XM™|How to open the FX account.

XM offers various instruments such as Forex, CFD instruments and others. When you trade these instruments, it is very important to know how much margin you need to prepare actually or how to calculate the required margin for each instrument. When you refer to 'List of required margin for all the instruments' XM offers, you will see the minimum threshold of margin to start trading at a first glance.

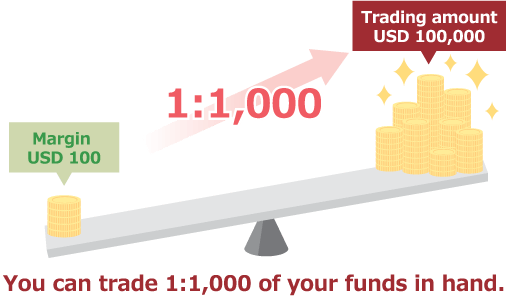

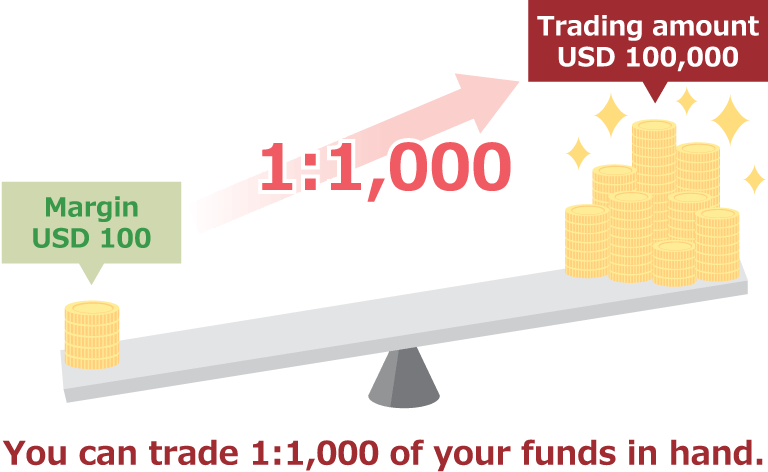

Traders who do not have enough funds to start trading and still wish to trade in a big size can utilize maximum 1:1,000 high leverage which is one of the attractiveness of XM. You can trade with minimal margin by using maximum 1:1,000 leverage of XM.

![]()

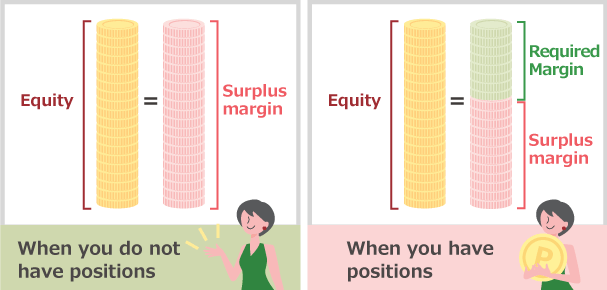

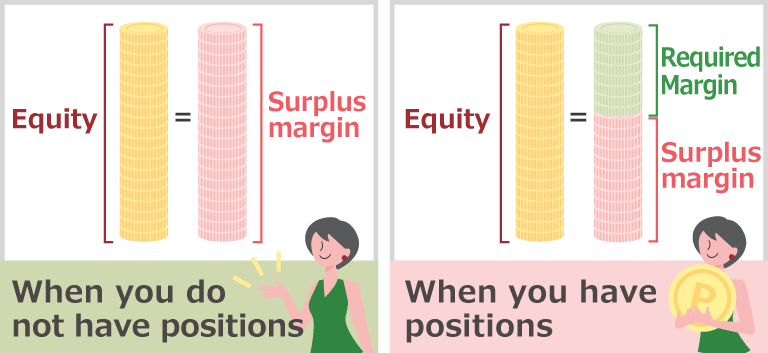

Margin refers to the minimum amount of funds you need to prepare for the minimum amount of trade, and you can trade based on this margin. Therefore if you do not have sufficient margin, you cannot have a new position. Furthermore, if you falls in a situation of lack of margin due to rapid market movement, you may need to close (settle) your position. In order to avoid this to happen, it is recommendable that you have enough margin in your account and manage your funds.

It is possible to open a new position only when you have 'surplus margin than required margin' in any case for all the instruments XM offers. Also when you hold the same lots of position on both sides in cross trade, the required margin for both sides trade in Forex, GOLD and SILVER will become zero, so you will be able to hold the position even when your margin level is below 100% without minding it. For other instruments the required margin will not become zero for cross trade and you will need to keep one side worth of margin. For your information, even on the cross trade you can have new position only when you have 'surplus equity than required margin.'

Margin and leverage have close relationship and high leverage can make you start to trade with minimal margin. For example, when USD 1 = € 1 in EUR/USD and you want to trade EUR 10,000 (0.1 lot), you need to have USD10,000 in your account by simple arithmetic. However if you trade by using 1:100 leverage, you only need to have USD 100, and by using 1:1,000 leverage, only USD 10.

As XM deploys a broad range of leverage such as 1:1 to 1:1,000, required margin for 0.1 lot trade will vary depending on the leverage you choose. You can conduct a big trade with minimal margin by using high leverage specialized with XM.

| Leverage | Required Margin |

| 1:1,000 | 10USD |

| 1:888 | 11.26USD |

| 1:500 | 20USD |

| 1:100 | 100USD |

| 1:50 | 200USD |

XM also has a leverage limitation depending on the balance of the margin in the account. Which means, when the equity in your account goes below a certain level, the leverage will be pulled down as follows:

| equity | Maximum leverage |

| $5~$40,000 | 1:1000 |

| $40,001~$80,000 | 1:500 |

| $80,001 ~$200,000 |

1:200 |

| more than $200,001 |

1:100 |

If you have multiple trading accounts with XM, the leverage will be limited when aggregated amount of all accounts' equity goes above USD 20,000, however not the equity of each account. So please be noted. For your information, when the equity goes below USD 20,000, then the limitation will be released and 1:1,000 leverage will become available once again.

Apart from above limitation, there are certain instruments which are under fixed leverage ratio. So please refer to the details of equity or leverage limitation by instrument, here in this page.

There may be the cases where equity becomes minus when market moves rapidly, the loss cut is failed to be conducted in time and the margin balance goes below zero and becomes minus while you trade by utilizing high leverage which is the strongest attractiveness of XM.

However you do not have to bear the minus balance as XM deploys Negative Balance Protection which averts the client from additional margin call. Minus balance will be reset on the next deposit paid-in and the deposit will be reflected in your account in full. Clients do not have to pay additional margin and do not have to bear the loss more than the account balance (deposit). So you can trade at ease.

For your information, the criteria of forced settlement timing are 'margin level' which can be calculated through below formula.

Margin level (%)

= equity/required margin * 100

When margin level goes below 20%, the forced settlement will be exercised with XM. However before that, when margin level goes below 50%, margin call will be exercised. Therefore it is advisable to take measures such as increase margin by additional deposit, settle some of the positions or others in order to avoid forced settlement.

What is additional margin call?

Additional margin call refers to the additional deposit for margin when the account balance becomes less than the required amount. As XM deploys Negative Balance Protection, you do not have to be bothered by depositing additional margin even when the account balance becomes minus.

How to calculate required margin for Forex XM offers is as follows:

Trading amount/leverage*current rate (*) = required margin

Suppose you trade 0.01 lot (= unit currency 1,000) in EUR/USD in Standard account when € 1 =USD 1. The amount of required margin for this position will be calculated in the formula below:

Unit currency1,000/1:1,000 * USD 1 = USD 1

For your information, there are some Forex which are under the leverage limitation. While unit amount of currency per lot in Standard Account and XM Ultra Low Account Standard will be 100,000, on the other hand, it will be 1,000 unit in Micro Account and XM Ultra Low Account Micro. So please be noted.

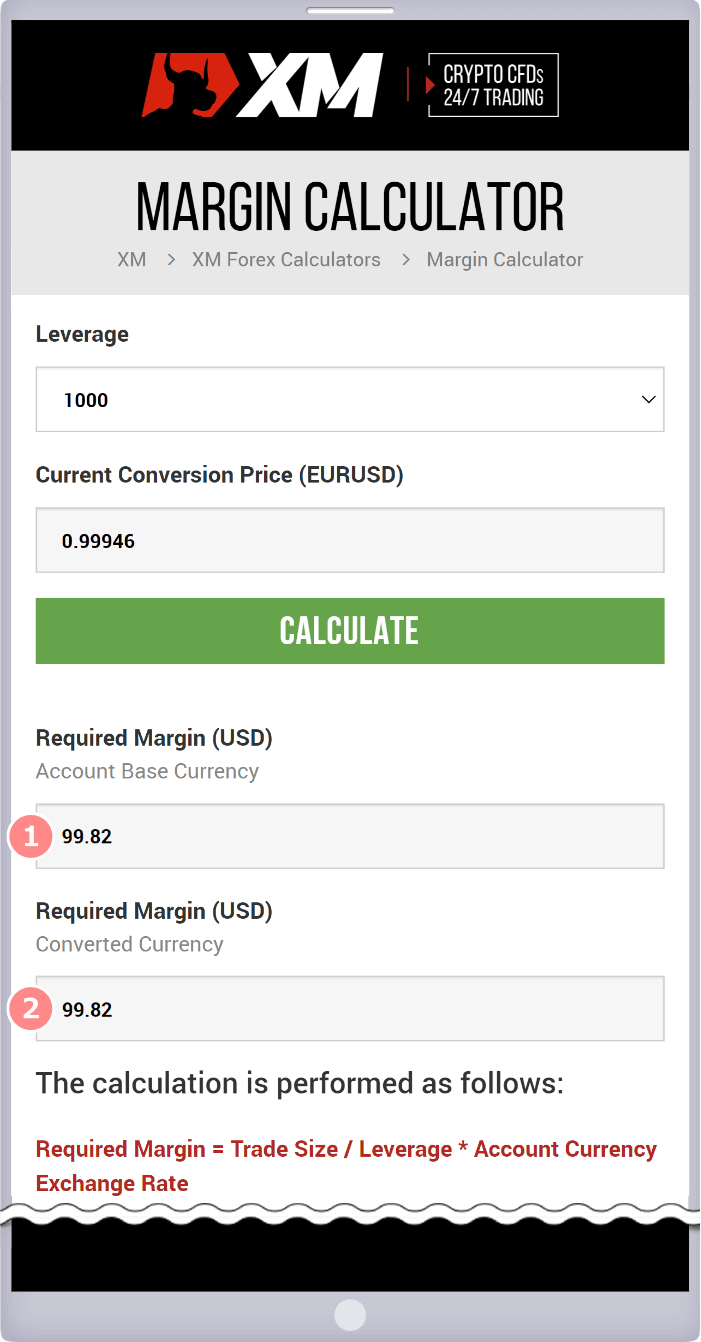

XM prepares "XM trading calculator" for Forex in order for you not to be bothered by calculating the margin ratio manually. By using this "XM trading calculator" anybody can calculate the required margin easily. Those who want to know how to use the trading calculator of XM in details, please see below.

The conversion rates are moving all the time.

List of required margin for all Forex and required margin per lot XM offers are below. For required margin of XM Micro Account, please read the margin below by 1/100.

| Currency Pair |

Leverage | Required Margin |

| EURUSD | 1:1,000 | USD |

| GBPUSD | 1:1,000 | USD |

| USDJPY | 1:1,000 | USD |

| USDCHF | 1:400 | USD |

| AUDUSD | 1:1,000 | USD |

| AUDCAD | 1:1,000 | USD |

| AUDCHF | 1:400 | USD |

| AUDJPY | 1:1,000 | USD |

| AUDNZD | 1:1,000 | USD |

| CADJPY | 1:1,000 | USD |

| CADCHF | 1:400 | USD |

| CHFJPY | 1:400 | USD |

| CHFSGD | 1:400 | USD |

| EURAUD | 1:1,000 | USD |

| EURCAD | 1:1,000 | USD |

| EURCHF | 1:400 | USD |

| EURDKK | 1:50 | USD |

| EURGBP | 1:1,000 | USD |

| EURHKD | 1:50 | USD |

| EURHUF | 1:1,000 | USD |

| EURJPY | 1:1,000 | USD |

| EURNOK | 1:1,000 | USD |

| EURPLN | 1:1,000 | USD |

| EURSEK | 1:1,000 | USD |

| EURSGD | 1:1,000 | USD |

| EURTRY | 1:100 | USD |

| EURZAR | 1:1,000 | USD |

| GBPAUD | 1:1,000 | USD |

| GBPCAD | 1:1,000 | USD |

| GBPCHF | 1:400 | USD |

| GBPDKK | 1:50 | USD |

| GBPJPY | 1:1,000 | USD |

| EURNZD | 1:1,000 | USD |

| GBPSGD | 1:1,000 | USD |

| GBPNOK | 1:1,000 | USD |

| GBPNZD | 1:1,000 | USD |

| GBPSEK | 1:1,000 | USD |

| NZDCAD | 1:1,000 | USD |

| NZDCHF | 1:400 | USD |

| NZDJPY | 1:1,000 | USD |

| NZDSGD | 1:1,000 | USD |

| NZDUSD | 1:1,000 | USD |

| SGDJPY | 1:1,000 | USD |

| USDCAD | 1:1,000 | USD |

| USDDKK | 1:50 | USD |

| USDHKD | 1:50 | USD |

| USDHUF | 1:1,000 | USD |

| USDMXN | 1:1,000 | USD |

| USDNOK | 1:1,000 | USD |

| USDPLN | 1:1,000 | USD |

| USDSEK | 1:1,000 | USD |

| USDSGD | 1:1,000 | USD |

| USDTRY | 1:100 | USD |

| USDZAR | 1:1,000 | USD |

| USDCNH | 1:50 | USD |

| Currency Pair |

Leverage | Required Margin |

| EURUSD | 1:1,000 | USD |

| GBPUSD | 1:1,000 | USD |

| USDJPY | 1:1,000 | USD |

| USDCHF | 1:400 | USD |

| AUDUSD | 1:1,000 | USD |

| AUDCAD | 1:1,000 | USD |

| AUDCHF | 1:400 | USD |

| AUDJPY | 1:1,000 | USD |

| AUDNZD | 1:1,000 | USD |

| CADJPY | 1:1,000 | USD |

| CADCHF | 1:400 | USD |

| CHFJPY | 1:400 | USD |

| CHFSGD | 1:400 | USD |

| EURAUD | 1:1,000 | USD |

| EURCAD | 1:1,000 | USD |

| EURCHF | 1:400 | USD |

| EURDKK | 1:50 | USD |

| EURGBP | 1:1,000 | USD |

| EURHKD | 1:50 | USD |

| EURHUF | 1:1,000 | USD |

| EURJPY | 1:1,000 | USD |

| EURNOK | 1:1,000 | USD |

| EURPLN | 1:1,000 | USD |

| EURSEK | 1:1,000 | USD |

| EURSGD | 1:1,000 | USD |

| EURTRY | 1:100 | USD |

| EURZAR | 1:1,000 | USD |

| GBPAUD | 1:1,000 | USD |

| GBPCAD | 1:1,000 | USD |

| GBPCHF | 1:400 | USD |

| GBPDKK | 1:50 | USD |

| GBPJPY | 1:1,000 | USD |

| EURNZD | 1:1,000 | USD |

| GBPSGD | 1:1,000 | USD |

| GBPNOK | 1:1,000 | USD |

| GBPNZD | 1:1,000 | USD |

| GBPSEK | 1:1,000 | USD |

| NZDCAD | 1:1,000 | USD |

| NZDCHF | 1:400 | USD |

| NZDJPY | 1:1,000 | USD |

| NZDSGD | 1:1,000 | USD |

| NZDUSD | 1:1,000 | USD |

| SGDJPY | 1:1,000 | USD |

| USDCAD | 1:1,000 | USD |

| USDDKK | 1:50 | USD |

| USDHKD | 1:50 | USD |

| USDHUF | 1:1,000 | USD |

| USDMXN | 1:1,000 | USD |

| USDNOK | 1:1,000 | USD |

| USDPLN | 1:1,000 | USD |

| USDSEK | 1:1,000 | USD |

| USDSGD | 1:1,000 | USD |

| USDTRY | 1:100 | USD |

| USDZAR | 1:1,000 | USD |

| USDCNH | 1:50 | USD |

| Currency Pair |

Leverage | Required Margin |

| EURUSD | 1:1,000 | USD |

| GBPUSD | 1:1,000 | USD |

| USDJPY | 1:1,000 | USD |

| USDCHF | 1:400 | USD |

| AUDUSD | 1:1,000 | USD |

| AUDCAD | 1:1,000 | USD |

| AUDCHF | 1:400 | USD |

| AUDJPY | 1:1,000 | USD |

| AUDNZD | 1:1,000 | USD |

| CADJPY | 1:1,000 | USD |

| CADCHF | 1:400 | USD |

| CHFJPY | 1:400 | USD |

| CHFSGD | 1:400 | USD |

| EURAUD | 1:1,000 | USD |

| EURCAD | 1:1,000 | USD |

| EURCHF | 1:400 | USD |

| EURDKK | 1:50 | USD |

| EURGBP | 1:1,000 | USD |

| EURHKD | 1:50 | USD |

| EURHUF | 1:1,000 | USD |

| EURJPY | 1:1,000 | USD |

| EURNOK | 1:1,000 | USD |

| EURPLN | 1:1,000 | USD |

| EURSEK | 1:1,000 | USD |

| EURSGD | 1:1,000 | USD |

| EURTRY | 1:100 | USD |

| EURZAR | 1:1,000 | USD |

| GBPAUD | 1:1,000 | USD |

| GBPCAD | 1:1,000 | USD |

| GBPCHF | 1:400 | USD |

| GBPDKK | 1:50 | USD |

| GBPJPY | 1:1,000 | USD |

| EURNZD | 1:1,000 | USD |

| GBPSGD | 1:1,000 | USD |

| GBPNOK | 1:1,000 | USD |

| GBPNZD | 1:1,000 | USD |

| GBPSEK | 1:1,000 | USD |

| NZDCAD | 1:1,000 | USD |

| NZDCHF | 1:400 | USD |

| NZDJPY | 1:1,000 | USD |

| NZDSGD | 1:1,000 | USD |

| NZDUSD | 1:1,000 | USD |

| SGDJPY | 1:1,000 | USD |

| USDCAD | 1:1,000 | USD |

| USDDKK | 1:50 | USD |

| USDHKD | 1:50 | USD |

| USDHUF | 1:1,000 | USD |

| USDMXN | 1:1,000 | USD |

| USDNOK | 1:1,000 | USD |

| USDPLN | 1:1,000 | USD |

| USDSEK | 1:1,000 | USD |

| USDSGD | 1:1,000 | USD |

| USDTRY | 1:100 | USD |

| USDZAR | 1:1,000 | USD |

| USDCNH | 1:50 | USD |

| Currency Pair |

Leverage | Required Margin |

| EURUSD | 1:1,000 | USD |

| GBPUSD | 1:1,000 | USD |

| USDJPY | 1:1,000 | USD |

| USDCHF | 1:400 | USD |

| AUDUSD | 1:1,000 | USD |

| AUDCAD | 1:1,000 | USD |

| AUDCHF | 1:400 | USD |

| AUDJPY | 1:1,000 | USD |

| AUDNZD | 1:1,000 | USD |

| CADJPY | 1:1,000 | USD |

| CADCHF | 1:500 | USD |

| CHFJPY | 1:400 | USD |

| CHFSGD | 1:400 | USD |

| EURAUD | 1:1,000 | USD |

| EURCAD | 1:1,000 | USD |

| EURCHF | 1:400 | USD |

| EURDKK | 1:50 | USD |

| EURGBP | 1:1,000 | USD |

| EURHKD | 1:50 | USD |

| EURHUF | 1:1,000 | USD |

| EURJPY | 1:1,000 | USD |

| EURNOK | 1:1,000 | USD |

| EURPLN | 1:500 | USD |

| EURSEK | 1:500 | USD |

| GBPSGD | 1:500 | USD |

| EURSGD | 1:1,000 | USD |

| EURTRY | 1:100 | USD |

| EURZAR | 1:1,000 | USD |

| GBPAUD | 1:1,000 | USD |

| GBPCAD | 1:1,000 | USD |

| GBPCHF | 1:1,000 | USD |

| GBPDKK | 1:400 | USD |

| GBPJPY | 1:50 | USD |

| EURNZD | 1:1,000 | USD |

| GBPNOK | 1:1,000 | USD |

| GBPNZD | 1:1,000 | USD |

| GBPSEK | 1:1,000 | USD |

| NZDCAD | 1:1,000 | USD |

| NZDCHF | 1:400 | USD |

| NZDJPY | 1:1,000 | USD |

| NZDSGD | 1:1,000 | USD |

| NZDUSD | 1:1,000 | USD |

| SGDJPY | 1:1,000 | USD |

| USDCAD | 1:1,000 | USD |

| USDDKK | 1:50 | USD |

| USDHKD | 1:50 | USD |

| USDHUF | 1:1,000 | USD |

| USDMXN | 1:1,000 | USD |

| USDNOK | 1:1,000 | USD |

| USDPLN | 1:1,000 | USD |

| USDSEK | 1:1,000 | USD |

| USDSGD | 1:1,000 | USD |

| USDTRY | 1:100 | USD |

| USDZAR | 1:1,000 | USD |

| USDCNH | 1:50 | USD |

How to calculate required margin for Stock CFDs offers is as follows:

Number of lots * contract size * open price (*) /leverage

Leverage of Stock CFDs does not vary on account types or margin balance and is fixed per instrument.

Market are moving all the time.

The required margin for representative stocks among the stock CFDs offered by XMTrading as of the time this article was written is as follows.

| Instruments | Contract Size | Leverage | Required Margin |

| Alibaba | 10 | 1:20 | USD |

| Amazon | 10 | 1:20 | USD |

| Apple | 10 | 1:20 | USD |

| 10 | 1:10 | USD | |

| GeneralElec | 10 | 1:20 | USD |

| 10 | 1:20 | USD | |

| Microsoft | 10 | 1:20 | USD |

| Taiwan-Semiconductor | 10 | 1:66.7 | USD |

| Nestle | 10 | 1:10 | USD |

| Lloyds | 100 | 1:20 | USD |

| Barclays | 100 | 1:20 | USD |

| Unilever | 100 | 1:20 | USD |

| BayerAG | 10 | 1:10 | USD |

| BMW | 10 | 1:10 | USD |

| Daimler | 10 | 1:10 | USD |

| Siemens | 10 | 1:10 | USD |

| Contract Size |

Leverage | Required Margin |

| Alibaba | ||

| 10 | 1:20 | USD |

| Amazon | ||

| 10 | 1:20 | USD |

| Apple | ||

| 10 | 1:20 | USD |

| 10 | 1:10 | USD |

| GeneralElec | ||

| 10 | 1:20 | USD |

| 10 | 1:20 | USD |

| Microsoft | ||

| 10 | 1:20 | USD |

| Taiwan-Semiconductor | ||

| 10 | 1:66.7 | USD |

| Nestle | ||

| 10 | 1:10 | USD |

| Lloyds | ||

| 100 | 1:20 | USD |

| Barclays | ||

| 100 | 1:20 | USD |

| Unilever | ||

| 100 | 1:20 | USD |

| BayerAG | ||

| 10 | 1:10 | USD |

| BMW | ||

| 10 | 1:10 | USD |

| Daimler | ||

| 10 | 1:10 | USD |

| Siemens | ||

| 10 | 1:10 | USD |

How to calculate required margin for Equity Indices CFDs offers is as follows:

Number of lots * contract size * open price (*) /leverage

Leverage of Equity Indices CFDs does not vary on account types or margin balance and is fixed per instrument.

Market are moving all the time.

List of required margin for Equity Indices CFDs of XM per lot is as follows:

| Instruments | Leverage | Required Margin |

| AUS200Cash | 1:100 | USD |

| CA60Cash | 1:250 | USD |

| China50Cash | 1:250 | USD |

| ChinaHCash | 1:250 | USD |

| EU50Cash | 1:100 | USD |

| EU50 | 1:100 | USD |

| FRA40Cash | 1:100 | USD |

| FRA40 | 1:100 | USD |

| GER40Cash | 1:500 | USD |

| GER40 | 1:500 | USD |

| HK50Cash | 1:67 | USD |

| IT40Cash | 1:100 | USD |

| JP225Cash | 1:500 | USD |

| JP225 | 1:500 | USD |

| NETH25Cash | 1:100 | USD |

| SA40Cash | 1:400 | USD |

| Sing30Cash | 1:250 | USD |

| SPAIN35Cash | 1:100 | USD |

| SWI20Cash | 1:100 | USD |

| SWI20 | 1:100 | USD |

| UK100Cash | 1:500 | USD |

| UK100 | 1:500 | USD |

| US100Cash | 1:500 | USD |

| US100 | 1:500 | USD |

| US2000Cash | 1:250 | USD |

| US30Cash | 1:500 | USD |

| US30 | 1:500 | USD |

| US500Cash | 1:500 | USD |

| US500 | 1:500 | USD |

| USDX | 1:100 | USD |

| VIX | 1:100 | USD |

How to calculate required margin for Precious Metals CFD offers is as follows:

Number of lots * contract size * market price (*) /leverage

Margin required for GOLD and SILVER trade can be easily calculated by using trading calculator of XM. While leverages for GOLD and SILVER will be capped at 1:1,000 and vary depending on the balance of margin, leverages of PALL (Palladium) and PLAT (Platinum) are fixed at 1:22.2. So please be noted.

Market are moving all the time.

List of required margin for Precious Metals CFD of XM per lot is as follows:

| Instruments | Contract Size | Leverage | Required Margin |

| GOLD | 100oz | 1:1,000 | USD |

| SILVER | 5,000oz | 1:400 | USD |

| XAUEUR | 100oz | 1:1,000 | USD |

| PALL | 10toz | 1:22.2 | USD |

| PLAT | 10toz | 1:22.2 | USD |

| Contract Size |

Leverage | Required Margin |

| GOLD | ||

| 100oz | 1:1,000 | USD |

| SILVER | ||

| 5,000oz | 1:400 | USD |

| XAUEUR | ||

| 100oz | 1:1,000 | USD |

| PALL | ||

| 10toz | 1:22.2 | USD |

| PLAT | ||

| 10toz | 1:22.2 | USD |

| Instruments | Contract Size | Leverage | Required Margin |

| GOLD | 1oz | 1:1,000 | USD |

| SILVER | 50oz | 1:400 | USD |

| XAUEUR | 1oz | 1:1,000 | USD |

| PALL | 10toz | 1:22.2 | USD |

| PLAT | 10toz | 1:22.2 | USD |

| Contract Size |

Leverage | Required Margin |

| GOLD | ||

| 1oz | 1:1,000 | USD |

| SILVER | ||

| 50oz | 1:400 | USD |

| XAUEUR | ||

| 1oz | 1:1,000 | USD |

| PALL | ||

| 10toz | 1:22.2 | USD |

| PLAT | ||

| 10toz | 1:22.2 | USD |

| Instruments | Contract Size | Leverage | Required Margin |

| GOLD | 100oz | 1:1,000 | USD |

| SILVER | 5,000oz | 1:400 | USD |

| XAUEUR | 100oz | 1:1,000 | USD |

| PALL | 10toz | 1:22.2 | USD |

| PLAT | 10toz | 1:22.2 | USD |

| Contract Size |

Leverage | Required Margin |

| GOLD | ||

| 100oz | 1:1,000 | USD |

| SILVER | ||

| 5,000oz | 1:400 | USD |

| XAUEUR | ||

| 100oz | 1:1,000 | USD |

| PALL | ||

| 10toz | 1:22.2 | USD |

| PLAT | ||

| 10toz | 1:22.2 | USD |

| Instruments | Contract Size | Leverage | Required Margin |

| GOLD | 100oz | 1:1,000 | USD |

| SILVER | 5,000oz | 1:400 | USD |

| XAUEUR | 100oz | 1:1,000 | USD |

| PALL | 10toz | 1:22.2 | USD |

| PLAT | 10toz | 1:22.2 | USD |

| Contract Size |

Leverage | Required Margin |

| GOLD | ||

| 100oz | 1:1,000 | USD |

| SILVER | ||

| 5,000oz | 1:400 | USD |

| XAUEUR | ||

| 100oz | 1:1,000 | USD |

| PALL | ||

| 10toz | 1:22.2 | USD |

| PLAT | ||

| 10toz | 1:22.2 | USD |

How to calculate required margin for Energies CFD offers is as follows:

Number of lots * contract size * open price (*) /leverage

Leverages of energy CFDs vary depending on the instruments. The leverages of BRENT, OIL, OILMn are fixed at 1:66.7 and the leverages of GSOIL and NGAS are fixed at 1:33.3. So please be noted.

Market are moving all the time.

List of required margin for Energies CFD of XM per lot is as follows:

| Instruments | Contract Size | Leverage | Required Margin |

| BRENTCash | 100Barrels | 1:200 | USD |

| NGASCash | 1,000MMBtu | 1:200 | USD |

| OILCash | 100Barrels | 1:200 | USD |

| OIL | 100Barrels | 1:66.7 | USD |

| OILMn | 10Barrels | 1:66.7 | USD |

| NGAS | 1,000MMBtu | 1:33.3 | USD |

| BRENT | 100Barrels | 1:66.7 | USD |

| GSOIL | 4Tonnes | 1:33.3 | USD |

| Contract Size |

Leverage | Required Margin |

| BRENTCash | ||

| 100Barrels | 1:200 | USD |

| NGASCash | ||

| 1,000 MMBtu |

1:200 | USD |

| OILCash | ||

| 100Barrels | 1:200 | USD |

| OIL | ||

| 100Barrels | 1:66.7 | USD |

| OILMn | ||

| 10Barrels | 1:66.7 | USD |

| NGAS | ||

| 1,000 MMBtu |

1:33.3 | USD |

| BRENT | ||

| 100Barrels | 1:66.7 | USD |

| GSOIL | ||

| 4Tonnes | 1:33.3 | USD |

How to calculate required margin for Commodities CFD offers is as follows:

Number of lots * contract size * market price (*) /leverage

Leverages of commodity CFDs are common for all the instruments and are 1:50.

Market are moving all the time.

List of required margin for Commodities CFD of XM per lot is as follows:

| Instruments | Contract Size | Leverage | Required Margin |

| COTTO | 10,000LBS | 1:50 | USD |

| CORN | 400Bushels | 1:50 | USD |

| HGCOP | 2,000LBS | 1:50 | USD |

| SBEAN | 400Bushels | 1:50 | USD |

| SUGAR | 10,000LBS | 1:50 | USD |

| WHEAT | 400Bushels | 1:50 | USD |

| COCOA | 1Metric Ton | 1:50 | USD |

| COFFE | 10,000LBS | 1:50 | USD |

| Contract Size |

Leverage | Required Margin |

| COTTO | ||

| 10,000LBS | 1:50 | USD |

| CORN | ||

| 400Bushels | 1:50 | USD |

| HGCOP | ||

| 2,000LBS | 1:50 | USD |

| SBEAN | ||

| 400Bushels | 1:50 | USD |

| SUGAR | ||

| 10,000LBS | 1:50 | USD |

| WHEAT | ||

| 400Bushels | 1:50 | USD |

| COCOA | ||

| 1Metric Ton | 1:50 | USD |

| COFFE | ||

| 10,000LBS | 1:50 | USD |

How to calculate required margin for Cryptocurrency CFD offers is as follows:

Number of lots * contract size * open price (*) /leverage

Leverages of cryptocurrency CFDs vary depending on the instruments. You can trade Bitcoin, Ethereum, XRP and Litecoin with maximum 1:250 leverage and other altcoins can be traded with maximum 1:50 leverage. For your information, cryptocurrency CFDs deploy 'Dynamic margin' where required margin changes depending on the trading size.

Market are moving all the time.

List of required margin for Cryptocurrency CFD of XM per lot is as follows:

| Instruments | Contract Size | Leverage(*) | Required Margin |

| 1INCHUSD | 10000 | 1:50 | USD |

| AAVEUSD | 10 | 1:50 | USD |

| ADAUSD | 1000 | 1:50 | USD |

| ALGOUSD | 1000 | 1:50 | USD |

| APEUSD | 1000 | 1:50 | USD |

| APTUSD | 100 | 1:50 | USD |

| ARBUSD | 1000 | 1:50 | USD |

| ATOMUSD | 100 | 1:50 | USD |

| AVAXUSD | 10 | 1:50 | USD |

| AXSUSD | 100 | 1:50 | USD |

| BATUSD | 1000 | 1:50 | USD |

| BCHUSD | 10 | 1:250 | USD |

| BTCEUR | 1 | 1:250 | USD |

| BTCGBP | 1 | 1:250 | USD |

| BTCUSD | 1 | 1:250 | USD |

| BTGUSD | 1000 | 1:500 | USD |

| CHZUSD | 10000 | 1:50 | USD |

| COMPUSD | 10 | 1:50 | USD |

| CRVUSD | 1000 | 1:50 | USD |

| DASHUSD | 100 | 1:50 | USD |

| DOGEUSD | 10000 | 1:50 | USD |

| DOTUSD | 100 | 1:50 | USD |

| EGLDUSD | 100 | 1:50 | USD |

| ENJUSD | 1000 | 1:50 | USD |

| EOSUSD | 1000 | 1:50 | USD |

| ETCUSD | 100 | 1:50 | USD |

| ETHBTC | 100000 | 1:500 | USD |

| ETHEUR | 1 | 1:250 | USD |

| ETHGBP | 1 | 1:250 | USD |

| ETHUSD | 1 | 1:500 | USD |

| FILUSD | 1000 | 1:50 | USD |

| FLOWUSD | 1000 | 1:50 | USD |

| GRTUSD | 1000 | 1:50 | USD |

| ICPUSD | 1000 | 1:50 | USD |

| IMXUSD | 1000 | 1:50 | USD |

| LDOUSD | 1000 | 1:50 | USD |

| LINKUSD | 100 | 1:50 | USD |

| LRCUSD | 10000 | 1:50 | USD |

| LTCUSD | 10 | 1:250 | USD |

| MANAUSD | 10000 | 1:50 | USD |

| MATICUSD | 1000 | 1:50 | USD |

| NEARUSD | 1000 | 1:50 | USD |

| OPUSD | 1000 | 1:50 | USD |

| SANDUSD | 1000 | 1:50 | USD |

| SHIBUSD | 100000 | 1:50 | USD |

| SNXUSD | 1000 | 1:50 | USD |

| SOLUSD | 10 | 1:50 | USD |

| STORJUSD | 1000 | 1:50 | USD |

| STXUSD | 1000 | 1:50 | USD |

| SUSHIUSD | 1000 | 1:50 | USD |

| UMAUSD | 1000 | 1:50 | USD |

| UNIUSD | 100 | 1:50 | USD |

| XLMUSD | 1000 | 1:50 | USD |

| XRPUSD | 1000 | 1:250 | USD |

| XTZUSD | 1000 | 1:50 | USD |

| ZECUSD | 100 | 1:50 | USD |

| ZRXUSD | 1000 | 1:50 | USD |

| Contract Size |

Leverage | Required Margin |

| 1INCHUSD | ||

| 10000 | 1:50 | USD |

| AAVEUSD | ||

| 10 | 1:50 | USD |

| ADAUSD | ||

| 1000 | 1:50 | USD |

| ALGOUSD | ||

| 1000 | 1:50 | USD |

| APEUSD | ||

| 1000 | 1:50 | USD |

| APTUSD | ||

| 100 | 1:50 | USD |

| ARBUSD | ||

| 1000 | 1:50 | USD |

| ATOMUSD | ||

| 100 | 1:50 | USD |

| AVAXUSD | ||

| 10 | 1:50 | USD |

| AXSUSD | ||

| 100 | 1:50 | USD |

| BATUSD | ||

| 1000 | 1:50 | USD |

| BCHUSD | ||

| 10 | 1:250 | USD |

| BTCEUR | ||

| 1 | 1:250 | USD |

| BTCGBP | ||

| 1 | 1:250 | USD |

| BTCUSD | ||

| 1 | 1:250 | USD |

| BTGUSD | ||

| 1000 | 1:500 | USD |

| CHZUSD | ||

| 10000 | 1:50 | USD |

| COMPUSD | ||

| 10 | 1:50 | USD |

| CRVUSD | ||

| 1000 | 1:50 | USD |

| DASHUSD | ||

| 100 | 1:50 | USD |

| DOGEUSD | ||

| 10000 | 1:50 | USD |

| DOTUSD | ||

| 100 | 1:50 | USD |

| EGLDUSD | ||

| 100 | 1:50 | USD |

| ENJUSD | ||

| 1000 | 1:50 | USD |

| EOSUSD | ||

| 1000 | 1:50 | USD |

| ETCUSD | ||

| 100 | 1:50 | USD |

| ETHBTC | ||

| 100000 | 1:500 | USD |

| ETHEUR | ||

| 1 | 1:250 | USD |

| ETHGBP | ||

| 1 | 1:250 | USD |

| ETHUSD | ||

| 1 | 1:500 | USD |

| FILUSD | ||

| 1000 | 1:50 | USD |

| FLOWUSD | ||

| 1000 | 1:50 | USD |

| GRTUSD | ||

| 1000 | 1:50 | USD |

| ICPUSD | ||

| 1000 | 1:50 | USD |

| IMXUSD | ||

| 1000 | 1:50 | USD |

| LDOUSD | ||

| 1000 | 1:50 | USD |

| LINKUSD | ||

| 100 | 1:50 | USD |

| LRCUSD | ||

| 10000 | 1:50 | USD |

| LTCUSD | ||

| 10 | 1:250 | USD |

| MANAUSD | ||

| 10000 | 1:50 | USD |

| MATICUSD | ||

| 1000 | 1:50 | USD |

| NEARUSD | ||

| 1000 | 1:50 | USD |

| OPUSD | ||

| 1000 | 1:50 | USD |

| SANDUSD | ||

| 1000 | 1:50 | USD |

| SHIBUSD | ||

| 100000 | 1:50 | USD |

| SNXUSD | ||

| 1000 | 1:50 | USD |

| SOLUSD | ||

| 10 | 1:50 | USD |

| STORJUSD | ||

| 1000 | 1:50 | USD |

| STXUSD | ||

| 1000 | 1:50 | USD |

| SUSHIUSD | ||

| 1000 | 1:50 | USD |

| UMAUSD | ||

| 1000 | 1:50 | USD |

| UNIUSD | ||

| 100 | 1:50 | USD |

| XLMUSD | ||

| 1000 | 1:50 | USD |

| XRPUSD | ||

| 1000 | 1:250 | USD |

| XTZUSD | ||

| 1000 | 1:50 | USD |

| ZECUSD | ||

| 100 | 1:50 | USD |

| ZRXUSD | ||

| 1000 | 1:50 | USD |

Dynamic margin where Required Margin changes depending on the trading size is applied for cryptocurrency CFDs.

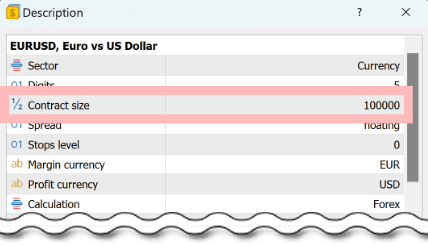

Contract size can be checked on MT4/MT5

Contract size of each instrument of XM can be checked on MT4 (MetaTrader 4)/MT5 (MetaTrader 5). Right-click Forex you wish to check on 'Indicative price indication screen,' then choose 'Specification,' you can check the contract size from trading condition.

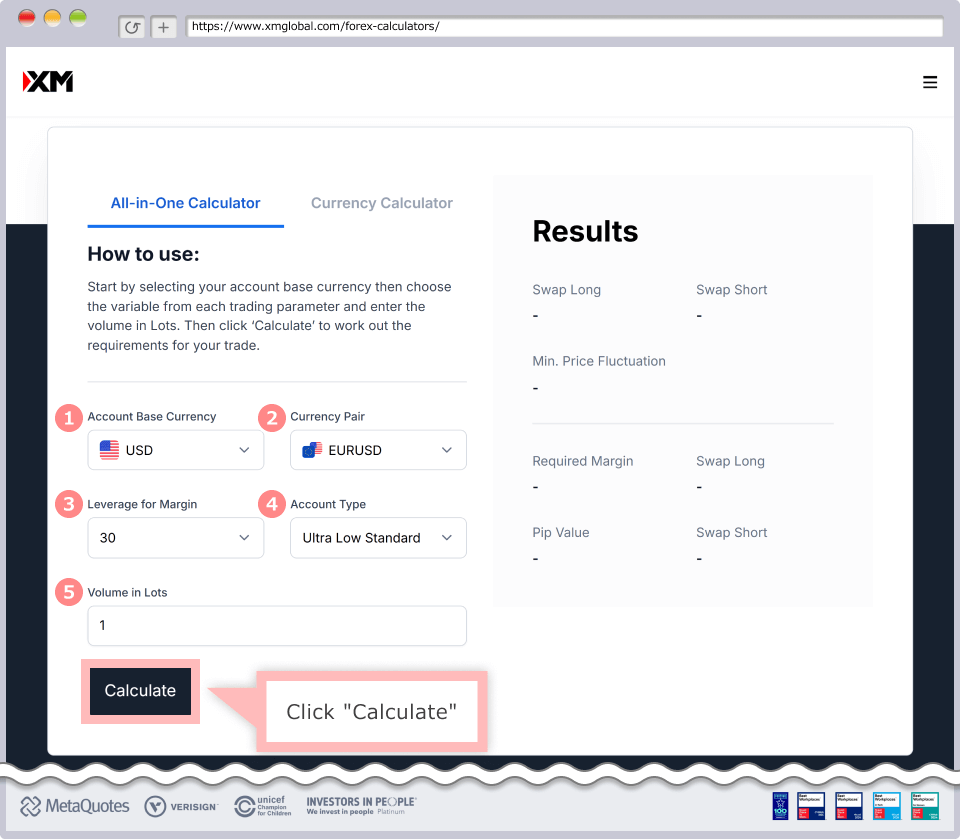

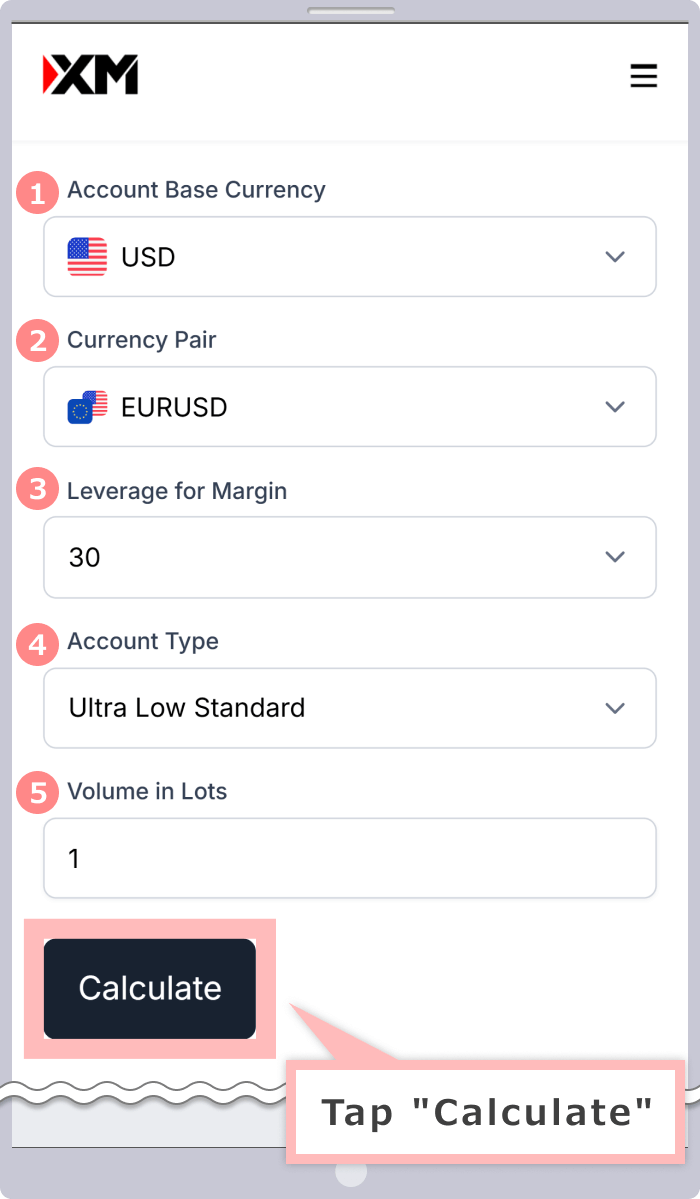

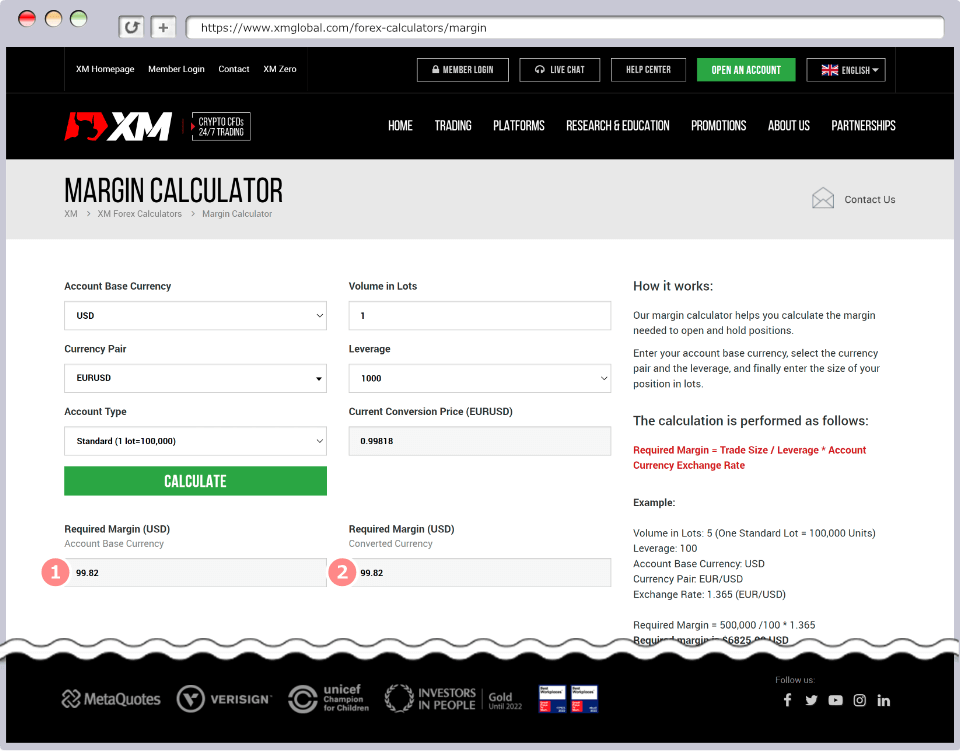

XM provides "XM Trading Calculator" which makes it easy to calculate required margin of Forex, GOLD and SILVER. You have only to input necessary figure, then you can work out the required margin easily. How to use XM Trading Calculator is as follows:

①Base currency and, choose ②Forex you wish to check, choose ③leverage, then ④account type you trade in, choose ⑤number of lots, then click 'Calculate.'

①Base currency and, choose ②Forex you wish to check, choose ③leverage, then ④account type you trade in, choose ⑤number of lots, then tap 'Calculate.'

| 1Account Base Currency | e.g. USD |

|---|---|

| 2Currency Pair | e.g. EURUSD |

| 3Leverage for Margin | e.g. 30 |

| 4Account Type | e.g. Ultra Low Standard |

| 5Volume in Lots | e.g. 1 |

Once the calculation is completed, required margin converted into base currency of the account will be indicated in ①required margin (USD).

How much is the required margin for cross trade with XM?

Cross trade in the same number of lots on both sides does not require any margin for Forex, GOLD and SILVER, therefore it is possible to hold positions even when the margin level is below 100%. However cross trade for other instruments require margin for the worth of one side, either buy or sell.

2022.10.27

Tell me how to calculate margin for XM CFDs

Margin of XM CFDs can be worked out by the formula, 'Number of lots * contract size * open price/leverage.' Contract size can be checked on MT4 (MetaTrader 4)/MT5 (MetaTrader 5) right-click Forex you wish to check on 'Indicative price indication screen,' then choose 'Specification.'

2022.10.27

Surplus margin of XM is what equity minus required margin and is the amount available to have a new position or to maintain existing position. Therefore it shows that the more you have surplus margin, the more you have enough room to trade.

2022.10.27

How high is the recommendable margin level?

When margin level goes below 50%, margin call will be exercised and when margin level goes below 20%, the forced settlement will be exercised. Therefore it is advisable to take measures such as increase margin by additional deposit, settle some of the positions or others so that you have enough margin in your account and manage your funds.

2022.10.27

What if margin goes below sufficient level?

You need to have enough margin with XM in order to place new orders or to maintain positions you have. When the margin becomes insufficient, you will not be able to place new orders or some of the positions may get exercised forcefully. Therefore it is advisable to take measures such as increase margin by additional deposit, settle some of the positions or others so that you have enough margin in your account and manage your funds.

2022.10.27