XM™|How to open the FX account.

Forex popular among traders and other attractive CFD instruments such as Precious Metals, Equity Indices, Energies, Commodities, Stock CFDs and Cryptocurrencies can be traded with high leverage with XM. As there is no need for further procedures and clients can trade all the instruments through the same trading tool (MT4/MT5), therefore various trade styles can be experienced by using the same one funds in the account actively.

![]()

Forex and total number of CFD instruments such as Precious Metals, Equity Indices, Energies, Commodities, Stock CFDs and Cryptocurrencies can be traded within the same one account of XM.

| Instruments | Number of instruments | Example of instruments |

|---|---|---|

| Forex | USDJPY, EURUSD, GBPJPY, etc. | |

| Precious Metals | GOLD, SILVER, XAUEUR, PALL, PLAT | |

| Equity Indices | JP225, US30, US500, GER40, etc. | |

| Energies | OIL, NGAS, etc. | |

| Commodities | SUGAR, SBEAN, COFFE, WHEAT, etc. | |

| Cryptocurrencies | BTCUSD, ETHUSD, XRPUSD, etc. | |

| Stock CFDs | (MT5 Only) |

Amazon, Apple, EasyJet, BNP Paribas, etc. |

| Shares (*) | Amazon, Easyjet, BMW, etc. |

| Forex | |

| Number of instruments |

|

| Example of instruments |

USDJPY, EURUSD, GBPJPY, etc. |

| Precious Metals | |

| Number of instruments |

|

| Example of instruments |

GOLD, SILVER, XAUEUR, PALL, PLAT |

| Equity Indices | |

| Number of instruments |

|

| Example of instruments |

JP225, US30, US500, GER40, etc. |

| Energies | |

| Number of instruments |

|

| Example of instruments |

OIL, NGAS, etc. |

| Commodities | |

| Number of instruments |

|

| Example of instruments |

SUGAR, SBEAN, COFFE, WHEAT, etc. |

| Cryptocurrencies | |

| Number of instruments |

|

| Example of instruments |

BTCUSD, ETHUSD, XRPUSD, etc. |

| Stock CFDs | |

| Number of instruments |

(MT5 Only) |

| Example of instruments |

Amazon, Apple, EasyJet, BNP Paribas, etc. |

| Shares (*) | |

| Number of instruments |

|

| Example of instruments |

Amazon, Easyjet, BMW, etc. |

"Shares" is available only in XM Shares Account.

For your information, you need to complete identification procedure in order to trade all the instruments in real account of XM.

What is CFD?

Precious Metals, Equity Indices, Energies, Commodities, Stock CFDs and Cryptocurrencies are referred to as CFDs among the instruments of XM. CFD stands for Contract for Difference and is one of the popular trading ways as 'trading by settlement on balance.' Agricultural commodities, Industrial products, Precious Metals, Energies, Equity Indices and the like are traded with minimal margin by using the leverage. Settlement will be done by the difference between the price entered and closed and there will be no delivery of items (crops, crude oil and the like).

XM allows you to trade CFDs such as Precious Metals, Equity Indices, Energies, Commodities, Stock CFDs and Cryptocurrencies on the same account with FX. As the result, there is no need for the additional account for CFDs nor for transfer/distribution of the funds between accounts. In addition, all the instruments can be traded on the same one trading tools (MT4/MT5 or Webtrader), therefore you can experience plentiful number of instruments easily.

Plentiful number of instruments can be traded by using maximum 1:1,000 leverage with XM. Especially maximum leverage of Equity Index CFDs with XM is 1:200 and considerably higher than other FX brokerage houses, therefore it becomes XM's feature that you can trade with minimal margin.

| Instruments | Maximum leverage |

| Forex, GOLD, SILVER | 1:1,000 |

| PALL, PLAT | 1:22.2 |

| Equity Indices | 1:500 |

| Energies | 1:200 |

| Commodities | 1:50 |

| Cryptocurrencies | 1:500 |

| Stock CFDs | 1:20 |

| Shares (*) | No Leverage |

| Instruments | Maximum leverage |

| Forex, GOLD, SILVER |

1:1,000 |

| PALL, PLAT | 1:22.2 |

| Equity Indices | 1:500 |

| Energies | 1:200 |

| Commodities | 1:50 |

| Cryptocurrencies | 1:500 |

| Stock CFDs | 1:20 |

| Shares (*) | No Leverage |

"Shares" is available only in XM Shares Account.

For your information, there are 2 types of instruments with XM, namely, instruments which leverage setting on the trading account will apply to and instruments which individual leverage setting will appliy to. Among the instruments 1:1 to 1:1,000 leverage which is set depending on the account types applies to Forex and Spot Metals (Gold and Silver). (For your information, maximum leverage of Silver is capped at 1:400 at the moment.) Other required margin depending on the each instrument apply to the rest of CFDs regardless of leverage setting on trading account or maximum leverage of each account type.

| Instruments | Leverage |

| Forex, GOLD, SILVER | Leverage setting on trading account 1:1~1:1,000 |

| Other CFDs (PALL, PLAT, Equity Indices, Energies, Commodities, Cryptocurrencies) |

Leverage is set on each individual instrument |

| Instruments | Leverage |

| Forex, GOLD, SILVER |

Leverage setting on trading account 1:1~1:1,000 |

| Other CFDs | Leverage is set on each individual instrument |

Here are the details of leverages for each individual instruments

Instruments of XM are divided into 2 types by swaps and Expiry date. There arise no swaps in future CFDs, however they have Expiry date. On the other hand, other instruments than CFDs do not have Expiry date and there arise swaps. For your information, there is no swaps nor Expiry date for Cryptocurrency CFDs.

| Instruments | Swap | Expiry date |

| Futures CFD (Future Metals, Energies, Future Equity Indices, Commodities) |

Not applicable | Applicable |

| Other CFDs (FX, Spot Metals, Cash Indices CFDs, Stock CFDs) |

Applicable | Not applicable |

| Cryptocurrencies, Shares | Not applicable | Not applicable |

| Futures CFD | |

| Swap | Not applicable |

| Expiry date | Applicable |

| Other CFDs | |

| Swap | Applicable |

| Expiry date | Not applicable |

| Cryptocurrencies, Shares | |

| Swap | Not applicable |

| Expiry date | Not applicable |

Open positions carried over until Expiry date will be settled forcefully for future CFDs. The rollover to the next contract month will not take place automatically, so please be noted.

Negative Balance Protection where XM does not seek for additional margin to protect clients' funds applies to all the trading products of XM. As the result, clients will not suffer the loss more than the funds deposited in the account in the unexpected rapid movement of market and you can trade with ease. Margin call will be exercised when margin level goes below 50% and loss cut will be exercised when margin level goes below 20% of margin level.

In addition, XM provides you with USD 50 bonus funds for who has opened a new account with XM. By utilizing this bonus you can trade plenty of products of XM without deposit and risk. Click here to apply for the Real Account of XM.

Clients can trade Forex and total number of CFDs such as Precious Metals, Equity Indices, Energies, Commodities, Stock CFDs and Cryptocurrencies. Trading conditions vary depending on the instruments, therefore please check the features before you trade. Trading hours also vary depending on the instruments. Please refer the following link for details.

Clients can trade Forex with focus on major Forex which is popular among FX traders. Forex are divided into 3 type depending on the level of liquidity and the trading volumes, which is, 'Major Forex,' 'Minor Forex' and 'Exotic Forex.'

Certain parts of Forex have each individual restriction on maximum leverages and trading hours in Major Forex, Minor Forex and Exotic Forex. Also trading conditions such as minimum/maximum trading size set at each account type will be applied to each individual FX instrument, and furthermore swap points predefined depending on each currency pair will arise on the positions carried over.

Major Forex with XM are the currency pairs which comprise of major currencies predominantly traded in the FX market. Component currencies are 6 currencies, which is, USD, Euro, JPY, Sterling Pounds, Swiss Franc and Canadian Dollar. USD/JPY and other Cross JPY pairs such as Euro/JPY or GBP/JPY are also within the group of Major Forex.

| Currency pair | Maximum leverage |

| Standard/Micro/XM Ultra Low Account Standard/ XM Ultra Low Account Micro |

|

| CADCHF | 1:400 |

| CADJPY | 1:1,000 |

| CHFJPY | 1:400 |

| EURCAD | 1:1,000 |

| EURCHF | 1:400 |

| EURGBP | 1:1,000 |

| EURJPY | 1:1,000 |

| EURUSD | 1:1,000 |

| GBPCAD | 1:1,000 |

| GBPCHF | 1:400 |

| GBPJPY | 1:1,000 |

| GBPUSD | 1:1,000 |

| USDCAD | 1:1,000 |

| USDCHF | 1:400 |

| USDJPY | 1:1,000 |

| Maximum leverage | |

| Standard/Micro/XM Ultra Low Account Standard/XM Ultra Low Account Micro | |

| CADCHF | 1:400 |

| CADJPY | 1:1,000 |

| CHFJPY | 1:400 |

| EURCAD | 1:1,000 |

| EURCHF | 1:400 |

| EURGBP | 1:1,000 |

| EURJPY | 1:1,000 |

| EURUSD | 1:1,000 |

| GBPCAD | 1:1,000 |

| GBPCHF | 1:400 |

| GBPJPY | 1:1,000 |

| GBPUSD | 1:1,000 |

| USDCAD | 1:1,000 |

| USDCHF | 1:400 |

| USDJPY | 1:1,000 |

Each account type uses different instrument symbol.

XM has different products menu depending on account types. You can trade only the products with name such as "USDJPY" in Standard Account, only the products with name "micro" at the end such as "USDJPYmicro" in Micro Account, only the products with name "#" at the end such as "USDJPY#" in Ultra Low Account Standard and only the products with "m# (m and #)" at the end such as "USDJPYm#" in Ultra Low Account Micro.

Minor Forex with XM are comprised of either AUD or NZD and major currency. AUDJPY and NZDJPY which are popular among traders are also within the group of Minor Forex.

| Currency pair | Maximum leverage |

| Standard/Micro/XM Ultra Low Account Standard/ XM Ultra Low Account Micro |

|

| AUDCAD | 1:1,000 |

| AUDCHF | 1:400 |

| AUDJPY | 1:1,000 |

| AUDNZD | 1:1,000 |

| AUDUSD | 1:1,000 |

| EURAUD | 1:1,000 |

| EURNZD | 1:1,000 |

| GBPAUD | 1:1,000 |

| GBPNZD | 1:1,000 |

| NZDCAD | 1:1,000 |

| NZDCHF | 1:1,000 |

| NZDJPY | 1:400 |

| NZDUSD | 1:1,000 |

| Maximum leverage | |

| Standard/Micro/XM Ultra Low Account Standard/XM Ultra Low Account Micro | |

| AUDCAD | 1:1,000 |

| AUDCHF | 1:400 |

| AUDJPY | 1:1,000 |

| AUDNZD | 1:1,000 |

| AUDUSD | 1:1,000 |

| EURAUD | 1:1,000 |

| EURNZD | 1:1,000 |

| GBPAUD | 1:1,000 |

| GBPNZD | 1:1,000 |

| NZDCAD | 1:1,000 |

| NZDCHF | 1:400 |

| NZDJPY | 1:1,000 |

| NZDUSD | 1:1,000 |

Exotic Forex of XM are comprised of currencies less traded in the market and major currencies. Currency pairs classified as Exotic Forex have less liquidity and normally do not have active movement, however when the market suddenly changes, there might be a volatile movement.

| Currency pair | Maximum leverage |

| Standard/Micro/XM Ultra Low Account Standard/ XM Ultra Low Account Micro |

|

| CHFSGD | 1:400 |

| EURDKK | 1:50 |

| EURHKD | 1:50 |

| EURHUF | 1:1,000 |

| EURNOK | 1:1,000 |

| EURPLN | 1:1,000 |

| EURSEK | 1:1,000 |

| EURSGD | 1:1,000 |

| EURTRY | 1:100 |

| EURZAR | 1:1,000 |

| GBPDKK | 1:50 |

| GBPNOK | 1:1,000 |

| GBPSEK | 1:1,000 |

| GBPSGD | 1:1,000 |

| NZDSGD | 1:1,000 |

| SGDJPY | 1:1,000 |

| USDCNH | 1:50 |

| USDDKK | 1:50 |

| USDHKD | 1:50 |

| USDHUF | 1:1,000 |

| USDMXN | 1:1,000 |

| USDNOK | 1:1,000 |

| USDPLN | 1:1,000 |

| USDSEK | 1:1,000 |

| USDSGD | 1:1,000 |

| USDTRY | 1:100 |

| USDZAR | 1:1,000 |

| Maximum leverage | |

| Standard/Micro/XM Ultra Low Account Standard/XM Ultra Low Account Micro | |

| CHFSGD | 1:400 |

| EURDKK | 1:50 |

| EURHKD | 1:50 |

| EURHUF | 1:1,000 |

| EURNOK | 1:1,000 |

| EURPLN | 1:1,000 |

| EURSEK | 1:1,000 |

| EURSGD | 1:1,000 |

| EURTRY | 1:100 |

| EURZAR | 1:1,000 |

| GBPDKK | 1:50 |

| GBPNOK | 1:1,000 |

| GBPSEK | 1:1,000 |

| GBPSGD | 1:1,000 |

| NZDSGD | 1:1,000 |

| SGDJPY | 1:1,000 |

| USDCNH | 1:50 |

| USDDKK | 1:50 |

| USDHKD | 1:50 |

| USDHUF | 1:1,000 |

| USDMXN | 1:1,000 |

| USDNOK | 1:1,000 |

| USDPLN | 1:1,000 |

| USDSEK | 1:1,000 |

| USDSGD | 1:1,000 |

| USDTRY | 1:100 |

| USDZAR | 1:1,000 |

For trading hours of Forex of XM, click here.

instruments of Precious Metal CFDs are available with XM. There are 2 types of tradings, namely, 'Spot Metals Instruments' and 'Futures Trading' in Precious Metal CFDs. Gold,Silver and XAUEUR which are popular among traders are classified as 'Spot Metals' and can be traded as Spot Trading. On the other hand, PALL and PLAT are classified as 'Precious Metal Future CFDs' and can be traded as Future Trading. 'Spot Trading' and 'Future Trading' have each individual trading rule.

What is Spot Trading and Future Trading?

Trade which is settled within 2 working days from the deal done date is called 'Spot Trade (Cash Trade) and settled after 3 working day onwards is called 'Future Trade' in financial market.

Each individual leverage setting and trading rule depending on each account type will apply to Spot Metals, namely GOLD,SILVER and XAUEUR. For your information, maximum leverage of SILVER is capped at 1:400 at the moment. Minus swap points will arise for both of GOLD,SILVER and XAUEUR positions carried over.

| Currency pair | Maximum leverage | Value of 1 lot | Min/Max trade size | |

| Standard/Micro/XM Ultra Low Account Standard/XM Ultra Low Account Micro |

Standard/XM Ultra Low Account Standard | Micro/XM Ultra Low Account Micro |

||

| GOLD | 1:1,000 | 100oz | 1oz | 0.01/50 |

| SILVER | 1:400 | 5,000oz | 50oz | 0.01/50 |

| XAUEUR | 1:1,000 | 100oz | 1oz | 0.01/50 |

| GOLD | |

| Standard/Micro/XM Ultra Low Account Standard/XM Ultra Low Account Micro | |

| Maximum leverage | 1:1,000 |

| Standard/ XM Ultra Low Account Standard |

|

| Value of 1 lot | 100oz |

| Micro/XM Ultra Low Account Micro | |

| Value of 1 lot | 1oz |

| Min/Max trade size | |

| 0.01/50 | |

| SILVER | |

| Standard/Micro/XM Ultra Low Account Standard/XM Ultra Low Account Micro | |

| Maximum leverage | 1:400 |

| Standard/ XM Ultra Low Account Standard |

|

| Value of 1 lot | 5,000oz |

| Micro/XM Ultra Low Account Micro | |

| Value of 1 lot | 50oz |

| Min/Max trade size | |

| 0.01/50 | |

| XAUEUR | |

| Standard/Micro/XM Ultra Low Account Standard/XM Ultra Low Account Micro | |

| Maximum leverage | 1:1,000 |

| Standard/ XM Ultra Low Account Standard |

|

| Value of 1 lot | 100oz |

| Micro/XM Ultra Low Account Micro | |

| Value of 1 lot | 1oz |

| Min/Max trade size | |

| 0.01/50 | |

What is troy ounce?

The prices of precious metals are denominated in dollars per troy ounce. Troy ounce is the unit used for weighing precious metals and is about 31.1 grams. GOLD price per oz is about USD 1,800 and when USD/JPY is 110.00, GOLD/oz is USD 1,800 = JPY 198,000, as the result GOLD per 1 gram will be JPY 198,000 divided by 31.1 = about JPY 6,367.

There is no difference in leverages nor rules depending on the account types or leverage setting for Future Precious Metal CFDs, PALL and PLAT, and same common rules will apply to both. There arise no swap points for Precious Metal CFD tradings, therefore you do not have to care about the cost of carrying overnight and you can still keep your position. However the settlement will take place forcefully on the predetermined date per instruments and you need to settle and roll it over to the next contract month. For your information, effective leverage of Future Precious Metal CFDs (PALL and PLAT) is about 1:22.2 (Required Margin 4.5%).

| Instruments | Margin percentage (Effective leverage) |

Value of 1 lot | Min/Max trade size |

| PALL | 4.5% (1:22.2) |

10oz | 1/45 |

| PLAT | 4.5% (1:22.2) |

10oz | 1/100 |

| PALL | |

| Margin percentage | 4.5% (1:22.2) |

| Value of 1 lot | 10oz |

| Min/Max trade size | 1/45 |

| PLAT | |

| Margin percentage | 4.5% (1:22.2) |

| Value of 1 lot | 10oz |

| Min/Max trade size | 1/100 |

Palladium and Platinum of XM have high movement ratio per day (range ratio to the present price per day) as average 3.5%, therefore they are popular among traders who try to earn a big profit within a short period although the practical leverage is relatively low as about 1:22.2. In addition, as minus swap points do not arise through carrying over, Palladium and Platinum are recommendable for who trade medium to long-term without awareness of Expiry date.

PALL & PLAT

Palladium and Platinum both are rare metals and belong to platinum group. Platinum along with gold/silver are valuable metals and are largely used for accessaries. At the same time Palladium and Platinum have the feature that they are highly demanded in automobile industry as indispensable material. With exhaust gas regulation getting tighter around the world, palladium and platinum become indispensable materials, the former is used for catalytic substance of gasoline vehicle and the latter is used for catalytic substance of diesel vehicle. Furthermore, the demand is foreseeable for fuel cell vehicle as catalytic substance, therefore big price movement is expected from real demand.

You can trade 2 types of Equity Indices, cash and future, with XM. We have instruments of cash equity indices and instruments of future equity indices. Equity indices are comprised of the stock prices of the popular enterprises listed in the stock exchange or of the representative instruments in each industrial field and is used for the indicator of economic trend of the country.

There is no difference of trading rules through instruments and the same rules will apply to all Equity Indices regardless of account types or leverage settings with XM. Required margin for each instrument, trading size or instrument symbol are the same with all 4 accounts. However there is differences in, with or without of swap and Expiry date, and the size of swap between cash and futures as follows:

| Swap | Expiry date | Spread | |

| Equity Indices (Cash) | Applicable | Not applicable | Tight |

| Equity Indices (Future) | Not applicable | Applicable | Wide |

| Equity Indices (Cash) | |

| Swap | Applicable |

| Expiry date | Not applicable |

| Spread | Tight |

| Equity Indices (Future) | |

| Swap | Not applicable |

| Expiry date | Applicable |

| Spread | Wide |

For your information, the names of instruments vary as follows and cash equity indices have the word, (cash) at the end of instrument names and future equity indices have the contract month such as (MAR22) at the end of instrument names.

Equity Index CFDs (Cash)

Equity Index CFDs (Futures)

instruments of Cash Equity Index CFDs are available with XM. There is no 'Expiry date' with Equity Index CFDs cash and the spread is set relatively narrower, however at the same time negative swap points arise for carry over. As negative swap points arise both on long and short positions, if you wish to have long-term position, it is recommendable for you to take the negative swaps into account.

| Instruments | Spreads as low as | Margin percentage (Effective leverage) |

Min/Max trade size MT4 |

Min/Max trade size MT5 |

| AUS200Cash (ASX 200) |

pips | 1% (1:100) |

0.1/12500 | 0.1/220 |

| CA60Cash (CANADA60) |

pips | 0.4% (1:250) |

- | 0.1/1080 |

| China50Cash (CHINA A50) |

pips | 0.4% (1:250) |

- | 0.01/110 |

| ChinaHCash (HONG KONG CHINA H-SHARES) |

pips | 0.4% (1:250) |

- | 0.1/550 |

| EU50Cash (EURO STOXX 50) |

pips | 1% (1:100) |

0.1/12500 | 0.1/280 |

| FRA40Cash (CAC 40) |

pips | 1% (1:100) |

0.1/12500 | 0.1/330 |

| GER40Cash (DAX) |

pips | 0.2% (1:500) |

0.1/12500 | 0.1/230 |

| HK50Cash (HSI) |

pips | 1.5% (1:66.6) |

0.1/12500 | 0.1/360 |

| IT40Cash (FTSE MIB) |

pips | 1% (1:100) |

0.1/12500 | 0.1/50 |

| JP225Cash (Nikkei) |

pips | 0.2% (1:500) |

0.1/12500 | 0.1/10000 |

| NETH25Cash (AEX) |

pips | 1% (1:100) |

0.1/12500 | 0.1/1500 |

| SA40Cash (SOUTH AFRICA 40) |

pips | 0.25% (1:400) |

- | 0.1/110 |

| Sing30Cash (SINGAPORE 30) |

pips | 0.4% (1:250) |

- | 0.1/1090 |

| SPAIN35Cash (IBEX) |

pips | 1% (1:100) |

0.1/12500 | 0.1/120 |

| SWI20Cash (SMI 20) |

pips | 1% (1:100) |

0.1/12500 | 0.1/90 |

| UK100Cash (FTSE 100) |

pips | 0.2% (1:500) |

0.1/12500 | 0.1/230 |

| US100Cash (NASDAQ) |

pips | 0.2% (1:500) |

0.1/12500 | 0.1/260 |

| US2000Cash (US 2000) |

pips | 0.4% (1:250) |

- | 0.1/770 |

| US30Cash (Dow Jones) |

pips | 0.2% (1:500) |

0.1/12500 | 0.1/150 |

| US500Cash (S&P 500) |

pips | 0.2% (1:500) |

0.1/12500 | 0.1/800 |

| AUS200Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/220 |

| CA60Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.4% (1:250) |

| Min/Max trade size MT4 | - |

| Min/Max trade size MT5 | 0.1/1080 |

| China50Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.4% (1:250) |

| Min/Max trade size MT4 | - |

| Min/Max trade size MT5 | 0.1/110 |

| ChinaHCash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.4% (1:250) |

| Min/Max trade size MT4 | - |

| Min/Max trade size MT5 | 0.1/550 |

| EU50Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/280 |

| FRA40Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/330 |

| GER40Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/230 |

| HK50Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1.5% (1:66.6) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/360 |

| IT40Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/50 |

| JP225Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/10000 |

| NETH25Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/1500 |

| SA40Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.25% (1:400) |

| Min/Max trade size MT4 | - |

| Min/Max trade size MT5 | 0.1/110 |

| Sing30Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.25% (1:400) |

| Min/Max trade size MT4 | - |

| Min/Max trade size MT5 | 0.1/1090 |

| SPAIN35Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/120 |

| SWI20Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/90 |

| UK100Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/230 |

| US100Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/260 |

| US2000Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.4% (1:250) |

| Min/Max trade size MT4 | - |

| Min/Max trade size MT5 | 0.1/770 |

| US30Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/150 |

| US500Cash | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size MT4 | 0.1/12500 |

| Min/Max trade size MT5 | 0.1/800 |

popular instruments of Equity Index CFD Futures are available with XM. 'Expiry date' are preset for all the instruments, therefore the duration of position holding will be 1 to 3 months in Equity Index CFD Futures. If you hold the position until the Expiry date, the position will be settled forcefully and the rollover to the next contract month will not take place automatically. So please be noted.

The spreads of Equity Index CFD Futures are set relatively wider than that of cash instruments, however there arise no negative swap points from the carry over, as the result, it is recommendable for traders who try to aim for profit from swing trade in medium-term while taking the Expiry date into consideration.

| Instruments | Spreads as low as | Margin percentage (Effective leverage) |

Min/Max trade size MT4 |

Min/Max trade size MT5 |

| EU50 (EURO STOXX 50) |

pips | 1% (1:100) |

1/12500 | 0.1/280 |

| FRA40 (CAC 40) |

pips | 1% (1:100) |

1/12500 | 0.1/170 |

| GER40 (DAX) |

pips | 0.2% (1:500) |

1/12500 | 0.1/230 |

| JP225 (Nikkei) |

pips | 0.2% (1:500) |

1/12500 | 0.1/10,700 |

| SWI20 (SMI 20) |

pips | 1% (1:100) |

1/12500 | 0.1/190 |

| UK100 (FTSE 100) |

pips | 0.2% (1:500) |

1/12500 | 0.1/120 |

| US100 (NASDAQ) |

pips | 0.2% (1:500) |

1/12500 | 0.1/170 |

| US30 (Dow Jones) |

pips | 0.2% (1:500) |

1/12500 | 0.1/160 |

| US500 (S&P 500) |

pips | 0.2% (1:500) |

1/12500 | 0.1/270 |

| USDX (US Dollar Index) |

pips | 1% (1:100) |

1/12500 | 1/950 |

| VIX (S&P 500) |

pips | 1% (1:100) |

- | 1/15000 |

| EU50 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/280 |

| FRA40 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/170 |

| GER40 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/230 |

| JP225 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/10,700 |

| SWI20 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/190 |

| UK100 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/120 |

| US100 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/170 |

| US30 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/160 |

| US500 | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

0.2% (1:500) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 0.1/270 |

| USDX | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size | 1/12500 |

| Min/Max trade size | 1/950 |

| VIX | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

1% (1:100) |

| Min/Max trade size | - |

| Min/Max trade size | 1/15000 |

What is U.S. Dollar Index?

U.S.Dollar Index is what the exchange rate of US Dollar is indexed against multiple major currencies such as Euro, JPY, Sterling Pound, Canadian Dollar, Swiss Franc. It is calculated by multiple institutions such as Federal Reserve Board (FRB), large financial institutions and rating company and used for the index to show the comprehensive value of US Dollars.

'U. S. Dollar Index' in the foreign exchange market mainly refers to the value of future products, 'ICE Futures U. S. Dollar Index' listed on 'ICE Futures U. S.' ICE U. S. Dollar Index is comprised of 57.6% of Euro, 13.6% of JPY, 11.9% of GBP, 9.1% of Canadian Dollar, 4.2% of Swedish Krona and 3.6% of Swiss Franc and is regarded as the index of how you see the 'strength' of US Dollar in the foreign exchange market where various Forex are traded. You can trade Dollar Index as futures instrument, 'USDX' within Equity Index CFDs.

For trading hours of Equity Index CFDs, click here.

instruments of Energy CFDs are available with XM. Trading rules are unified through all accounts regardless of account types. Among other Energy CFDs Crude Oil CFD has the feature that it moves largely within the short time soon after the news headline is released and is favored by traders who aims for a big profit with leverage. In addition, both West Texas Intermediate OIL traded in North American market and BRENT traded in European market are available with required margin 1.5% (practical leverage 66.7%). WTI OIL Mini (OILMn) is the instrument which enables traders with smaller margin at 1/10 size of WTI OIL.

For your information, all the instruments have 'Expiry date', therefore the settlement will take place forcefully if you hold the position until the Expiry date. In addition, the rollover to the next contract month will not take place automatically. So please be noted.

| Instruments | Margin percentage (Effective leverage) |

Value of 1 lot | Min/Max trade size |

| BRENT (Brent Crude Oil) |

1.5% (About 1:66.7) |

100Barrels | 1/280 |

| OIL (WTI Oil) |

1.5% (About 1:66.7) |

100Barrels | 1/400 |

| OILMn (WTI Oil Mini) |

1.5% (About 1:66.7) |

10Barrels | 1/4,000 |

| GSOIL (London Gas Oil) |

3% (About 1:33.3) |

4Tonnes | 1/500 |

| NGAS (Natural Gas) |

3% (About 1:33.3) |

1,000MMBtu | 1/300 |

| BRENT | |

| Margin percentage (Effective leverage) |

1.5% (About 1:66.7) |

| Value of 1 lot | 100Barrels |

| Min/Max trade size | 1/280 |

| OIL | |

| Margin percentage (Effective leverage) |

1.5% (About 1:66.7) |

| Value of 1 lot | 100Barrels |

| Min/Max trade size | 1/400 |

| OILMn | |

| Margin percentage (Effective leverage) |

1.5% (About 1:66.7) |

| Value of 1 lot | 10Barrels |

| Min/Max trade size | 1/4,000 |

| GSOIL | |

| Margin percentage (Effective leverage) |

3% (About 1:33.3) |

| Value of 1 lot | 4Tonnes |

| Min/Max trade size | 1/500 |

| NGAS | |

| Margin percentage (Effective leverage) |

3% (About 1:33.3) |

| Value of 1 lot | 1,000MMBtu |

| Min/Max trade size | 1/300 |

For trading hours of Energy CFDs of XM, click here.

Most popular instruments of Commodity CFDs can be traded on the same FX trading platform with XM. Commodity trading is one of the Futures which deal with grains or metals and is known as 'Commodity Futures Trading.' Commodity Future Exchanges are in every part of the world and various agricultural commodities and Industrial products are traded actively.

Commodity CFD instruments with XM are comprised of 7 instruments of agricultural commodities and an instrument of industrial product which are mainly traded in commodity future exchanges in US and are all denominated in US dollars. Commodity CFD of XM are traded with required margin 2% which are common to all 4 accounts (practical leverage 1:50) and there arise no swap points. Each instrument of commodity CFD has its own 'Expiry date', therefore the settlement will take place forcefully if you hold the position until the Expiry date. The rollover to the next contract month will not take place automatically. So please be noted.

| Instruments | Margin percentage (Effective leverage) |

Value of 1 lot | Min/Max trade size |

| COCOA (US COCOA) |

2% (1:50) |

1Metric Ton | 1/500 |

| COFFE (US COFFE) |

2% (1:50) |

10,000LBS | 1/40 |

| CORN (US CORN) |

2% (1:50) |

400Bushels | 1/400 |

| COTTO (US COTTO) |

2% (1:50) |

10,000LBS | 1/100 |

| HGCOP (High Grade Copper) |

2% (1:50) |

2,000LBS | 1/140 |

| SBEAN (US Soybeans) |

2% (1:50) |

400Bushels | 1/160 |

| SUGAR (US SUGAR) |

2% (1:50) |

10,000LBS | 1/550 |

| WHEAT (US Wheat) |

2% (1:50) |

400Bushels | 1/290 |

| COCOA | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1Metric Ton |

| Min/Max trade size | 1/500 |

| COFFE | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000LBS |

| Min/Max trade size | 1/40 |

| CORN | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 400Bushels |

| Min/Max trade size | 1/400 |

| COTTO | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000LBS |

| Min/Max trade size | 1/100 |

| HGCOP | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 2,000LBS |

| Min/Max trade size | 1/140 |

| SBEAN | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 400Bushels |

| Min/Max trade size | 1/160 |

| SUGAR | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000LBS |

| Min/Max trade size | 1/550 |

| WHEAT | |

| Margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 400Bushels |

| Min/Max trade size | 1/290 |

For trading hours of Commodity CFDs of XM, click here.

Including Bitcoin, a representative example, instruments of cryptocurrency CFDs are available ranging from popular cryptocurrencies such as Ethereum/Ripple/Litecoin to Altcoin in Standard, Micro Account,Ultra Low Account Standard and Ultra Low Account Micro. Leverages differ depending on the instruments and BTCUSD/BTGUSD/ETHBTC/ETHUSD are traded with maximum 1:500 leverage,Bitcoin/Ethereum/Ripple/Litecoin are traded with maximum 1:250 leverage and other Altcoins with 1:50.

There arise no swap points for Cryptocurrency CFDs and there are also no 'Expiry date.' You do not have to be bothered by bearing interest payment nor rollover and can trade actively 7 days a week including weekends and basically 24 hours a day.

For your information, cryptocurrency CFDs deploy 'Dynamic margin' where requied margin changes depending on the trading size.

| Instruments | Dynamic margin percentage (Effective leverage) |

Value of 1 lot | Min/Max trade size |

| 1INCHUSD (1INCH Network/USD) |

2% (1:50) |

10,000tokens | 0.01/100 |

| AAVEUSD (Aave/USD) |

2% (1:50) |

10Aave | 0.01/1000 |

| ADAUSD (Cardano/USD) |

2% (1:50) |

1,000Cardano | 0.01/3000 |

| ALGOUSD (Algorand/USD) |

2% (1:50) |

1,000Algorand | 0.01/3000 |

| APEUSD (ApeCoin/USD) |

2% (1:50) |

1,000tokens | 0.01/100 |

| APTUSD (Aptos/USD) |

2% (1:50) |

100tokens | 0.01/500 |

| ARBUSD (Arbitrum/USD) |

2% (1:50) |

1,000tokens | 0.01/500 |

| ATOMUSD (Cosmos/USD) |

2% (1:50) |

100tokens | 0.01/500 |

| AVAXUSD (Avalanche/USD) |

2% (1:50) |

10Avalanche | 0.01/7000 |

| AXSUSD (Axie Infinity/USD) |

2% (1:50) |

100Axie Infinity | 0.01/1000 |

| BATUSD (Basic Attention Token/ USD) |

2% (1:50) |

1,000Basic Attention Tokens |

0.01/3000 |

| BCHUSD (Bitcoin Cash/USD) |

0.4% (1:250) |

10Bitcoin Cash | 0.01/460 |

| BTCEUR (Bitcoin/EUR) |

0.4% (1:250) |

1Bitcoin | 0.01/30 |

| BTCGBP (Bitcoin/GBP) |

0.4% (1:250) |

1Bitcoin | 0.01/30 |

| BTCUSD (Bitcoin/USD) |

0.2% (1:500) |

1Bitcoin | 0.01/80 |

| BTGUSD (Bitcoin Gold/USD) |

0.2% (1:500) |

1,000tokens | 0.01/22 |

| CHZUSD (Chiliz/USD) |

2% (1:50) |

10,000tokens | 0.01/500 |

| COMPUSD (Compound/USD) |

2% (1:50) |

10Compound | 0.01/1600 |

| CRVUSD (Curve DAO Token/USD) |

2% (1:50) |

1,000tokens | 0.01/500 |

| DASHUSD (Dash/USD) |

2% (1:50) |

100tokens | 0.01/100 |

| DOGEUSD (Dogecoin/USD) |

2% (1:50) |

10,000tokens | 0.01/500 |

| DOTUSD (Polkadot/USD) |

2% (1:50) |

100tokens | 0.01/800 |

| EGLDUSD (MultiversX/USD) |

2% (1:50) |

100tokens | 0.01/100 |

| ENJUSD (Enjin Coin/USD) |

2% (1:50) |

1,000Enjin Coins | 0.01/1600 |

| EOSUSD (EOS/USD) |

2% (1:50) |

1,000tokens | 0.01/500 |

| ETCUSD (Ethereum Classic/USD) |

2% (1:50) |

100tokens | 0.01/200 |

| ETHBTC (Ethereum/Bitcoin) |

0.2% (1:500) |

100,000tokens | 0.01/43 |

| ETHEUR (Ethereum/EUR) |

0.4% (1:250) |

1Ethereum | 0.01/400 |

| ETHGBP (Ethereum/GBP) |

0.4% (1:250) |

1Ethereum | 0.01/400 |

| ETHUSD (Ethereum/USD) |

0.2% (1:500) |

1Ethereum | 0.01/1180 |

| FILUSD (Filecoin/USD) |

2% (1:50) |

1,000tokens | 0.01/100 |

| FLOWUSD (Flow/USD) |

2% (1:50) |

1,000tokens | 0.01/500 |

| GRTUSD (The Graph/USD) |

2% (1:50) |

1,000The Graph | 0.01/7000 |

| ICPUSD (Internet Computer/USD) |

2% (1:50) |

1,000tokens | 0.01/100 |

| IMXUSD (Immutable/USD) |

2% (1:50) |

1,000tokens | 0.01/500 |

| LDOUSD (Lido DAO/USD) |

2% (1:50) |

1,000tokens | 0.01/200 |

| LINKUSD (Chainlink/USD) |

2% (1:50) |

100Chainlink | 0.01/1000 |

| LRCUSD (Loopring/USD) |

2% (1:50) |

10,000tokens | 0.01/200 |

| LTCUSD (Litecoin/USD) |

0.4% (1:250) |

10Litecoin | 0.01/720 |

| MANAUSD (Decentraland/USD) |

2% (1:50) |

10,000tokens | 0.01/100 |

| MATICUSD (Polygon/USD) |

2% (1:50) |

1,000Polygon | 0.01/1000 |

| NEARUSD (NEAR Protocol/USD) |

2% (1:50) |

1,000tokens | 0.01/200 |

| OPUSD (Optimism/USD) |

2% (1:50) |

1,000tokens | 0.01/200 |

| SANDUSD (The Sandbox/USD) |

2% (1:50) |

1,000tokens | 0.01/800 |

| SHIBUSD (Shiba Inu/USD) |

2% (1:50) |

100,000tokens | 0.01/500 |

| SNXUSD (Synthetix Network Token/USD) |

2% (1:50) |

1,000Synthetix Network Tokens |

0.01/400 |

| SOLUSD (Solana/USD) |

2% (1:50) |

10Solanas | 0.01/3000 |

| STORJUSD (Storj/USD) |

2% (1:50) |

1,000Storj | 0.01/3000 |

| STXUSD (Stacks/USD) |

2% (1:50) |

1,000tokens | 0.01/500 |

| SUSHIUSD (SushiSwap/USD) |

2% (1:50) |

1,000SushiSwap | 0.01/1000 |

| UMAUSD (UMA/USD) |

2% (1:50) |

1,000UMA | 0.01/400 |

| UNIUSD (UNI/USD) |

2% (1:50) |

100Uniswap | 0.01/1000 |

| XLMUSD (Stellar Lumens/USD) |

2% (1:50) |

1,000Stellar Lumens | 0.01/7000 |

| XRPUSD (Ripple/USD) |

0.4% (1:250) |

1,000Ripple | 0.01/1600 |

| XTZUSD (Tezos/USD) |

2% (1:50) |

1,000tokens | 0.01/500 |

| ZECUSD (Zcash/USD) |

2% (1:50) |

100tokens | 0.01/100 |

| ZRXUSD (0x/USD) |

2% (1:50) |

1,000 0x | 0.01/3000 |

| 1INCHUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000tokens |

| Min/Max trade size | 0.01/100 |

| AAVEUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10Aave |

| Min/Max trade size | 0.01/1000 |

| ADAUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Cardano |

| Min/Max trade size | 0.01/3000 |

| ALGOUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Algorand |

| Min/Max trade size | 0.01/3000 |

| APEUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/100 |

| APTUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100tokens |

| Min/Max trade size | 0.01/500 |

| ARBUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/500 |

| ATOMUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100tokens |

| Min/Max trade size | 0.01/500 |

| AVAXUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10Avalanche |

| Min/Max trade size | 0.01/7000 |

| AXSUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100Axie Infinity |

| Min/Max trade size | 0.01/1000 |

| BATUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Basic Attention Tokens |

| Min/Max trade size | 0.01/3000 |

| BCHUSD | |

| Dynamic margin percentage (Effective leverage) |

0.4% (1:250) |

| Value of 1 lot | 10Bitcoin Cash |

| Min/Max trade size | 0.01/460 |

| BTCEUR | |

| Dynamic margin percentage (Effective leverage) |

0.4% (1:250) |

| Value of 1 lot | 1Bitcoin |

| Min/Max trade size | 0.01/30 |

| BTCGBP | |

| Dynamic margin percentage (Effective leverage) |

0.4% (1:250) |

| Value of 1 lot | 1Bitcoin |

| Min/Max trade size | 0.01/30 |

| BTCUSD | |

| Dynamic margin percentage (Effective leverage) |

0.2% (1:500) |

| Value of 1 lot | 1Bitcoin |

| Min/Max trade size | 0.01/80 |

| BTGUSD | |

| Dynamic margin percentage (Effective leverage) |

0.2% (1:500) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/22 |

| CHZUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000tokens |

| Min/Max trade size | 0.01/500 |

| COMPUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10Compound |

| Min/Max trade size | 0.01/1600 |

| CRVUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/500 |

| DASHUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100tokens |

| Min/Max trade size | 0.01/100 |

| DOGEUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000tokens |

| Min/Max trade size | 0.01/500 |

| DOTUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100tokens |

| Min/Max trade size | 0.01/800 |

| EGLDUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100tokens |

| Min/Max trade size | 0.01/100 |

| ENJUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Enjin Coins |

| Min/Max trade size | 0.01/1600 |

| EOSUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/500 |

| ETCUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100tokens |

| Min/Max trade size | 0.01/200 |

| ETHBTC | |

| Dynamic margin percentage (Effective leverage) |

0.2% (1:500) |

| Value of 1 lot | 100,000tokens |

| Min/Max trade size | 0.01/43 |

| ETHEUR | |

| Dynamic margin percentage (Effective leverage) |

0.4% (1:250) |

| Value of 1 lot | 1Ethereum |

| Min/Max trade size | 0.01/400 |

| ETHGBP | |

| Dynamic margin percentage (Effective leverage) |

0.4% (1:250) |

| Value of 1 lot | 1Ethereum |

| Min/Max trade size | 0.01/400 |

| ETHUSD | |

| Dynamic margin percentage (Effective leverage) |

0.2% (1:500) |

| Value of 1 lot | 1Ethereum |

| Min/Max trade size | 0.01/1180 |

| FILUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/100 |

| FLOWUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/500 |

| GRTUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000The Graph |

| Min/Max trade size | 0.01/7000 |

| ICPUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/100 |

| IMXUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/500 |

| LDOUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/200 |

| LINKUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100Chainlink |

| Min/Max trade size | 0.01/1000 |

| LRCUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000tokens |

| Min/Max trade size | 0.01/200 |

| LTCUSD | |

| Dynamic margin percentage (Effective leverage) |

0.4% (1:250) |

| Value of 1 lot | 10Litecoin |

| Min/Max trade size | 0.01/720 |

| MANAUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10,000tokens |

| Min/Max trade size | 0.01/100 |

| MATICUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Polygon |

| Min/Max trade size | 0.01/1000 |

| NEARUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/200 |

| OPUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/200 |

| SANDUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/800 |

| SHIBUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100,000tokens |

| Min/Max trade size | 0.01/500 |

| SNXUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Synthetix Network Tokens |

| Min/Max trade size | 0.01/400 |

| SOLUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 10Solanas |

| Min/Max trade size | 0.01/3000 |

| STORJUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Storj |

| Min/Max trade size | 0.01/3000 |

| STXUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/500 |

| SUSHIUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000SushiSwap |

| Min/Max trade size | 0.01/1000 |

| UMAUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000UMA |

| Min/Max trade size | 0.01/400 |

| UNIUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100Uniswap |

| Min/Max trade size | 0.01/1000 |

| XLMUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000Stellar Lumens |

| Min/Max trade size | 0.01/7000 |

| XRPUSD | |

| Dynamic margin percentage (Effective leverage) |

0.4% (1:250) |

| Value of 1 lot | 1,000Ripple |

| Min/Max trade size | 0.01/1600 |

| XTZUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000tokens |

| Min/Max trade size | 0.01/500 |

| ZECUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 100tokens |

| Min/Max trade size | 0.01/100 |

| ZRXUSD | |

| Dynamic margin percentage (Effective leverage) |

2% (1:50) |

| Value of 1 lot | 1,000 0x |

| Min/Max trade size | 0.01/3000 |

For trading hours of Cryptocurrency CFDs of XM, click here.

Including Amazon and Apple, a representative example, 1261 instruments of Stock CFDs are available ranging from popular Stock CFDs such as Accenture to Shell in Standard, Micro, Ultra Low Account Standard and Ultra Low Account Micro. There is no difference of trading rules through instruments and the same rules will apply to all Stock CFDs regardless of account types or leverage settings with XM. Required margin for each instrument, trading size or instrument symbol are the same with all 4 accounts.

There is no 'Expiry date' with CFDs cash and the spread is set relatively narrower, however at the same time negative swap points arise for carry over. As negative swap points arise both on long and short positions, if you wish to have long-term position, it is recommendable for you to take the negative swaps into account.

| Instruments | Spreads as low as | Margin percentage (Effective leverage) |

Min/Max trade size |

| Alibaba (BABA.K) |

pips | 5% (1:20) |

0.08/54 |

| Amazon (AMZN.OQ) |

pips | 5% (1:20) |

0.17/83 |

| Apple (AAPL.OQ) |

pips | 5% (1:20) |

0.6/68 |

| BMW (BMWG.DE) |

pips | 10% (1:10) |

0.11/100 |

| Facebook (FB.OQ) |

pips | 10% (1:10) |

0.03/33 |

| GeneralElec (GE.N) |

pips | 5% (1:20) |

0.08/90 |

| Google (GOOG.OQ) |

pips | 5% (1:20) |

0.06/79 |

| Microsoft (MSFT.OQ) |

pips | 5% (1:20) |

0.2/36 |

| Taiwan Semiconductor Manufacturing Company, Limited(TSM.N) |

pips | 15% (About 1:6.67) |

0.6/107 |

| Nestlé (NESN.VX) |

pips | 10% (1:10) |

0.15/92 |

| Alibaba(BABA.K ) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

5% (1:20) |

| Min/Max trade size | 0.08/54 |

| Amazon(AMZN.OQ) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

5% (1:20) |

| Min/Max trade size | 0.17/83 |

| Apple(AAPL.OQ) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

5% (1:20) |

| Min/Max trade size | 0.6/68 |

| BMW(BMWG.DE) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

10% (1:10) |

| Min/Max trade size | 0.11/100 |

| Facebook (FB.OQ) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

10% (1:10) |

| Min/Max trade size | 0.03/33 |

| GeneralElec(GE.N) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

5% (1:20) |

| Min/Max trade size | 0.08/90 |

| Google (GOOG.OQ) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

5% (1:20) |

| Min/Max trade size | 0.06/79 |

| Microsoft(MSFT.OQ) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

5% (1:20) |

| Min/Max trade size | 0.2/36 |

| Taiwan Semiconductor Manufacturing Company, Limited(TSM.N) |

|

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

15% (About 1:6.67) |

| Min/Max trade size | 0.6/107 |

| Nestlé(NESN.VX) | |

| Spreads as low as | pips |

| Margin percentage (Effective leverage) |

10% (1:10) |

| Min/Max trade size | 0.15/92 |

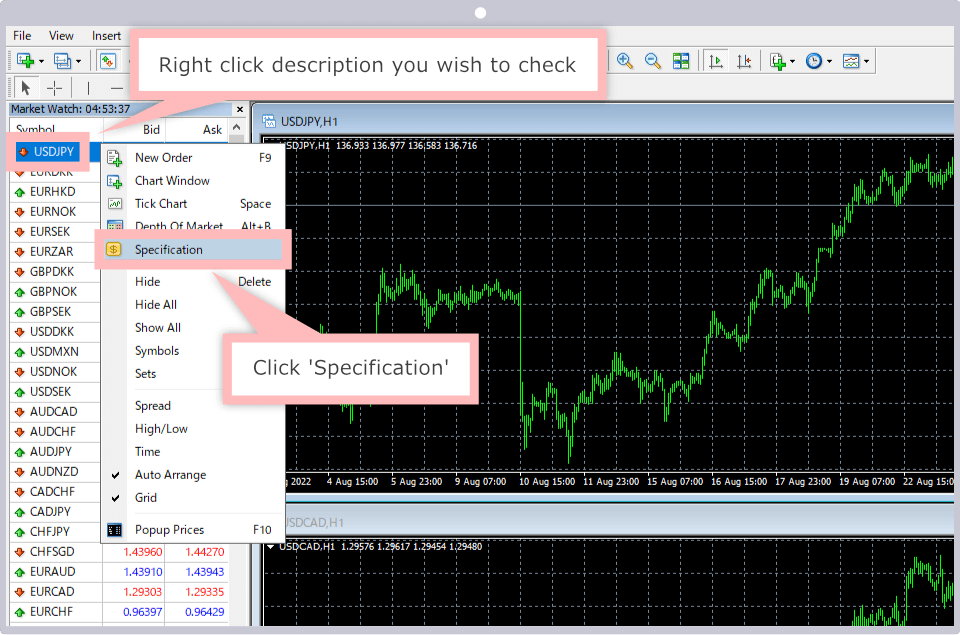

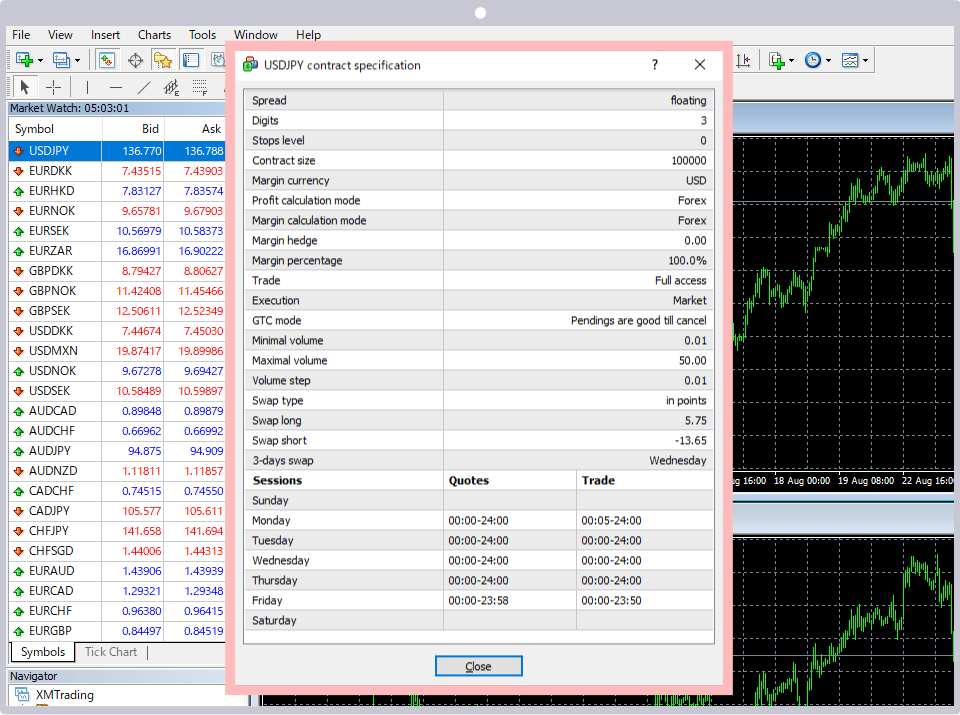

XM allows you to check the details of trading conditions of each instrument on MT4 (MetaTrader 4)/MT5 (MetaTrader 5) designed exclusively for XM. How to check the trading conditions on MT4/MT5 is as follows:

Activate XM's MT4/MT5 and after right-clicking Forex you wish to check on 'Indicative price indication screen,' choose 'Specification.' If Indicative price indication screen is not shown, click 'Indication' from MT4/MT5 menu and activate 'Indicative price indication.'

Trading Conditions Screen comes up and you can check the conditions such as margin ratio, swap and trading hours of each instrument.

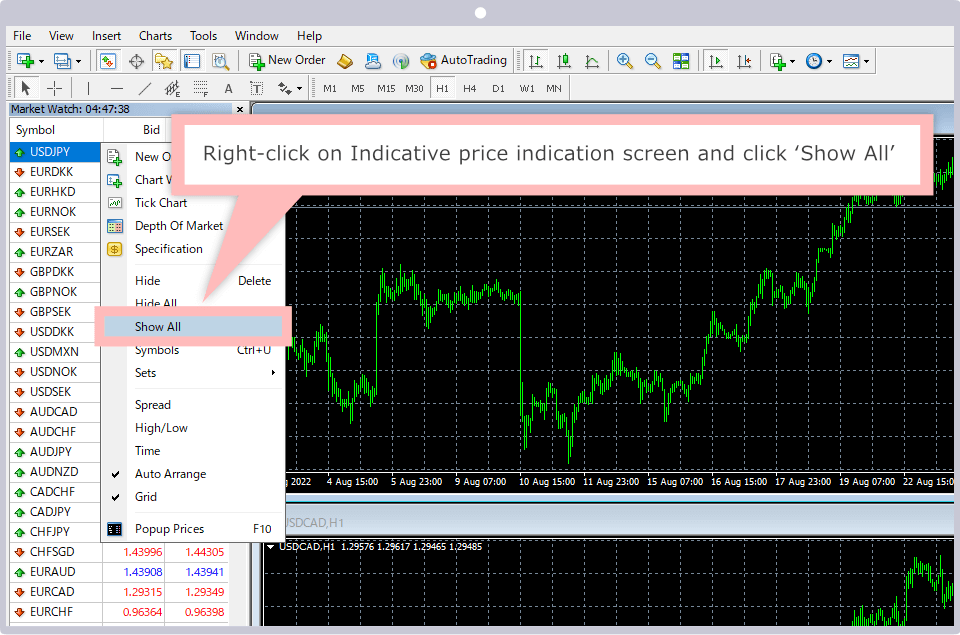

If the instrument you wish to check does not come up, right-click on Indicative price indication screen and click 'Show all,' then all the instruments XM offers come up on the Indicative price indication screen.

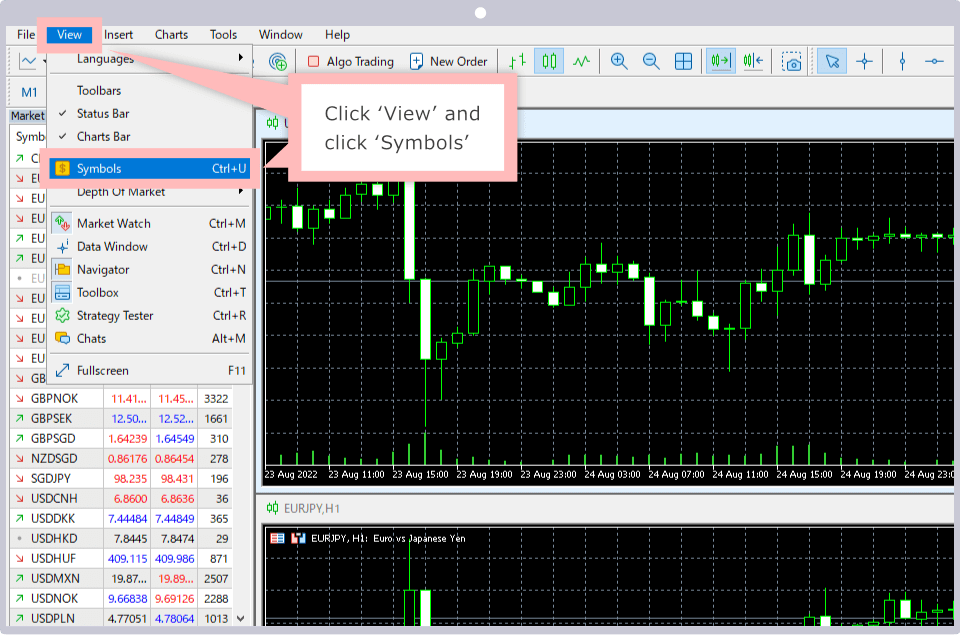

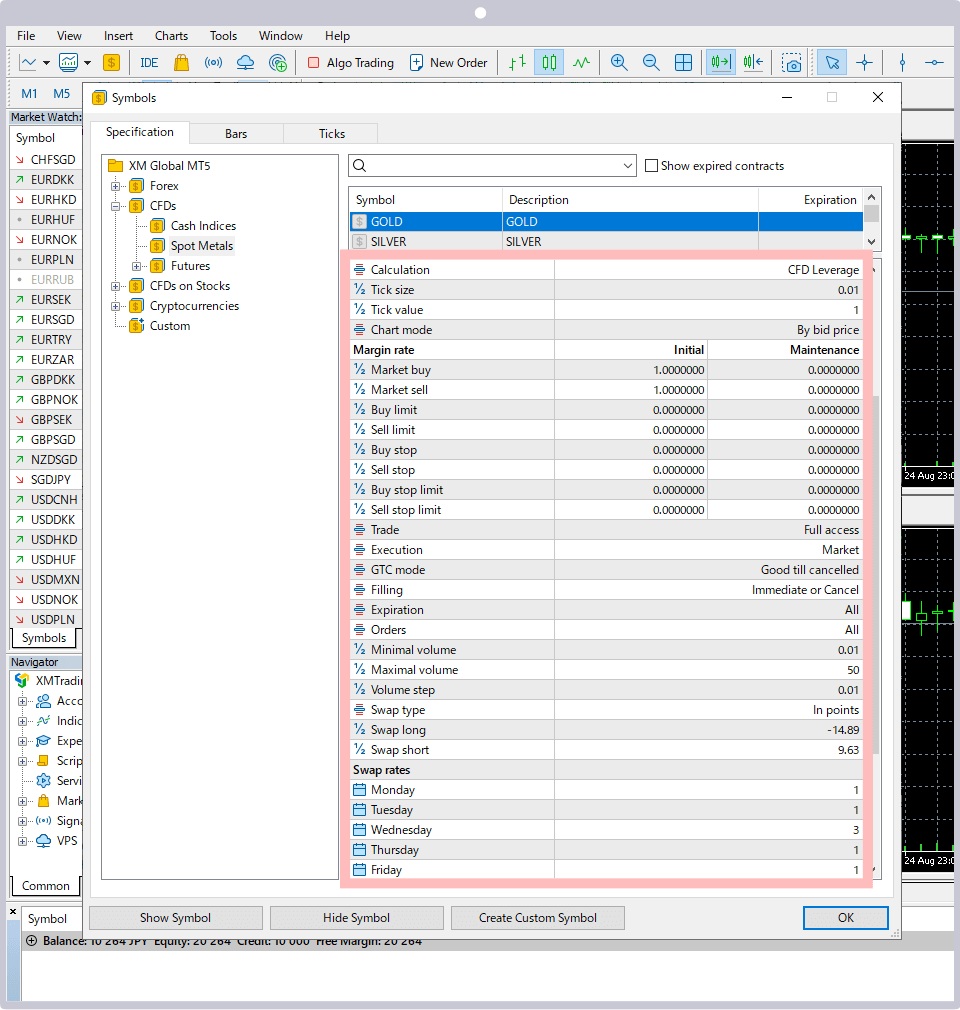

If you use MT5, another way to check the conditions is also available. Click 'View,' then choose 'Symbols.'

Once the Instrument screen comes up, click the instrument you wish to check. You can check the conditions of each instrument.

You can experience the trade of all the instruments on the demo account of XM with virtual funds. XM can make you experience the trade such as chart movements or trading hours under almost the same conditions as real account, so it is recommendable to experience the movement specialized with each instrument or how to setup/how to use MT4/MT5.

You can choose demo account of XM from 2 types, Standard account and XM Ultra Low Account Standard. There is no demo account in Micro Account. For who wish to open demo account of XM, click here.

How can I choose the instruments available on XM's MT4/MT5?

The names of instruments shown on MetaTrader 4 (MT4)/MetaTrader 5 (MT5) vary depending on the account types, so you need to choose the appropriate instruments applicable to the account type. Choose standard format 6 character instrument name such as 'EURUSD' on Standard Account.

2022.08.24

Tell me how to check the trading conditions of instrument of XM.

Trading Conditions of instruments of XM can be checked through MT4/MT5. Right-click Forex you wish to check on 'Indicative price indication screen' of MetaTrader 4 (MT4)/MetaTrader 5 (MT5), then choose 'Specification' and check.

2022.08.24

Do the leverages vary depending on the instruments?

Yes, maximum leverages vary depending on the instruments with XM. 1:1 to 1:1,000 preset leverages chosen by clients will apply to Forex and Silver, on the other hand, each individual required margin will apply to other CFDs.

2022.08.24

Tell me the names of instruments XM deals with.

55 Forex, 1,387 CFDs (Precious Metals, Equity Indices, Energies, Commodities, Stock CFDs and Cryptocurrencies), total number of 1,442 instruments are available with XM and all the instruments can be traded within the same one account and on the same one trading tool. Also all the instruments deploy Negative Balance Protection, so you can trade at ease.

2022.08.24

Do I need to prepare exclusive account for CFDs with XM?

No, you don't have to. XM allows you to trade all the CFD instruments such as Precious Metals, Equity Indices, Energies, Commodities, Stock CFDs and Cryptocurrencies including Forexa on the same one account.

2022.08.24