XM™|How to open the FX account.

Clients can earn profit continuously by proactively using "swap point" which arises from the difference of interest rates between currencies with XM. Unlike foreign exchange gain, swap point which clients can earn automatically simply by holding position is one of the important barometers of choosing FX brokerage house.

As XM provides high yield currencies such as Turkish Lira, Mexican Peso or South African Rand, clients can trade with long term strategy aiming for earning swap points by taking the advantage of high leverage which is the best part of XM's feature. Even in the case unexpected volatile movement of the market causes the loss in the client account, our negative balance protection averts client from the loss above deposit amount.

![]()

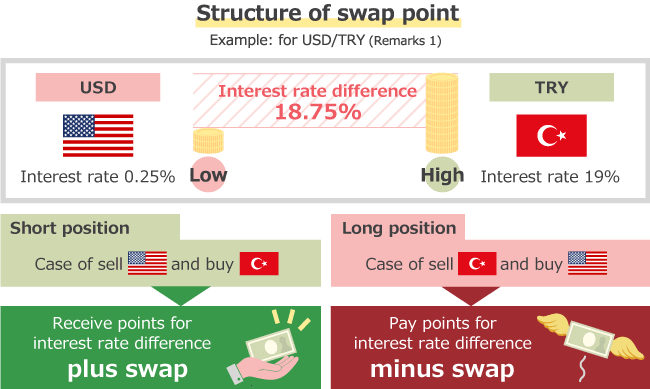

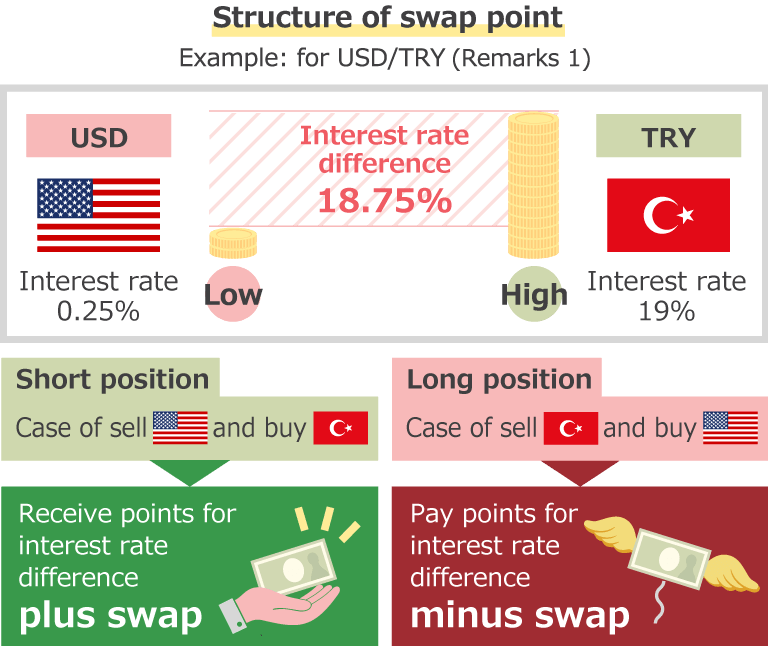

Swap point is the profit and loss arising from adjusting the difference of interest rates between countries. In FX trading where two currencies which have different policy interest rates are exchanged, receipt and pay-out of swap point arising out as the adjustment of difference of policy interest rates between 2 countries continue everyday until the position is settled.

When you buy higher interest rate currencies and sell lower interest rate currencies, you can earn swap points, on the other hand, when you buy lower interest rate currencies and sell higher rate currencies, you need to pay swap point. For your information, to receive swap points and to pay the points may switch places with each other as FX rates or market interest rates change from day to day.

Generally policy interest rates of advanced countries' currencies such as USD or JPY are set at low level. For example Japan's policy interest rate is set at -0.10%. On the other hand, policy interest rates of emerging countries' currencies such as Turkish Lira or Mexican Peso are set at high level. For example Turkey's policy interest rate which is famous for high yield interest rate is set at 14%.

| Currency | Policy interest rate |

| JPY | % |

| USD | % |

| EUR | % |

| GBP | % |

| AUD | % |

| CAD | % |

| CHF | % |

| MXN | % |

| ZAR | % |

| TRY | % |

What is policy interest rate?

Policy interest rate means the interest rate which central banks of each country set for monetary policy. Referring to these policy interest rates private financial institutions fix their rates such as deposit rates and lending rates. Generally policy interest rates are set higher in order to contain inflation when the economy is good and they are set lower in order to stimulate economy when the economy is bad. Swap points become bigger or smaller depending on the change of policy interest rates.

Swap point arises on the timing of rollover from Monday to Friday with XM. Namely the unsettled position carried over to the following business day bears swap point at the timing of 22:00 GMT when NY market closes. If you are trying to gain plus swap point, but you have closed your position before this timing, you will not be able to receive the swap points for the day. On the other hand, if you avoid to pay minus swap point, you need to settle your position by the time of rollover.

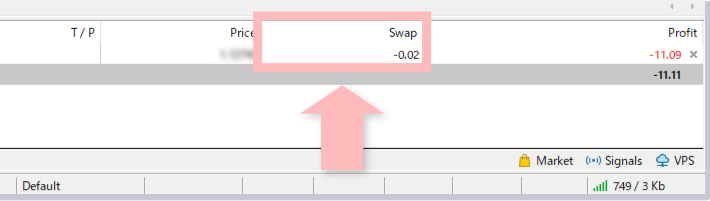

Swap point given to you can be checked on "Trade" tab in "Terminal" of MT4/MT5."

3 times bigger swap points than other days arise on the position rolled over from Wednesday to Thursday with XM. Settlement day in FX market is normally 2 days after trade, as the result trade on Thursday is settled on Monday and trade on Friday is settled on Tuesday. Because of this the trade done on Wednesday earns 3 day swap points including weekends (Saturday and Sunday), namely there is no rollover on weekends as there is no FX market. Plus swap points as well as minus swap points arise 3 times bigger than in other weekdays. If you hold your position over Wednesday, please be noted.

| Day of week | Mon. | Tue. | Wed. | Thur. | Fri. | Sat. | Sun. |

| Swap Point |

Points for one day | Points for one day | Points for three days |

Points for one day | Points for one day | Closed | Closed |

| Day of week | swap point |

| Monday | Points for one day |

| Tuesday | Points for one day |

| Wednesday | Points for three days |

| Thursday | Points for one day |

| Friday | Points for one day |

| Saturday | Closed |

| Sunday | Closed |

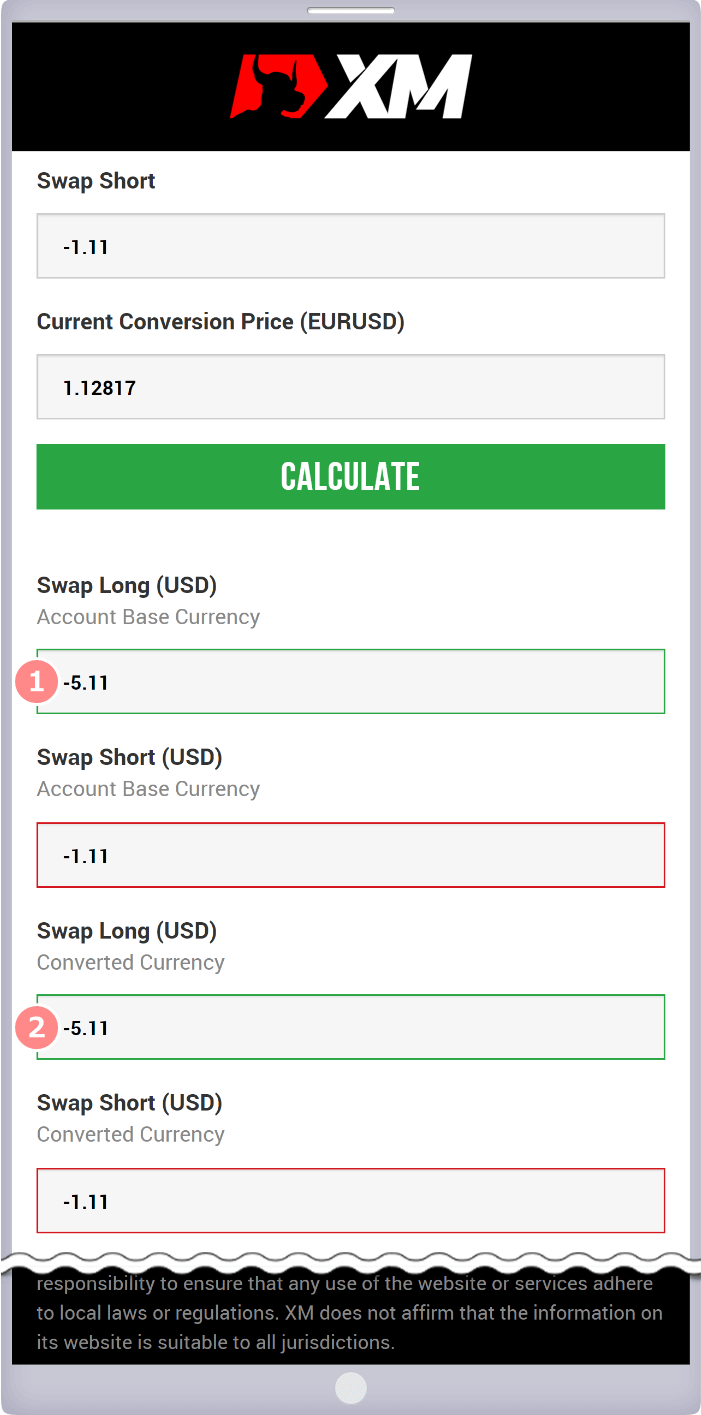

XM Trading's swap points are automatically calculated by XM and reflected depending on the trade conditions. If you wish to convert swap points to USD or other currencies, you need to calculate it with every currency pair. XM provides "Swap calculator" in order to calculate these automatically, so you can check profit and loss calculated into the base currency of your account without troublesome calculations of swap points.

How to calculate swap points and use XM Swap calculator is as follows:

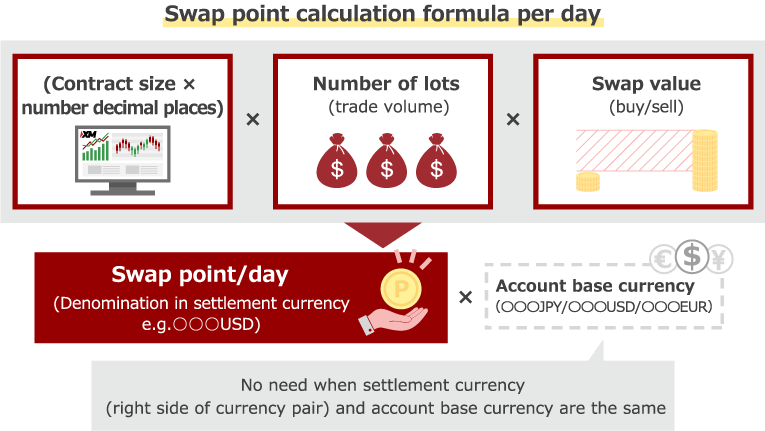

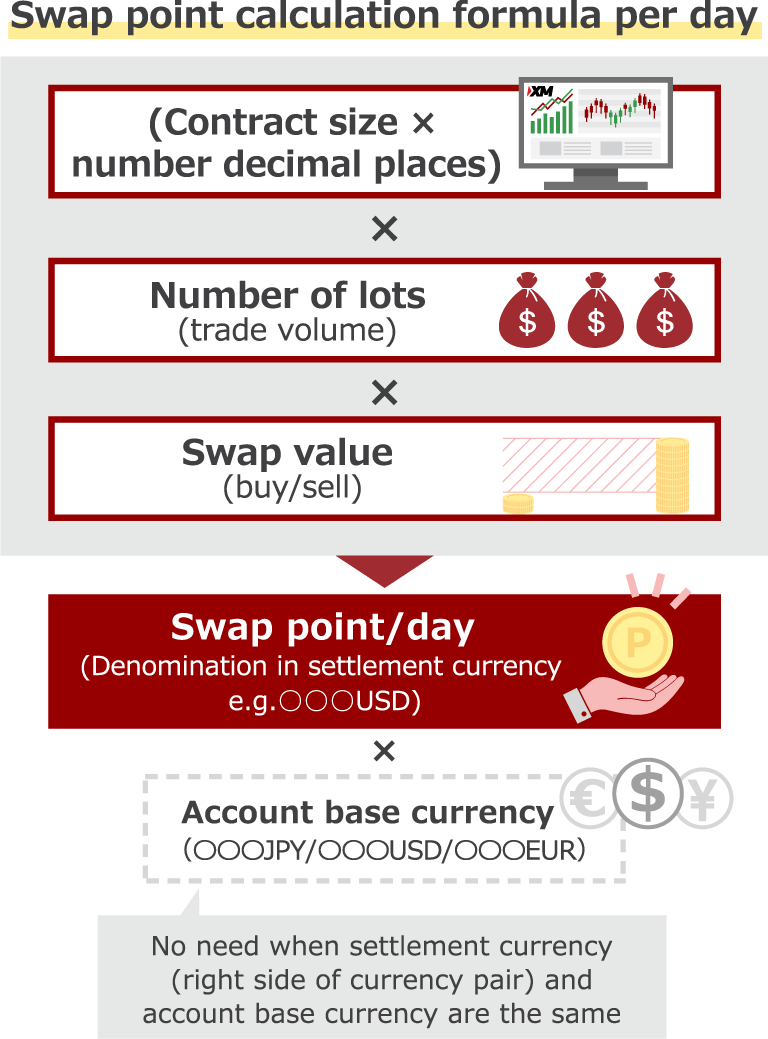

XM's swap points can be calculated with contract size (value of 1 lot), decimal places (3 decimal places = 0.001/5 decimal places = 0.00001), number of lots (trading volume) and swap value (buy/sell). Swap point calculation formula per day is as follows:

Swap points are evaluated in the settlement currency (right side of the currency pair). When you convert swap point into JPY, you need to convert the result into JPY denominated amount. If the currency pair you trade is USD/JPY and the settlement currency is in JPY, you do not need to convert the points into JPY. For your information, Micro Account deals with different lot size, swap points will be calculated in 1/100. Please be noted.

e.g.1) In the case client sold "1 lot" of "USDJPY (contract size 100,000, using 3 decimal places)" in Yen denominated account and swap point for sales position was "-3.8."

(100,000 × 0.001) × 1Lot × -3.8 = -380JPY/DAY

e.g.2) In the case client bought "1 lot" of "EURUSD (contract size 100,000, using 5 decimal places)" in Yen denominated account and swap point for buy position was "-5.42."

(100,000 × 0.00001) x 1Lot × -5.42 = -5.42USD/DAY

-5.42USD x (USDJPY:110JPY) = -596.2JPY/DAY

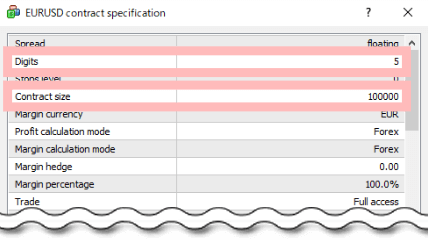

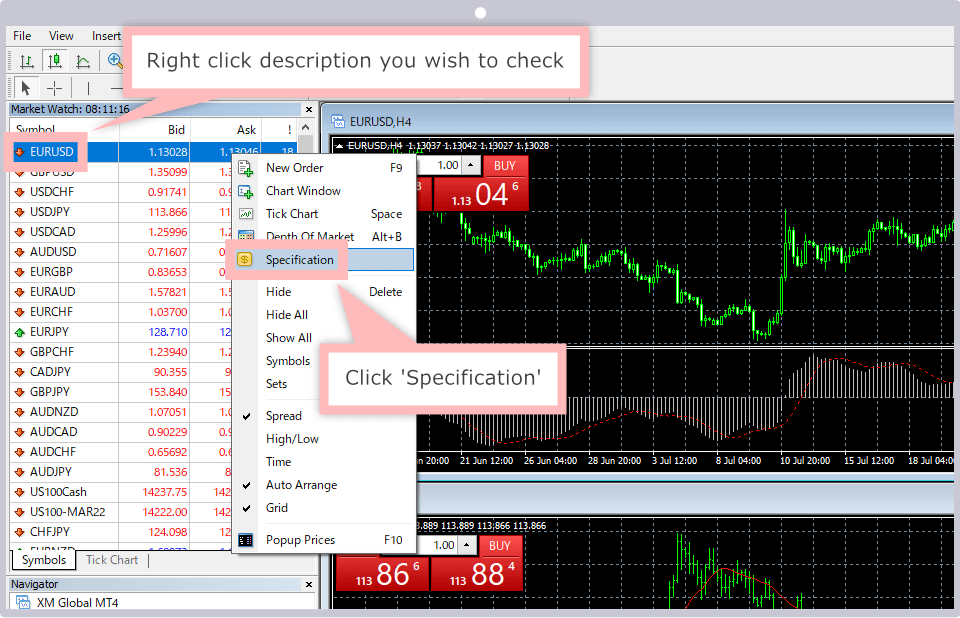

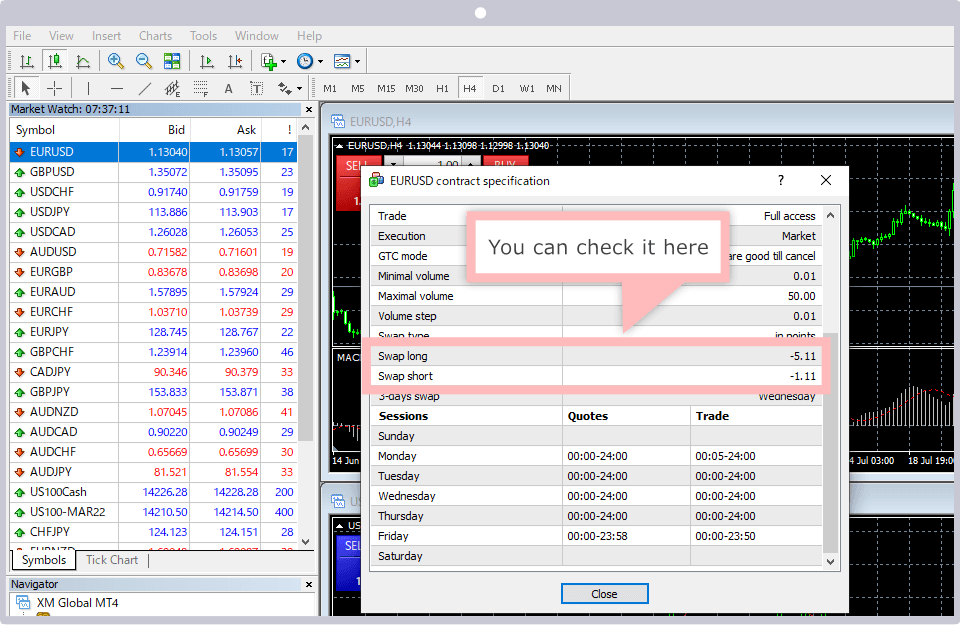

Contract size/ number of decimal places can be checked with MT4/MT5

Contract size and number of decimal places of each description of XM can be checked with MT4/MT5 (MetaTrader). After clicking currency pair you wish to check from indicative 'prices window' of MT4/MT5 and choose 'Specification,' you can check contract size/number of decimal places in trading conditions. For your information, 3 decimal places represent '0.001' and 5 decimal places represent '0.00001.'

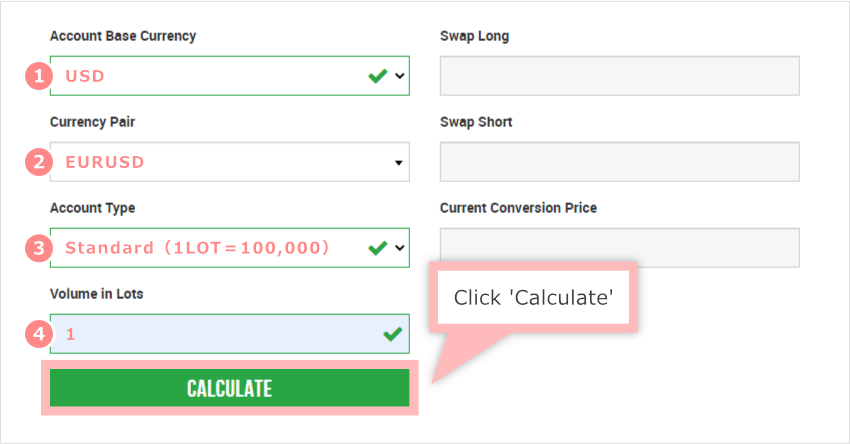

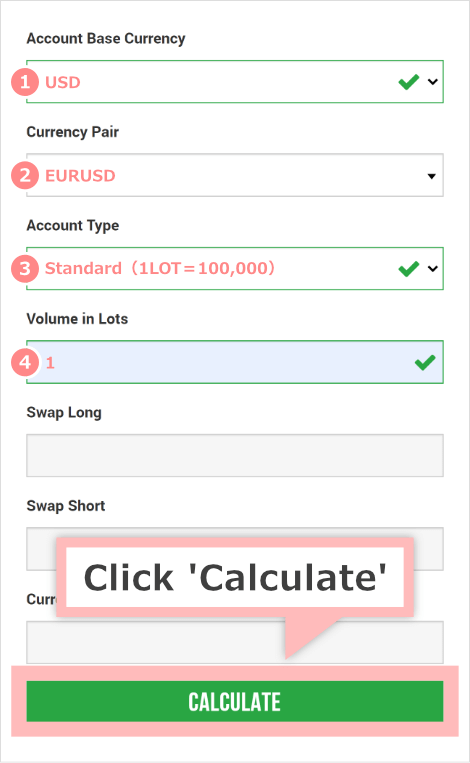

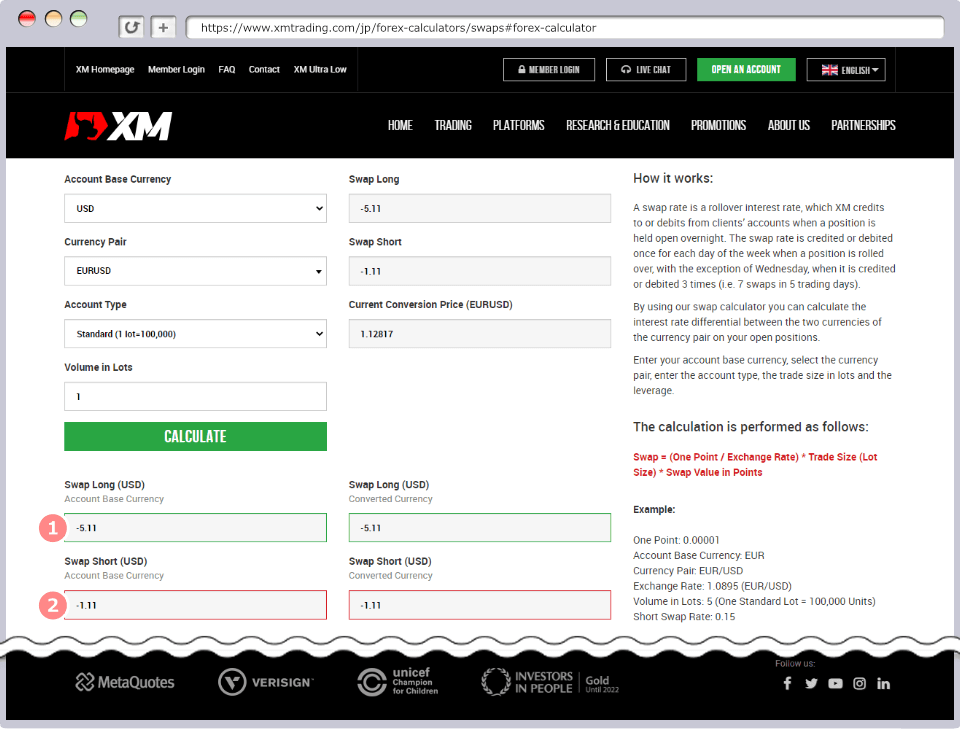

XM provides 'XM Swap calculator' with which you can calculate swap point easily. Without login to Member Page or cumbersome procedure you can calculate latest swap point easily. Why not check the real swap point by using XM Swap calculator before trade. How to use XM Swap calculator is as follows:

Choose ①account base currency and ②currency pair of which you wish to calculate swap point. Then, choose ③leverage for margin, ④account type and ⑤volume in lots, and click "Calculate."

Choose ①account base currency and ②currency pair of which you wish to calculate swap point. Then, choose ③leverage for margin, ④account type and ⑤volume in lots, and tap "Calculate."

| 1Account base currency | e.g.USD |

|---|---|

| 2Currency pair | e.g.EURUSD |

| 3Leverage for margin | e.g.1000 |

| 4Account type | e.g.Standard |

| 5Volume in lots | e.g.1 |

When calculation completed, swap point per day denominated in account base currency is indicated in ①swap point for purchase (in USD) and ②swap point for sales (in USD).

Profit and loss arising from swap point will be fixed at the time of position settlement and realized in your account collectively with XM. As the result, unrealized swap point profit only cannot be withdrawn. In order to become the swap point profit realized in the balance to be withdrawn you need to settle the open position.

While swap point is in plus, there would be no problem. On the other hand when the swap point is in minus, accumulated minus swap points will be deducted from the settled amount. Also swap points in the unsettled open position as well as unrealized profit and loss are included in equity, and have an effect on the margin level in case of loss cut (forced settlement), therefore be noted for the account balance for loss not being realized due to loss cut.

No swap points arise in CFD futures with XM. As Commodities and Energies are all in future products, no swap points arise in all descriptions. Please note that there are some CFD future products also in precious metals and stock indices. List of CFD futures where no swap points arise with XM are as follows:

| Commodities | COCOACOFFECORNCOTTOHGCOPSBEANSUGARWHEAT |

|---|---|

| Precious Metals | PALLPLAT |

| Energies | BRENTGSOILNGASOILOILMn |

| Stock CFD futures | EU50FRA40GER30JP225SW120UK100US100US30US500USDXVIX |

| Cryptocurrency |

AAVEUSDADAUSDALGOUSDAVAXUSDAXSUSDBATUSDBCHUSDBTCEURBTCGBPBTCUSDCOMPUSDENJUSDETHEURETHGBPETHUSDGRTUSDLINKUSDLTCUSDMATICUSDSNXUSDSOLUSDSTORJUSDSUSHIUSDUMAUSDUNIUSDXLMUSDXRPUSDZRXUSD1INCHUSDAPEUSDAPTUSDARBUSDATOMUSDBTGUSDCHZUSDCRVUSDDASHUSDDOGEUSDDOTUSDEGLDUSDEOSUSDETCUSDETHBTCFILUSDFLOWUSDICPUSDIMXUSDLDOUSDLRCUSDMANAUSDNEARUSDOPUSDSANDUSDSHIBUSDSTXUSDXTZUSDZECUSD Read moreClose |

For your information, swap points arise in cash stock indices as usual. Cash/future stock indices have different description names as follows:

Stock indices (cash)

Stock indices (futures)

Cash stock indices have the word(Cash) at the end of description names, and future stock indices have delivery month such as (MAR22) at the end of description names.

Dividend adjustment does not apply to cash stock indices with XM. Dividend changes depending on the timing of rollover on dividend pay day. If you have long position, you will receive the adjustment of dividends and if you have short position, you need to pay the adjustment. Dividend schedule of each description is updated every Monday. For your information, dividend adjustment does not apply to future stock indices.

Even if any of descriptions has plus swap in either sales swap or purchase swap, minus swap is set intentionally bigger in value with XM. As the result, if you transact cross trade, total of swap points will definitely become minus. Not only cross trade aiming for earning swap points but also long-term cross trade will result in unrealized daily loss. So please be noted.

Swap points arise not only in FX currency pairs (major/minor currencies) but also in CFDs of precious metals (gold/silver) and stock indices (cash) with XM. List of swap points of products provided by XM are as follows:

| Commodities | Long (purchase) Swap point |

Short (sales) Swap point |

| USDJPY | ||

| EURUSD | ||

| GBPUSD |

| USDCHF | ||

| USDCAD | ||

| CADCHF | ||

| CADJPY | ||

| CHFJPY | ||

| EURCAD | ||

| EURCHF | ||

| EURGBP | ||

| EURJPY | ||

| GBPCAD | ||

| GBPCHF | ||

| GBPJPY |

| Commodities | Long (purchase) Swap point |

Short (sales) Swap point |

| AUDCAD | ||

| AUDCHF | ||

| AUDJPY |

| AUDNZD | ||

| AUDUSD | ||

| CHFSGD | ||

| EURAUD | ||

| EURDKK | ||

| EURHKD | ||

| EURHUF | ||

| EURNOK | ||

| EURNZD | ||

| EURPLN | ||

| EURSEK | ||

| EURSGD | ||

| EURTRY | ||

| EURZAR | ||

| GBPAUD | ||

| GBPDKK | ||

| GBPNOK | ||

| GBPNZD | ||

| GBPSEK | ||

| GBPSGD | ||

| NZDCAD | ||

| NZDCHF | ||

| NZDJPY | ||

| NZDSGD | ||

| NZDUSD | ||

| SGDJPY | ||

| USDCNH | ||

| USDDKK | ||

| USDHKD | ||

| USDHUF | ||

| USDMXN | ||

| USDNOK | ||

| USDPLN | ||

| USDSEK | ||

| USDSGD | ||

| USDTRY | ||

| USDZAR |

| Commodities | Long (purchase) Swap point |

Short (sales) Swap point |

| GOLD | ||

| SILVER | ||

| XAUEUR |

| Commodities | Long (purchase) Swap point |

Short (sales) Swap point |

| AUS200Cash | ||

| CA60Cash | ||

| ChinaHCash |

| EU50Cash | ||

| FRA40Cash | ||

| GER40Cash | ||

| HK50Cash | ||

| IT40Cash | ||

| JP225Cash | ||

| NETH25Cash | ||

| SA40Cash | ||

| SPAIN35Cash | ||

| SWI20Cash | ||

| UK100Cash | ||

| US100Cash | ||

| US2000Cash | ||

| US30Cash | ||

| US500Cash |

Currency pairs of emerging countries with high swap points such as Turkish Lira, South African Rand or Mexican Peso have risk of rapid price changes due to domestic unstable political situation, geopolitical risks or other factors. As the result, loss cut may occur due to rapid price changes and the loss may become bigger than the profit arising from swap points you have been earning. Unlike other trade technique, swap trade has certain attractiveness as the position can be left without touched to some extent. Still though as far as you hold the position, it would be advisable to check the required margin.

Here are some currency pairs with high swap points suitable for long-term swap trade among many currency pairs. Below are the values of daily swap points converted to Yen per lot.

| Commodities | Position | Swap point |

| about USD | ||

| about USD | ||

| about USD | ||

| about USD |

| Position | |

| Swap point | about USD |

| Position | |

| Swap point | about USD |

| Position | |

| Swap point | about USD |

| Position | |

| Swap point | about USD |

Plus swap bears profit on your account at the time of settlement and there won't be any problem. On the other hand, minus swap costs you daily and as the result trading cost will become bigger. So please be noted.

Even though you are not aiming for swap points, you will be affected greatly by swap points when you hold positions over the turn of the days in swing trade, long-tem trade, system trade or others. Also depending on the situation or monetary policy of each country plus swap until then may turn into minus. When you actually trade, check the swap point in real time by using swap calculator.

You can conduct swap trade with relatively small amount of margin by using high leverage specialized with XM. However if the amount of margin is extremely small, even a small change in the FX market may cause forced loss cut. Therefore when you conduct long-term swap trade, you need to invest your funds with reasonable allowance in order to withstand rapid change of the rate.

As emerging countries' currencies with high interest rates especially have high volatility, if the account balance goes below required margin, loss cut occurs and as the result you may suffer the bigger loss than the swap points you have earned. Even though you have earned lots of swap points, if you have unrealized loss, it does not make sense. So it is recommendable that you have sufficient margin in your account.

XM's swap points can be checked with MetaTrader 4 (MT4)/MetaTrader 5 (MT5) or 'Swap calculator' provided by XM.

With XM you can check swap points of each description with MT4/MT5 specialized for XM. How to check swap points with MT4/MT5 is as follows:

After you activate XM's MT4/MT5, show 'Indicative price indication' screen. Right click currency pair you wish to check on Indicative price indication screen, choose 'Sprcification.' If Indicative price indication screen is not shown, click 'Indication' from MT4/MT5 menu and activate 'Indicative price indication.'

Once you see the trading conditions screen, scroll to the bottom. You will see the points of 'Purchase swap' and 'Sales swap' of said currency pair.

Swap points arising while you have not settled positions can be checked in 'Trading' tab in 'Terminal' of XM's MetaTrader 4 (MT4)/MetaTrader 5 (MT5). Receipt or Payment of swap points will be reflected as unrealized profit and loss in the calculation of your equity as well as FX profit and loss.

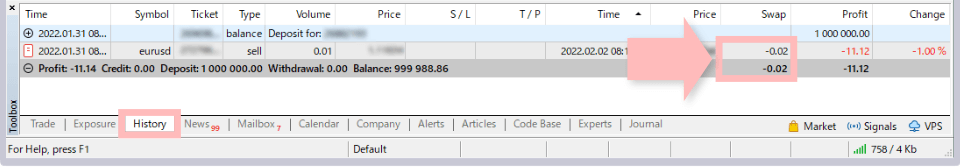

Swap points given after the position is settled can be checked on 'Account history' tab in 'Terminal' of XM's MT4/MT5. Swap points while you hold positions are calculated as unsettled profit and loss, the result will be fixed at the time of position settled and reflected in the account balance.

Where can I check swap points arising with XM?

You can check swap points arising from trades with XM in 'Terminal' of MetaTrader4 (MT4)/MetaTrader5 (MT5). Unsettled swap points are checked on 'Trade' tab and settled positions are checked on 'account history' tab.

2022.01.31

3 days swap points are arising in XM. Why is that?

As FX market generally has two days for settlement from the deal done, when you hold position from Wednesday to Thursday with XM, 3 day swap points including weekends (Saturday and Sunday) arise. For your information, not only earnings from plus swap but also loss from minus swap will become 3 times than other days.

2022.01.31

Tell me about XM's CFD swap points.

Swap points arise from cash CFDs of stock index or precious metal with XM, however swap points do not apply to future CFDs such as commodity future CFDs or energy future CFDs. Future CFDs are included in some of precious metals or stock indices. Please check.

2022.01.31

XM's swap points arise also on cross trade?

Yes, swap points also arise in cross trade with XM. However the total swap points of cross trade are intentionally set in minus in value. As the result, cross trade transaction aiming for swap points bears unrealized loss. So please be noted.

2022.01.31

Tell me how to calculate XM's swap points.

XM's swap points can be calculated through '(contract size × number of decimal places) × number of lots (trade volume) × swap value (buy/sell).' For your information, swap points are denominated in settlement currency.

2022.01.31