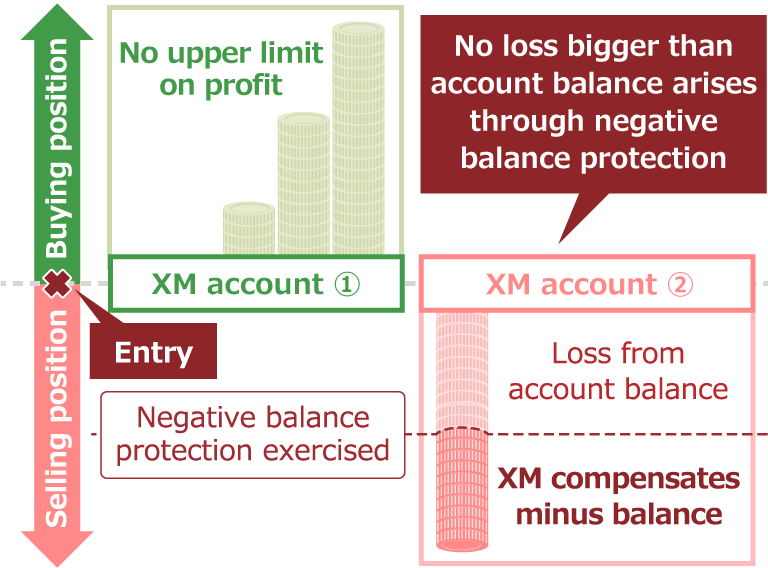

The reason why many overseas FX brokerage houses including XM set prohibit matters for cross trades is to avoid abuse negative balance protection system. Negative balance protection system is the service where FX brokerage houses take the loss of clients and reset the minus balance back to nil when the volatile market movement does not meet the loss cut timing and loss exceeds the valid margin money.

If you have a selling position in one account with XM and a buying position in another account with XM respectively and there happens volatile market movement, there will be a big profit in one of the two accounts. However a loss left in the other account upto the account balance at most, and traders can earn the difference of profit and loss of two accounts without any risk as XM compensates the loss through Negative Balance Protection System.

In order to avoid this kind of unilateral disadvantage arising XM prohibits cross trade between multiple accounts with XM or between XM and other FX brokerage houses.

XM prohibits cross trade between multiple accounts within XM. Though it is allowed for each individual client to open maximum 8 accounts with XM, if the client conducts cross trade and have selling and buying position respectively between these accounts, it will be a conflict of rules. When you manage your positions in multiple accounts or use EA (trading robots), you may conduct prohibited activities without noticing them as cross trades. So please be noted.

XM prohibits cross trade between trading account of XM and the different account of other FX brokerage houses. Those FX brokerage houses include all other brokerage houses regardless domestic or overseas. When you use multiple FX brokerage houses, there may be the cases that positions you have might unintentionally become cross trades. So please be noted.

Is it possible for XM to check cross trades with other brokerage houses?

When client uses common trading platform such as MT4/MT5 which XM also deploys, transaction history or client's information can be checked each other between FX brokerage houses. Therefore XM can easily see client's transaction history when cross trades are conducted between the accounts of XM and other brokerage houses. If you conduct a prohibited transaction under an easy expectation that it would not come to light as the trades are between XM and other brokerage houses, penalties would be imposed on you. So please be noted.

XM prohibits organized cross trade by multiple people. For example, if one person has a buying position in his/her account and the other person has selling position at the same time, the cross trade come into effect and the trade through abuse of negative balance protection could become likely. If, by chance, you have a position which is opposite of your friend, it would not be a problem. However in the cases such as when clearly unnatural profit arises and XM considers that it is an organized cross trade, then the trade will be deemed to be a prohibited transaction. In these cases penalties such as profit nullification or account freeze might occur.

XM prohibits cross trade between multiple accounts aiming for avoiding risk of specific currency. For example, when you have EUR/USD buying position and have EUR/JPY selling position in another account intentionally in order to avoid the risk of 'EUR' falling down, it may deem to be the cross trade prohibited by XM. This could also fall on the case of cross trade between multiple accounts and become the violation of rules. So please be noted.

Caution needed when EA is in use!?

Caution needed when you use EA (trading robot) in any one of the accounts you have in XM. As when you have a position in a discretionary or other accounts, there may be the cases where EA accidentally creates the prohibited positions which are deemed to be an avoidance of risk of the specific currency or the same kind of position. In such cases positions accidentally created by EA might also be regarded as a prohibited activity. So please be noted.

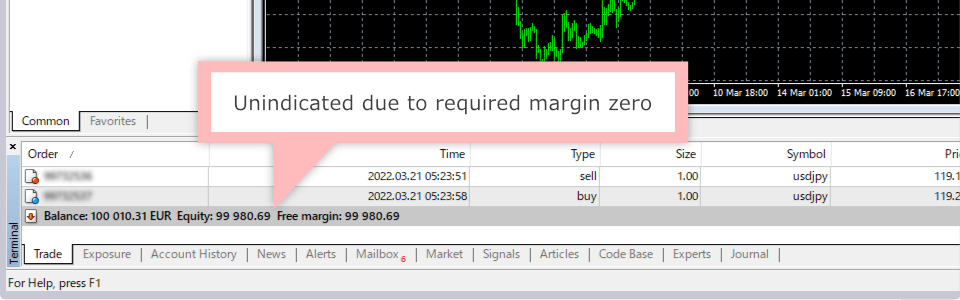

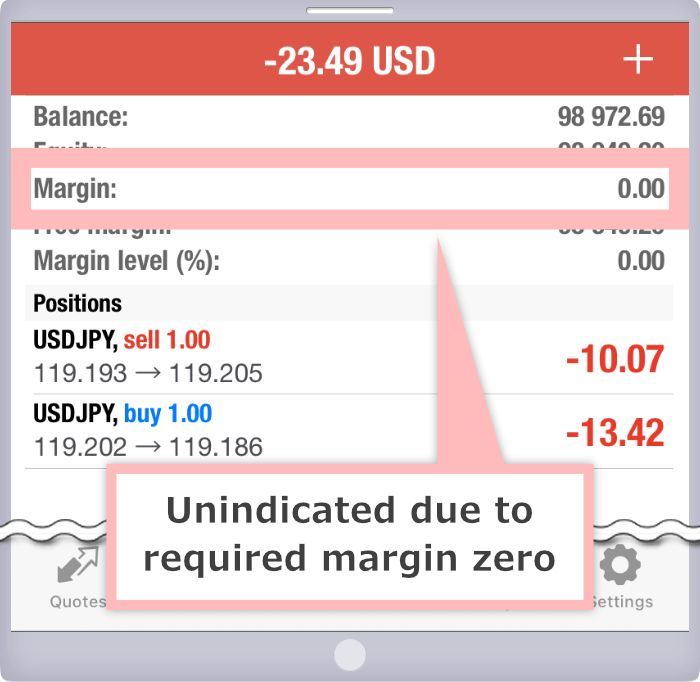

Required margin for the position of FX currency pairs, gold and silver will become "0" (zero) with XM when client holds the same number of lots in cross trade in the same account with XM. Some other FX brokerage houses require margin for cross trades, however XM does not. As the result, client has an allowance in margin and can hold positions with maintaining the margin, therefore is able to avoid forced settlement and manage to cut the loss at the best timing. However cases where you do not need margin are only when you have the same number of lots positions in cross trade. If you have the different number of lots in cross trade, there arise required margin. So please be noted.

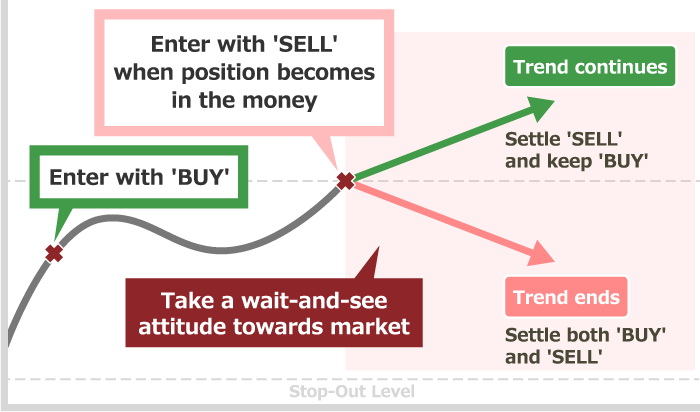

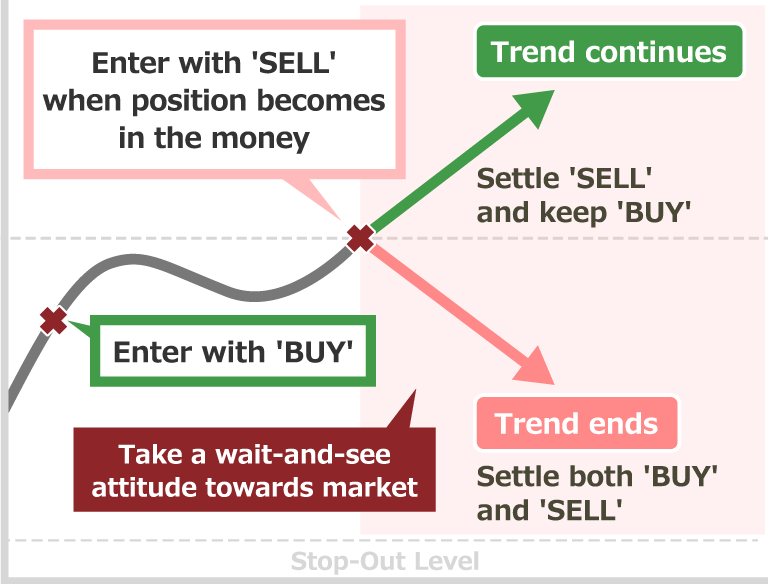

You can take a wait-and-see attitude towards market trend ahead while maintaining positions without closing the position by holding cross trade positions within the same account of XM. For example, if your position is in the money, you can see if the market trend continues without risk by entering the market with opposite position and lock in profits at the right timing. Specifically if the trend seems to continue, close the position which is against the trend and if the trend seems to end, close both positions. By doing these, you can avoid forced loss cut and maximize the profit.

Various trading techniques with different holding periods of position depending on market trend are available simultaneously such as holding short-term position while holding long-term position through cross trade. You may be able to have a chance to generate more profit by combining different trading techniques such as combining swing trade, day trade or scalping.

XM provides 'XM Loyalty Program' where you can earn XM Point (XMP) exchangeable for bonus or cash every time you trade. If you use XM's Standard Account and Micro Account, you can earn XM Points on both sides of the trade through cross trading. However the intentional cross trade aiming for XM Points will become a conflict of rules. So please be noted.

When you hold positions overnight, there arise swap points coming from the interest difference between two currencies to adjust profit and loss. There are certain FX currency pairs provided by XM which have bigger minus swap points than plus swap points. If you hold such currency pairs for a long-term over days in cross trade, loss will arise from swap points. So please be noted.

As there are 2 positions, SELL and BUY in cross trade, if the cross trade does not work well, the loss will become double compared with single position case. Especially when important economic indicators are released, market tends to move rapidly and there is a possibility that cross trade cause a bigger loss and might lead to a loss cut. While cross trade has many advantages in a normal market, it involves risks in a volatile market. So please be noted. When you conduct cross trade with XM, you should stay alert for the market even when the market is relatively stable.

When you conduct cross trade with XM, the position of cross trade needs to be settled at the same time (Multiple Close By). That is because if selling and buying position are settled in a different timing, time difference might lead to an increase of unrealized loss or decrease of unrealized profit. XM's MT4 (MetaTrader 4)/ MT5 (MetaTrader 5) has 'cross trade cancellation' function and it is possible to cancel cross trade with easy procedure.

Caution needed when only one of the positions of cross trade is settled

When either one of selling or buying position of cross trade is settled, caution is needed for decrease of valid margin ratio. Though required margin for same number of lots cross trade is zero with XM, once either one of selling or buying position is settled, required margin will arise depending on the size of the position. If you conduct cross trade in order to avoid forced loss cut, settlement of one-side position might lead to a rapid decrease of margin ratio and go below loss cut line. So please be noted.

It is possible to cancel cross trade with easy procedure through proprietary 'Multiple Close By' function of XM's MT4 (MetaTrader 4)/ MT5 (MetaTrader 5). How to cancel cross trade on MT4/MT5 is as follows:

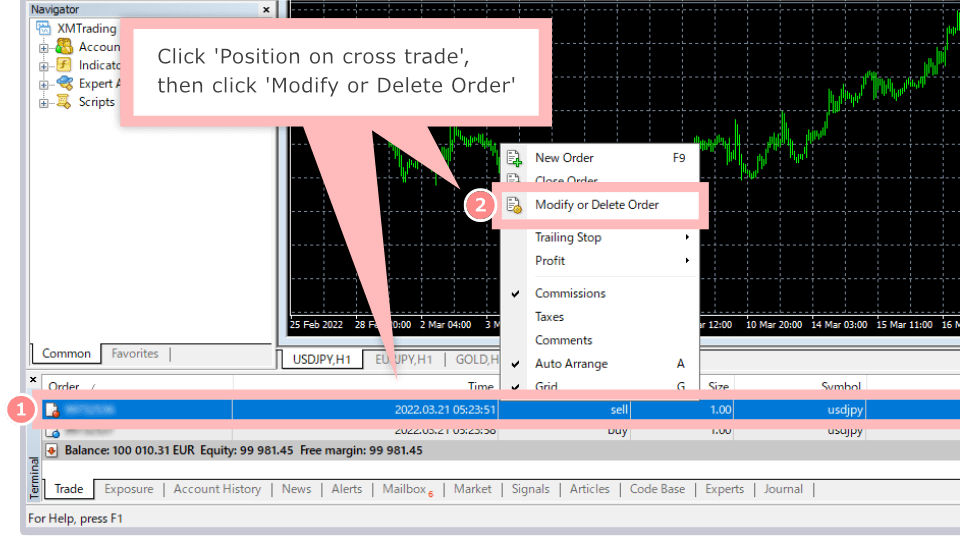

①Right click currency pair on cross trade, ②choose 'Modify or Delete Order' on MT4/MT5 terminal.

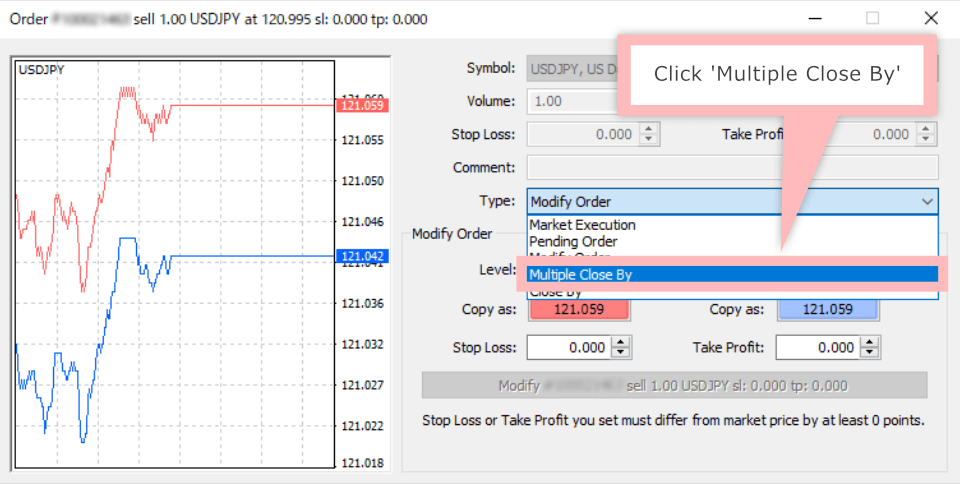

Choose 'Multiple Close By' from 'Type'

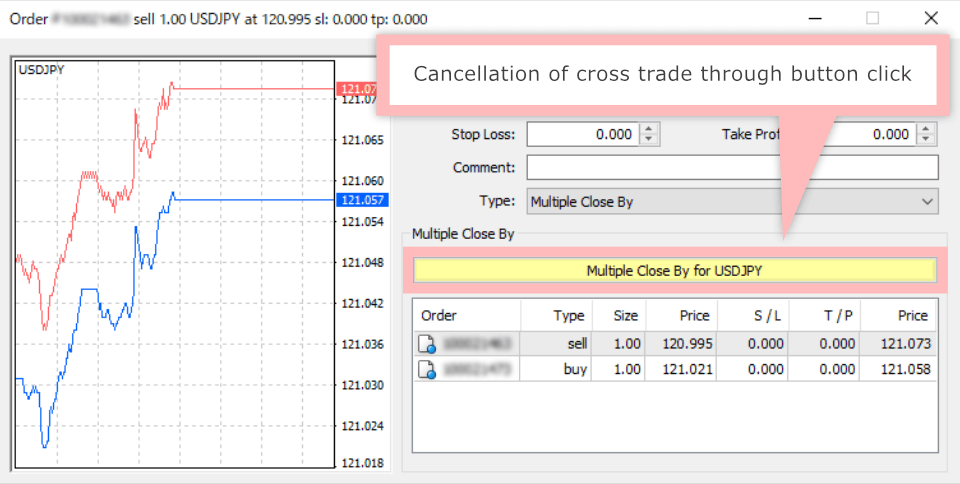

A yellow button, 'Multiple Close By' is indicated. Check if you choose correct currency pair you wish to cancel, and click. Now the 'Multiple Close By' is completed.

Scalping trade, EA or cross trade prohibited with XM?

No, there is no specific restrictions on scalping trade, EA or cross trade within the same account with XM. However cross trade between multiple accounts within XM or cross trade between XM and other brokerage houses (cross trade using other brokerage houses' FX account) are prohibited.

2022.03.18

What will required margin become on cross trade with XM?

Required margin for the position will become '0' (zero) with XM when cross trade is conducted in the same number of lots within the same account. Therefore there will be an allowance for margin and you can avoid forced stop-out while on cross trade. However if you conduct cross trade in different number of lots, required margin arises. So please be noted.

2022.03.18

Tell me how to cancel cross trade with XM.

When you cancel the both position of cross trade with XM at the same time (Multiple Close By), right click currency pair on cross trade, choose 'Modify or Delete Order' then choose 'Multiple Close By' from 'Type.'

2022.03.18

Can I close only one-side position of cross trade with XM?

Yes, you can close only one-side position of cross trade with XM. However if you close either one of the positions, selling or buying position, cross trade should be cancelled at the timing of position close and there arise required margin depending on the position size.

2022.03.18

What is the advantage of cross trade with XM?

There are advantages such as required margin will become '0' (zero) with XM, you can conduct different trading techniques or you can earn XM Points (XMP). However cross trade aiming for earning XM Point (XMP) will become a conflict of rules. Please make sure that you check the prohibited matters in advance.

2022.03.18