XM™|How to open the FX account.

Apart from Forex instruments such as Commodities, Equity Indices, Precious Metals, Energies, Cryptocurrencies and Stock CFDs can be traded on CFDs. Among others, GOLD which belongs to Precious Metals family has the popularity for many traders from its high volatility.

GOLD trade with XM is also available on the same trading tool as FX (MT4/MT5 or Webtrader). In addition, maximum 1:1,000 leverage is also available, therefore inexperienced person for GOLD trade can start trading with the same feeling with FX. This is the feature of GOLD trade.

Explanation for instruments of XM

GOLD which XM deals with is the precious metal, GOLD which has a rare value as metal. The demand is also high as the investment object and its correlation with Forex market is well known. As GOLD is finite and its demand is high, it is a real asset where the price hardly declines even in a recession period and many investors carefully watch the trend. It is often referred as 'GOLD as a safe heaven' in a risk-off market such as economic crisis.

GOLD is also used as a criteria for risk appetite of market participants as GOLD is sensitive to its risk-off atmosphere. For example, when long position of GOLD is predominant in its position ratio, the feeling of market participants is favor for risk-on.

Gold has high liquidity and the average range of the day (difference of highest and lowest price) is about USD 20.00. When the movement is slow, the range would be within about USD 10.00, still though when the movement becomes hectic, the range may become more than USD 50.00. Even in the hectic market, there will not be any requote (or rejection) of the price with XM.

As is shown in the table below, GOLD stands out for its high volatility compared with GBP/JPY which is popular for its high volatility among Forex. This high volatility is the feature is one of the reasons why GOLD is popular for the traders who favor short-term trades.

| Average range (*) | Volatility | |

| GOLDUSD | 20.0 USD(200pips) | 1.10% |

| USDJPY | 0.7 JPY(70pips) | 0.60% |

| EURJPY | 0.8 JPY(80pips) | 0.60% |

| GBPJPY | 1.3 JPY(130pips) | 0.80% |

| GOLDUSD | |

| Average range* | 20.0 USD (200pips) |

| Volatility | 1.10% |

| USDJPY | |

| Average range | 0.7 JPY (70pips) |

| Volatility | 0.60% |

| EURJPY | |

| Average range | 0.8 JPY (80pips) |

| Volatility | 0.60% |

| GBPJPY | |

| Average range | 1.3 JPY (130pips) |

| Volatility | 0.80% |

Average range = highest price - lowest price

The unit used for FX trading is the 'pip.' (Plural form is 'pips.')For GOLD the 1 pip in FX is equal to 0.1 dollars. Normally GOLD price denominated in US dollars is expressed in 2 decimal places (ex. 1792.67 USD). The figure in first decimal place shown in red is the rough standard of 1 pip.

GOLD has about USD 20.00 range per day, therefore the range will be USD 20.00 = 200 pips. It is quite rare that major Forex move 200 pips per day, so you will be impressed by a high volatility of GOLD.

XM has required a high reputation from many clients as there are plenty of advantages which other brokerage houses do not have. Whoever opens an account and deposit funds into the account can start trade GOLD with maximum 1:1,000 leverage.

XM allows you to trade GOLD with the same maximum leverage 1:1,000 as FX. GOLD trade is available even with minimal amount of margin, so it is possible to earn money speculatively in scalping trade. Also for who does not use high leverage can do with small amount of required margin, so you can trade GOLD with wide range of strategies such as pyramiding with multiple entries.

Explanation of required margin for GOLD trading

XM realizes top-level high execution power among others also in GOLD trading. Even though GOLD has wide range of price movements, 99% of all the orders will be executed within 1 second and there is no requote. Even when the market moves rapidly, you can trade with ease. Also traders who feel stress about the execution speed for a large size trade can concentrate GOLD trade without stress with XM.

GOLD can be traded from 0.01 lot in any of the accounts, Standard Account, Micro Account, XM Ultra Low Account Standard and XM Ultra Low Account Micro. When you trade GOLD first time, many of you are surprised how big the volatility of GOLD. GOLD requires accurate strategies on the spot as it moves quickly in a short time and it is quite difficult to keep generating profits from short-term trades. However XM allows you to trade with minimum 0.01 lot, therefore you can experience the dynamism of GOLD trade with the limited risk.

For your information, maximum leverage and number of trade units vary depending on the account types. So please be noted.

| Standard Account | Micro Account | XM Ultra Low Account Standard |

XM Ultra Low Account Micro |

|

| Maximum leverage | 1:1,000 | |||

| Value of 1 lot | 1 lot = 100 oz | 1 lot = 1 oz | 1 lot = 100 oz | 1 lot = 1 oz |

| Minimum trade volume | 0.01 lot = 1 oz | 0.1 lot = 0.1 oz | 0.01 lot = 1 oz | 0.1 lot = 0.1 oz |

| Commission (on one side) | Not available | |||

| Instrument symbol | GOLD | GOLDmicro | GOLD# | GOLDm# |

| XM points given | Available | |||

| Standard Account | |

| Maximum leverage | 1:1,000 |

| Value of 1 lot | 1 lot =100 oz |

| Minimum trade volume |

0.01 lot =1 oz |

| Commission (on one side) |

Not available |

| Instrument symbol | GOLD |

| XM points given | Available |

| Micro Account | |

| Maximum leverage | 1:1,000 |

| Value of 1 lot | 1 lot = 1 oz |

| Minimum trade volume |

0.1 lot = 0.1 oz |

| Commission (on one side) |

Not available |

| Instrument symbol | GOLDmicro |

| XM points given | Available |

| XM Ultra Low Account Standard | |

| Maximum leverage | 1:1,000 |

| Value of 1 lot | 1 lot = 100 oz |

| Minimum trade volume |

0.01 lot = 1 oz |

| Commission (on one side) |

Not available |

| Instrument symbol | GOLD# |

| XM points given | Available |

| XM Ultra Low Account Micro | |

| Maximum leverage | 1:1,000 |

| Value of 1 lot | 1 lot = 1 oz |

| Minimum trade volume |

0.1 lot = 0.1 oz |

| Commission (on one side) |

Not available |

| Instrument symbol | GOLDm# |

| XM points given | Available |

Explanation of account types of XM

Trading unit of GOLD

GOLD trading is based on the unit, troy ounce (symbol is oz) which is used as a unit to weigh precious metals or precious stones.

When 1 oz is converted into grams, 1 oz will be about 31.1 grams. Gold is traded based on the price denominated in US dollars per oz.

Example)

XM points (XMP) applicable in Standard Account, Micro Account, XM Ultra Low Account Standard and XM Ultra Low Account Micro can also be obtained from GOLD trade depending on the trading volume.

XM Points can be obtained per 1 lot (GOLD 100 oz) round-trip in Standard Account same as Forex and upto 20 XMP (XM Points) per 1 lot.

3 XMP can also be exchanged into USD 1 worth of credit, therefore you can earn maximum about USD 6 dollars worth of trading bonus for GOLD 1 lot trade.

GOLD can be traded with the maximum leverage of 1:1,000 same as FX with XM. GOLD trade is basically denominated in US dollars, therefore in order to work out the required margin for GOLD trade, you need to take USD/JPY price into consideration as well as GOLD price.

For example, when 1 oz of GOLD is US dollars 1,800 and USD/JPY = 110.00, the required margin to trade 1 oz GOLD with 1:1,000 leverage would be as follows:

If the account is in US. Dollars:

USD 1,800 decided by 1,000

= about US 1.80.

XM Standard Account requires 100 oz for 1 lot GOLD, therefore the required margin for 1 lot GOLD to trade is as follows:

Required margin for GOLD 1 lot (100 oz) in USD account is: USD 180

The table below shows that; required margin for 1 lot with 1:1,000 leverage by instruments in Standard Account.

| Price(*1) | Required Margin(*2) | |

| GOLDUSD | 1,786.65 USD | 178.67 USD |

| USDJPY | 133.21 JPY | 100.00 USD |

| EURJPY | 136.82 JPY | 101.60 USD |

| GBPJPY | 162.13 JPY | 120.36 USD |

| GOLDUSD | |

| Price(*1) | 1,786.65 USD |

| Required Margin(*2) | 178.67 USD |

| USDJPY | |

| Price | 133.21 JPY |

| Required Margin | 100.00 USD |

| EURJPY | |

| Price | 136.82 JPY |

| Required Margin | 101.60 USD |

| GBPJPY | |

| Price | 162.13 JPY |

| Required Margin | 120.36 USD |

By utilizing 1:1,000 leverage in GOLD trade, you can start 1 lot trade with just about USD 200 margin. If you use Micro Account, you can experience dynamic GOLD trade even with a smaller margin.

The important feature in GOLD trade with XM is that GOLD trade bears minus swap points both in selling and buying position. Even when you have selling position (short) or buying position (long), minus swap points arise in roll over (carrying position in the overnight).

There are 2 ways to check the swap points: either to use 'Swap Calculation Tool' in FX calculation tool or to check through MT4/MT5.

How to use Swap Calculation Tool

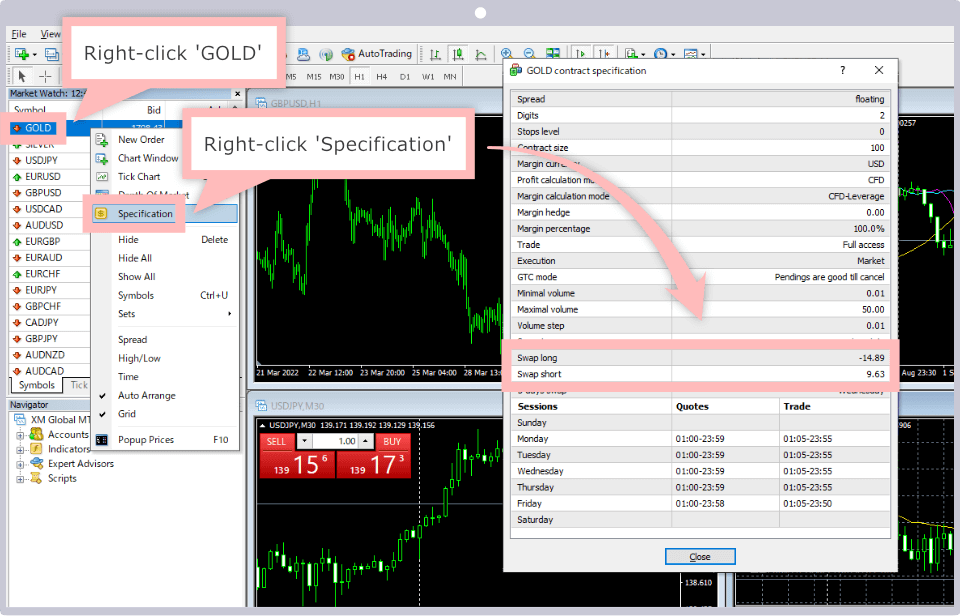

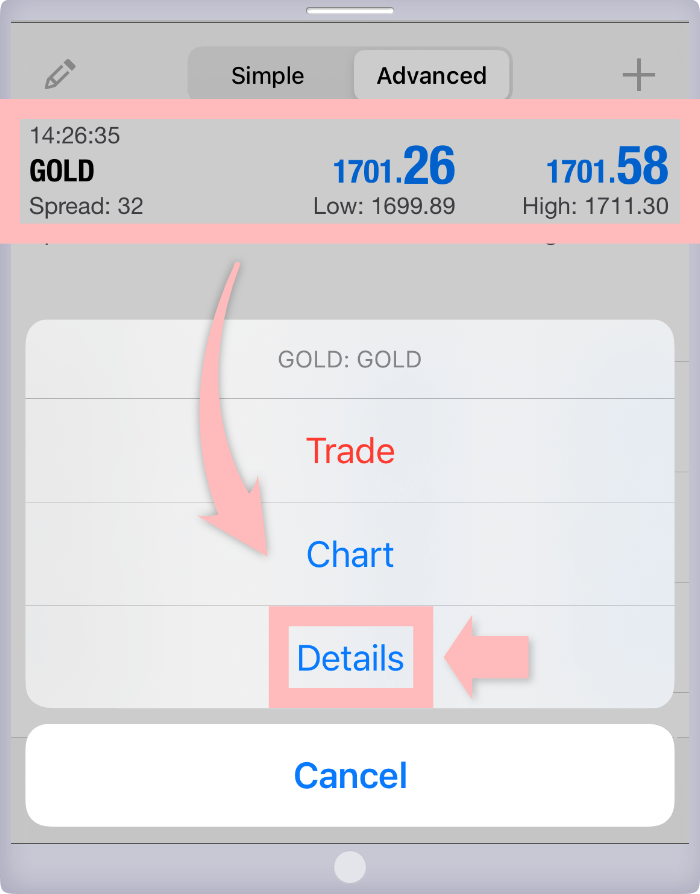

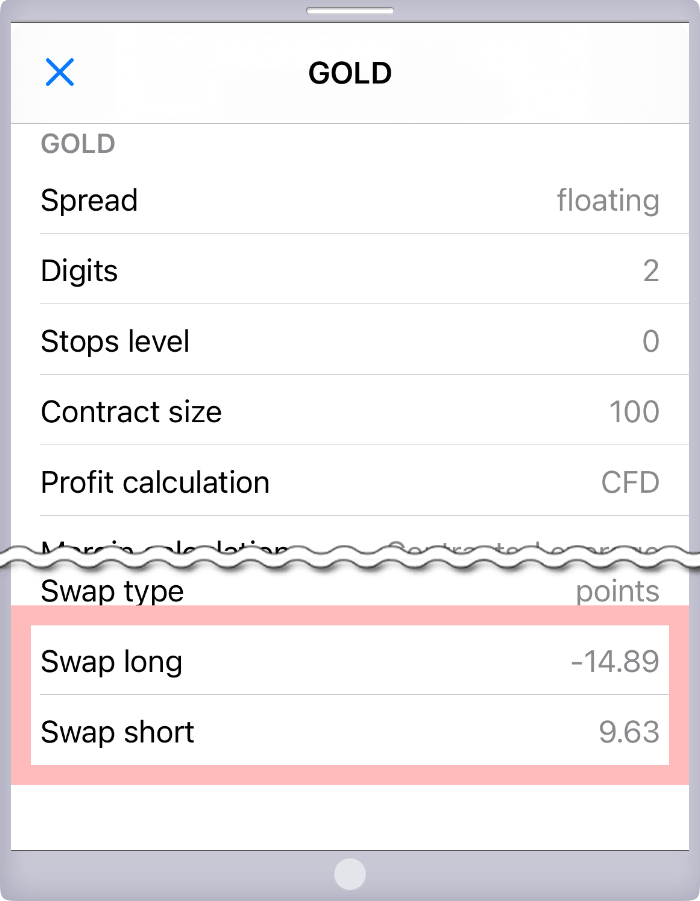

In order to check the swap points of GOLD from MT4/MT5, right-click 'GOLD' on 'Indicative price indication screen,' then open 'Details' screen on 'Specification' in the Menu. GOLD swap points on MT4/MT5 are denominated in US dollars.

Average spread of GOLD on Standard Account is 3.5 pips with XM. The spread of GOLD is about 2 times compared with popular USDJPY or EURJPY in FX, still though it is about the same spread level as GBPJPY popular for its high volatility. The conversion rates are moving all the time.

| Instruments | Price | Standard Account | Micro Account | XM Standard Ultra Low Account |

XM Micro Ultra Low Account |

|---|---|---|---|---|---|

| GOLD | 1,800USD | pips | pips | pips | pips |

| USDJPY | 138 JPY | pips | pips | pips | pips |

| EURJPY | 138 JPY | pips | pips | pips | pips |

| GBPJPY | 161 JPY | pips | pips | pips | pips |

| GOLD | |

| Price | 1,800USD |

| Standard Account | pips |

| Micro Account | pips |

| XM Standard Ultra Low Account |

pips |

| XM Micro Ultra Low Account |

pips |

| USDJPY | |

| Price | 138 JPY |

| Standard Account | pips |

| Micro Account | pips |

| XM Standard Ultra Low Account |

pips |

| XM Micro Ultra Low Account |

pips |

| EURJPY | |

| Price | 138 JPY |

| Standard Account | pips |

| Micro Account | pips |

| XM Standard Ultra Low Account |

pips |

| XM Micro Ultra Low Account |

pips |

| GBPJPY | |

| Price | 161 JPY |

| Standard Account | pips |

| Micro Account | pips |

| XM Standard Ultra Low Account |

pips |

| XM Micro Ultra Low Account |

pips |

Though GOLD and GBPJPY and others are suitable for scalping for its large volatility, it is recommendable for medium to long-term trade taking the large spread into consideration.

GOLD trading hours with XM are different from ordinary GOLD trading hours. As rollover takes place on the change of day of week, there is the interruption of 70 minutes. You will not be able to trade for those 70 minutes, please be noted. Also the market closes 5 minutes earlier only on Friday than other weekdays.

| GMT+2 time zone (GMT+3 in summer time) |

| 01:05 - 23:55 (23:50 only on Friday) |

For your information, the time shown on MT4/MT5 is GMT+3 for summer time and GMT+2 for winter time. Please be noted.

Once you completed the account opening procedure and personal identification, you can start trading immediately. Clients who have already completed to open an account can choose GOLD instrument from Indicative Price Screen on MT4/MT5. You can take the same procedures as FX.

If you have not opened the trading account of XM yet, you can open it from here. Application procedure will be completed within about 5 minutes and you can start trading of GOLD as early as 30 minutes.

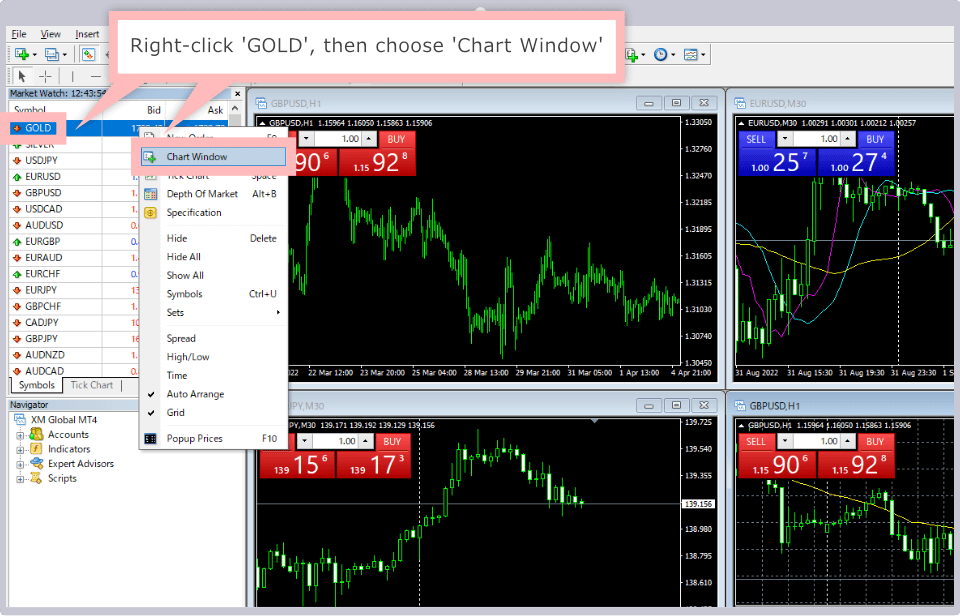

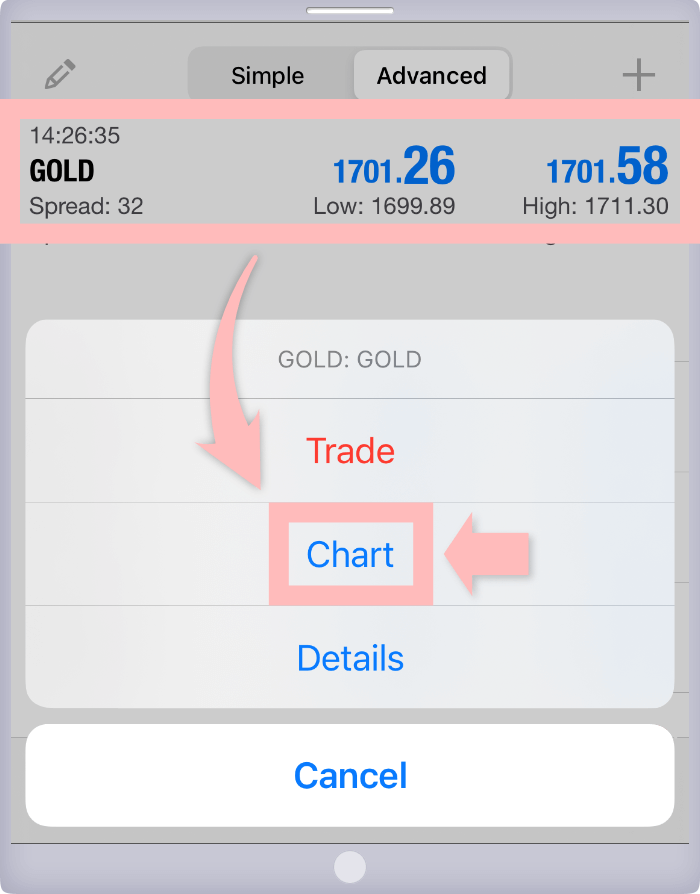

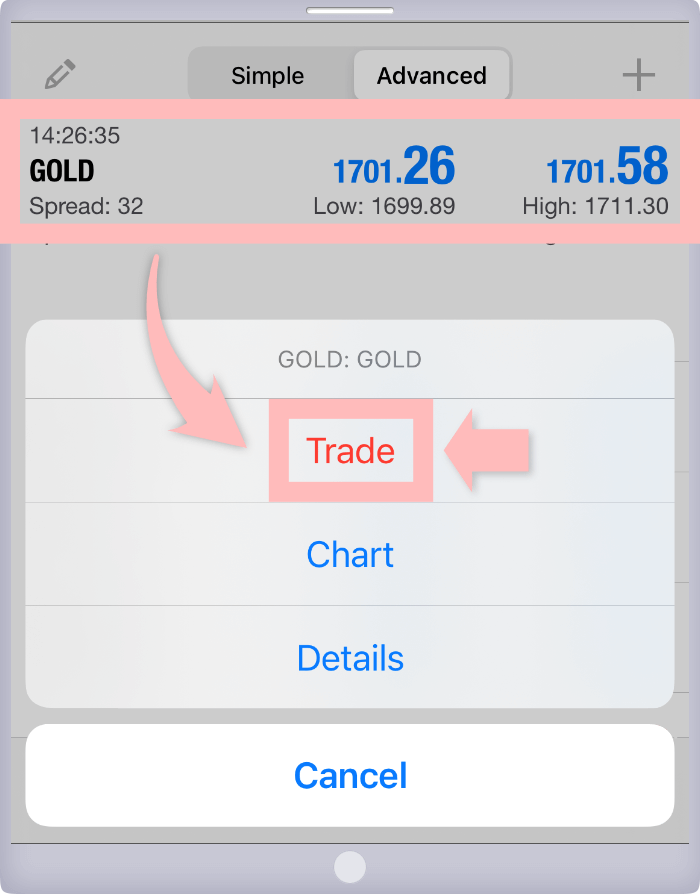

In order to show GOLD chart on MT4/MT5, right-click instrument, 'GOLD' on Indicative Price Indication Window, then click 'Chart Window (*).'

Click 'Show Chart' on MT4

You have alternative ways to open GOLD chart on MT4/MT5 apart from the way above, which is, Select 'New Chart' from 'File' menu, or drag the instrument symbol of 'GOLD' from 'Indicative Price Indication' screen to an existing chart screen and drop.

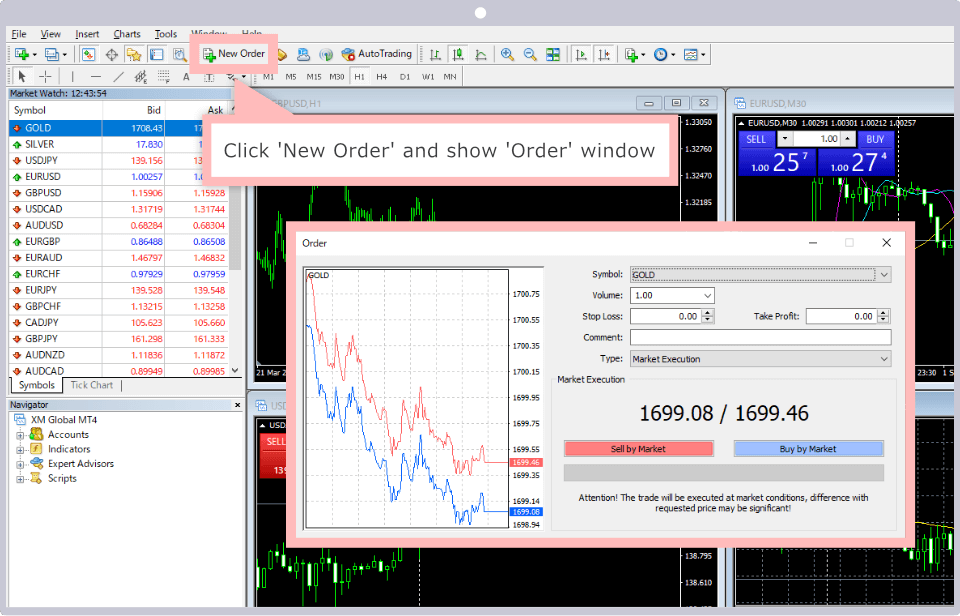

If you want to place a new order of GOLD from MT4/MT5, click 'New Order' on Tool Bar, then place an order from 'Order' window.

Apart from above, there is also ways to place new orders where you choose 'New Order' from 'Tool' menu, use 'Trading Panel' on top left of chart (One click trading) or double-click instrument symbol, 'GOLD' on 'Indicative Price Indication' window.

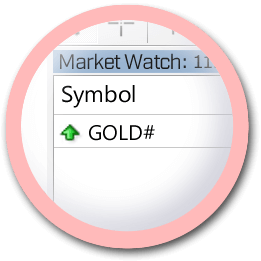

Each account type uses different instrument symbol on MT4/MT5 with XM.

Standard Account

Micro Account

Ultra Low Account Standard

Ultra Low Account Micro

Standard Account

Micro Account

Ultra Low Account Standard

Ultra Low Account Micro

Symbol name of GOLD on Standard Account is just shown as it is, on Micro Account it is shown with the name micro as (GOLDmicro), on XM Ultra Low Account Standard with the sign, # as (GOLD#) and on XM Ultra Low Account Micro with the sign m and #, (GOLDm#).

Tell me about the swap points of GOLD trading with XM.

Minus swap points will arise for both selling and buying positions of GOLD carried over with XM. Swap points are checked through 'Specification' or 'Calculation Tool of XM' on MT4/MT5.

2022.08.31

Is XM Point Program applicable for GOLD trading?

Yes, XM Point (XMP) can be earned by trading volume of Precious Metal CFD GOLD of XM. For your information, XM Points you can earn are fixed at your Loyalty Status and the limit is maximum 20 XMP per lot.

2022.08.31

What is the advantage of GOLD trading with XM?

The advantages of XM GOLD trading are that the maximum leverage 1:1,000 is available as well as minimum trading unit is 0.01 and you can enjoy dynamic trading with the risk limited. Also GOLD is available on the same account and trading tool as FX, therefore it is quite easy for beginners to trade.

2022.08.31

Tell me about the trading hours of GOLD with XM

Trading hours of GOLD with XM is from 01:05 to 23:55 (close on Friday at 23:50) in GMT+2 time zone. Friday close is 5 minutes earlier than other weekdays. So please be noted.

2022.08.31

Is there any limit on leverage for GOLD trade with XM?

No, leverage limit on GOLD is the same as FX and maximum 1:1,000. Therefore it is quite easy for beginners to start trading volatile GOLD with minimal margin.

2022.08.31